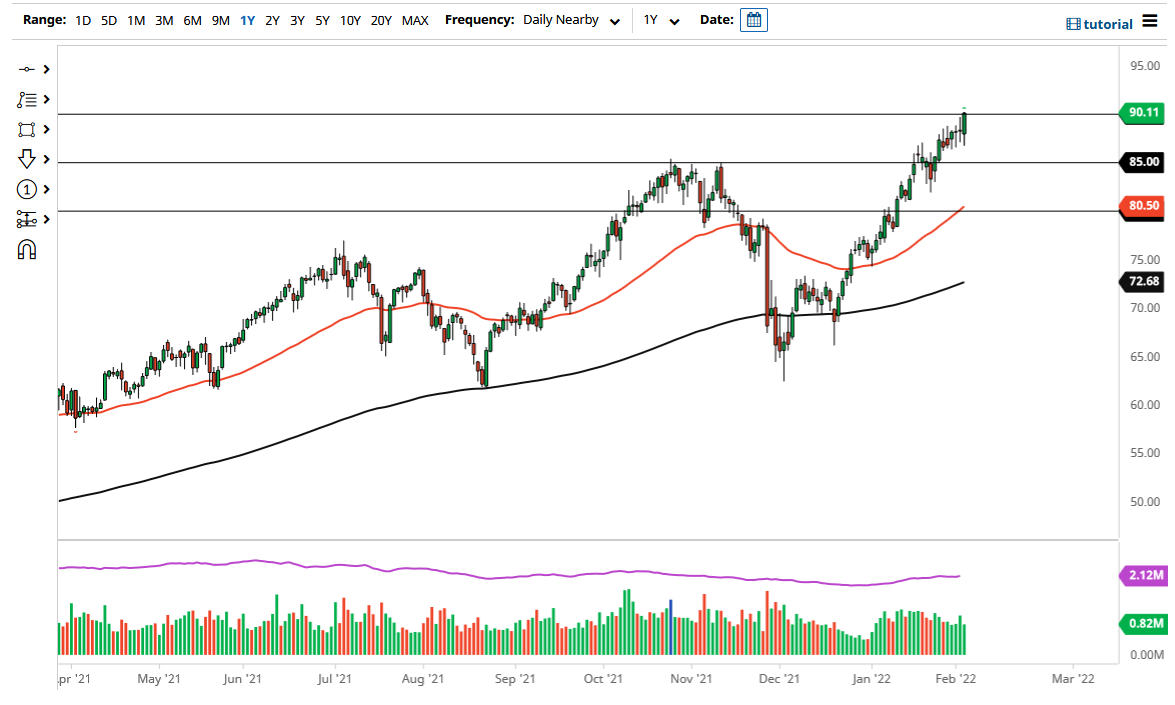

The West Texas Intermediate Crude Oil market pulled back a bit initially during the trading session on Thursday but then turned around to show signs of strength yet again. It is possible that somebody leaked something from OPEC, because that is quite common when it comes to oil markets in meetings. Nonetheless, we have broken above the $90 level and that of course is a very bullish sign. With that being the case, it looks like we are ready to continue going higher, and therefore I do not have any interest in trying to short this market anytime soon.

Looking at this market, if we were to pull back, I think it would make a certain ammount of sense to find value in the oil markets, as the $86.50 level could offer a significant amount of support based upon what we have seen of the last couple of weeks. This is not to say that it will be easy to buy-and-hold oil, but it is obvious that we are clearly going to continue to see plenty of upward pressure based upon the overall trend. We have been consolidating for a while which certainly makes sense as well, due to the fact that we have seen a lot of demand coming out of the rest of the world as OPEC has been relatively tight with its production. In fact, it is very possible that OPEC will not be able to meet quotas anyway.

The US dollar of course has an influence on the market as well, so you should keep an eye on the US Dollar Index, as it will give us an idea as to what the US dollar is going to do in general. There is a lot of demand for crude oil in general as countries around the world continue to reopen. Ultimately, the market is likely to remain bullish, and the fact that we have had a little bit of consolidation heading into this area makes quite a bit of sense, as we have to digest all of those massive gains. That being said, the $85 level underneath could offer significant support, as it was previous resistance. I would love to buy crude oil closer to that level, but at this point in time it is very unlikely that we even get that far.