The US dollar has pulled back a bit during the trading session on Friday as traders go a little bit more “risk on” when it comes to appetite. This is in reaction to the market turning around from the previous selloff when Ukraine was invaded by Russia. You can make an argument for the technical analysis suggesting this move already.

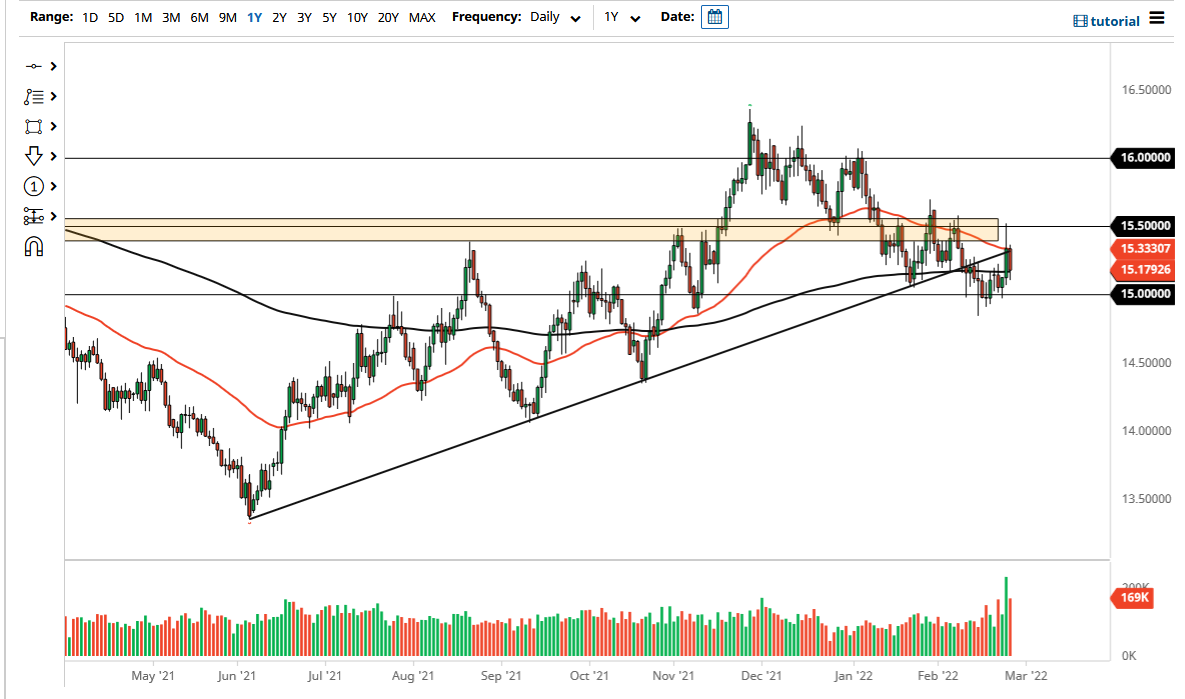

When you look at the chart, you can see that we tested the 50 day EMA, and a significant uptrend line from before. That does of course suggests the idea that we were going to see a little bit of resistance in this area, and of course trendlines like to be retested after being broken through like we had seen. It is worth noting that the 50 day EMA lined up perfectly with the trend line, so that of course attract a lot of attention in and of itself. Before all of that happened, the market bounce from the psychologically significant 15 Rand level, and therefore it all lines up quite well for technical traders.

Keep in mind that the South African Rand is a commodity driven currency, and of course a currency from an emerging market, and other words, you need to have traders feeling relatively good about risk prospects, as they will reach towards higher interest rates in South Africa. If we can break down below the 15 Rand level, then it is likely that this pair will continue to drift lower. It is worth noting that even though there has been a lot of concern out there about risk appetite, the reality is that most of the Forex trading world has been focusing on the carry trade, and that certainly favors the downside here as well.

If we do break out to the upside, it will almost certainly be due to the fact that there was some type of “risk off event” or fear entering the market as traders will want to own the US dollar and/or US Treasuries. That essentially means the same thing, so in that scenario you will probably see the US dollar strengthened against almost everything, not just the South African Rand. This will be a true especially with emerging market currencies, as they are quite a bit riskier than other US dollar counterparts like the Euro or the Pound.