Crude oil markets remain elevated on Monday as concerns about the Russia/Ukraine situation continue to dominate the headlines. As long as there is tension there, this is yet another reason to think that oil markets might be bullish. Granted, we had already been bullish for quite some time, so it should not be a huge surprise to see that we have in fact rallied yet again. In fact, the market gapped higher from the open and then was extraordinarily volatile. I do believe that eventually you will see some continuation to the upside, but a little bit of a pullback would be a good thing.

That pullback may very well happen if the Russians pull back from the border. This will be a temporary situation though, as it is very likely that the same fundamental reasons that have had gold going higher for so long are not going anywhere. The markets are trying to price in the reopening trade, which will feature a lot of excess demand for energy. The market has been having a hard time keeping up with demand as OPEC continues to struggle, and the fact that the entire world shut down for a year means that there was very limited extraction.

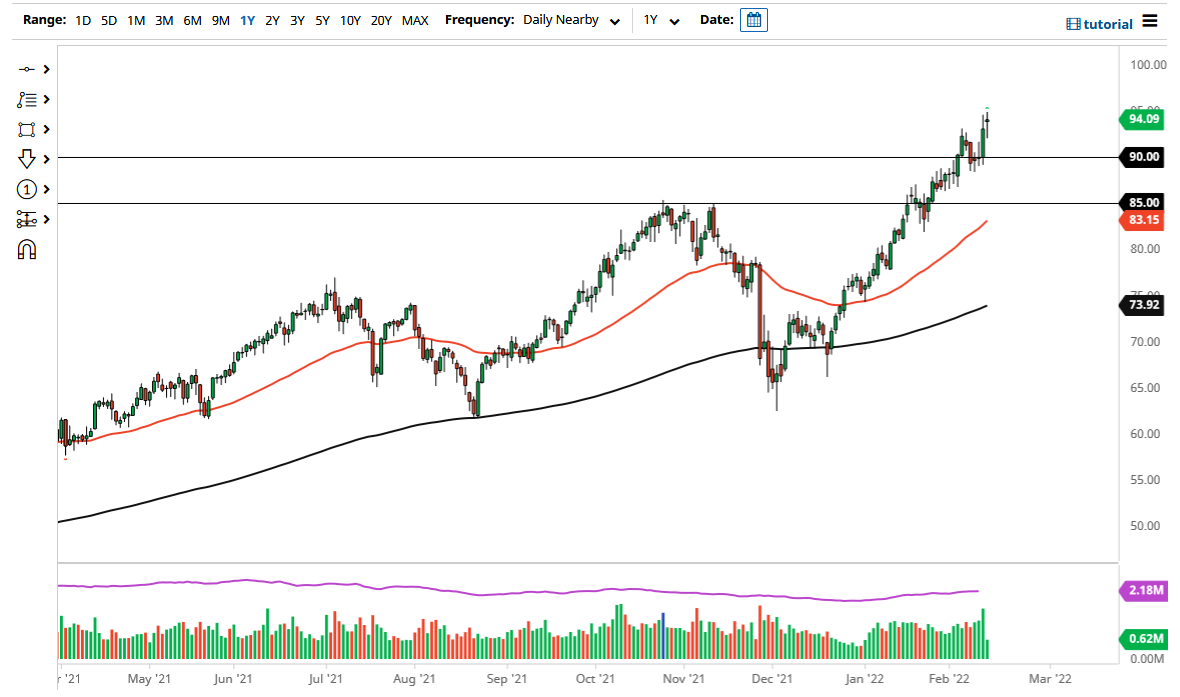

To the downside I believe that the $90 level continues to be important, so we need to pay close attention to the idea of that being a bit of a “floor the market.” I am looking for some type of pullback in order to offer value, because this is a trend that I do not want to fight. I do believe that we are trending higher for a reason, and that will more than likely continue to be the case. The WTI market continues to grind higher through most of the year, eventually finding its way towards the $100 a barrel level. This does not necessarily have to happen overnight, but it certainly looks as if there is nothing to stop that happening anytime soon. In fact, I do not know a scenario in which I would be willing to sell oil, at least not anytime soon. Like I mentioned, the Russians may step away from the Ukraine and we could see oil fall as a result, but I think it is somewhat disingenuous to think that it would change the entire trend.