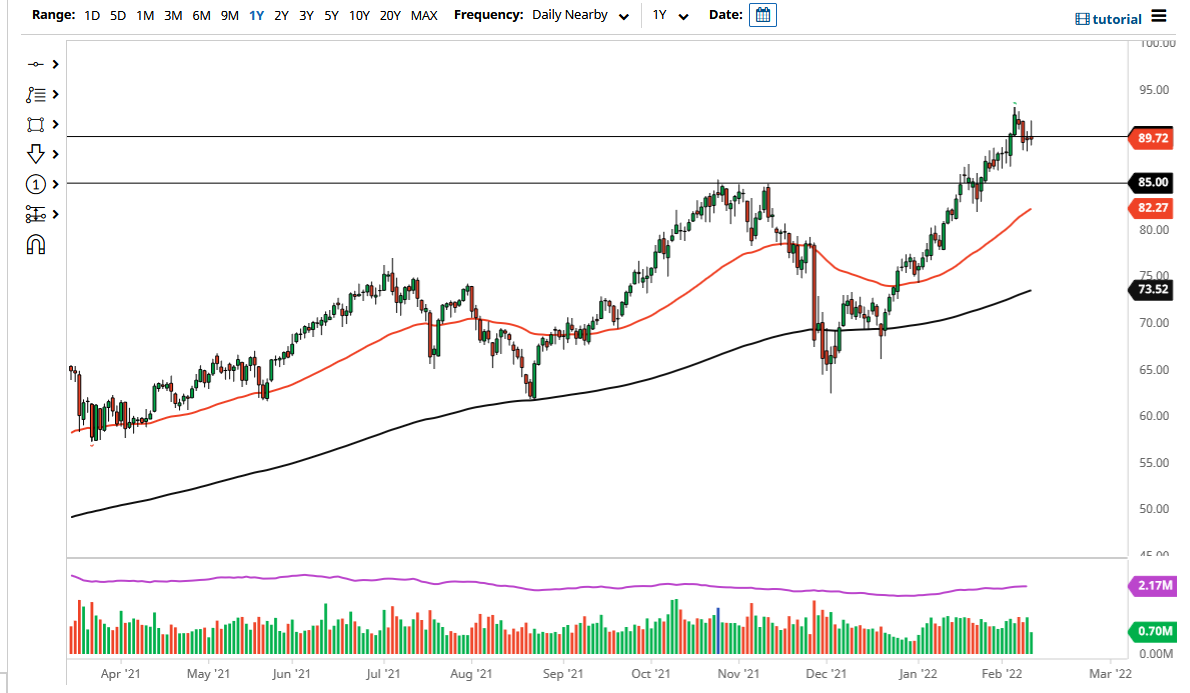

The West Texas Intermediate Crude Oil market has initially tried to rally during the trading session on Thursday as we have seen a lot of volatility in various markets. That being said, the market has rallied significantly during the course of the trading session, only to turn around and fall towards the $90 level. That being said, we did up forming a bit of a shooting star, and it does suggest that maybe we get a little bit of a pullback.

However, the market has seen a hammer from the previous session, so be interesting to see if we just definitely hang about the $90 level, or if we are going to have a little bit deeper pullback. Quite frankly, I would love to see a little bit more of a pullback, but I do not know that we get it. If we break down below the bottom of the candlestick from the Wednesday session, then I will start looking to pick up this market somewhere around the $86.50 level with an eye on the $85 level underneath being massive support. The 50 day EMA is also reaching higher, and therefore it is likely it will kind of combined to add a massive “floor in the trend.”

If we do turn around a break above the top of the candlestick for the trading session on Thursday, then it could open up a move towards the highs. Either way, I do not have any interest in shorting this market, due to the massive uptrend that we have seen, but quite frankly this is a market that is probably due for some type of correction. This will be especially true if the US dollar starts to spike going forward, which obviously has a small influence on this market.

I think the only thing you can count on at this point is a bit of volatility as we are at a major level, and of course the markets in general are freaking out about the Federal Reserve and the high inflation that we see. If they slam on the brakes by tightening monetary policy, it could drive down demand in the world’s biggest economy, which has a knock on effect in several other economies. Because of this, crude oil will more than likely have to cool off a bit in order to build up momentum to the upside.