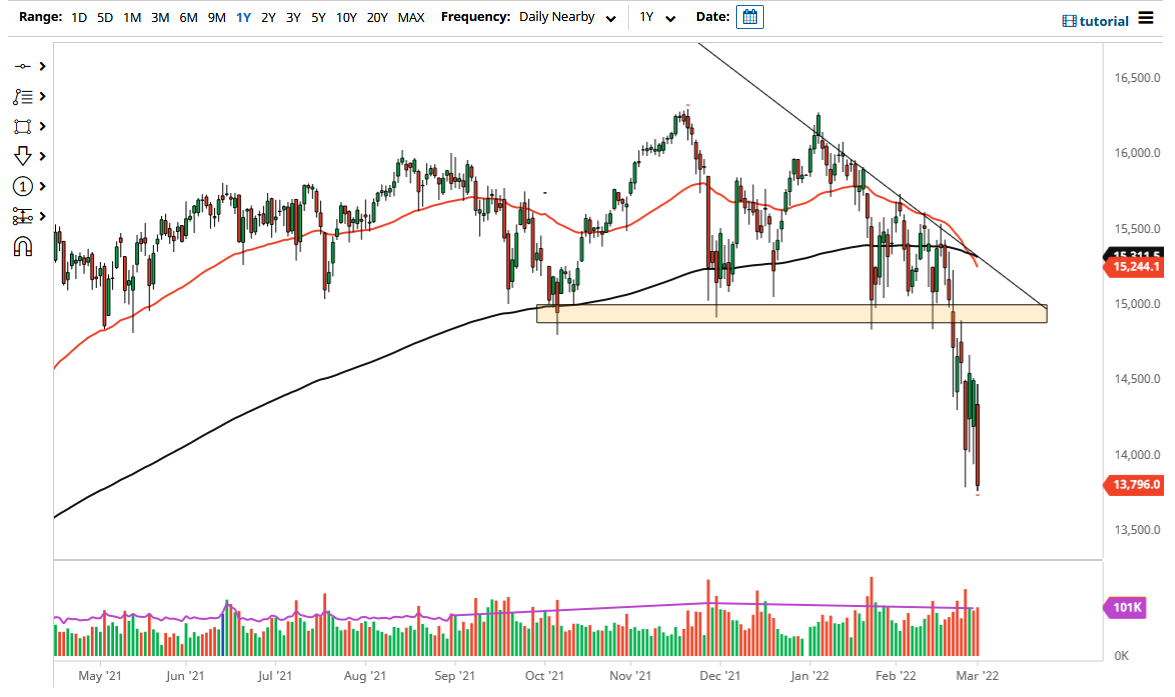

The German DAX Index has had a very rough 24 hours in the futures market, as it had initially tried to rally towards the €14,500 level but then failed. By doing so, it suggests that we are going to continue to see downward pressure, especially due to the fact that we broke down below the most recent low. At this point, the DAX looks as if it is going to continue to see sellers on short-term rallies, as not only does the DAX look vulnerable, but stock indices overall look vulnerable. Remember, as the DAX goes, so goes the rest of the European Union as far as stocks are concerned.

It is worth noting that the conflict in Ukraine has not shown itself to slow down; quite the opposite. Because of this, it is likely that the DAX will continue to see outflow, as it is the biggest index in the European Union, and people do not want to have money there if they can avoid it. The DAX also has to worry about the overall global economy, as it is a major export listing. The German economy is highly sensitive to export, and if we are in fact going to see a slowdown overall, Germany will be hit.

Furthermore, we have seen inflation in Germany rise, so the question now is whether or not we have stagflation? That is probably the case in most economies, so Germany will not be spared this problem. The market breaking down below the lows of the candlestick for the trading session on Tuesday would be a sign that we are more likely than not going to go looking towards the €13,500 level and breaking down below there opens up the trapdoor.

As far as buying is concerned, we would need to break above €14,500 at the very least, something that we have not been able to do for several sessions. Even then, I think the €15,000 level causes quite a few problems as well, due to the fact that it had been previous support on the massive triangle that had formed. It is really not until we break above there that you could say the market is ready to truly go to the upside. However, if we got some type of cease-fire in Ukraine, that might cause a short-term rally.