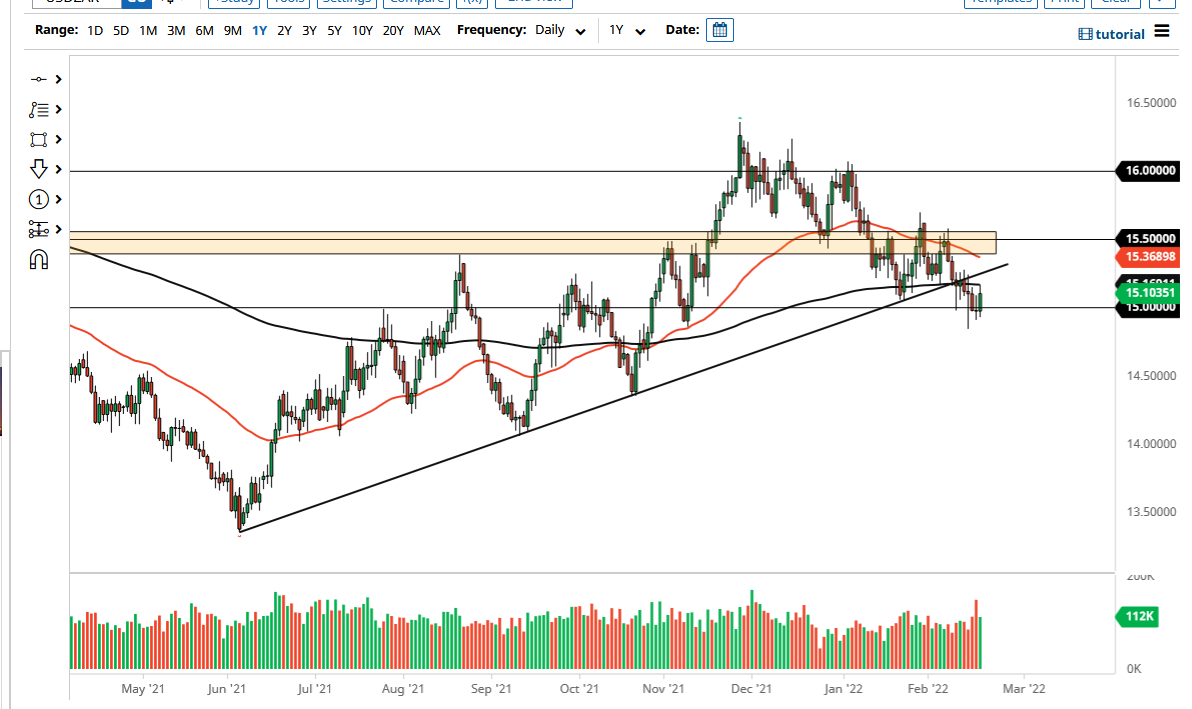

The US dollar rallied a bit on Friday as the 15 rand area continues to be a bit of a support level that has been tested multiple times. That being said, I think it is probably only a matter of time before we have to make a bigger move, but it is quite telling that the US dollar had to rally heading into the weekend due to fears around the world. After all, there are fears of inflation which work against the emerging market economies, but there is also a lot of concern about the Ukraine/Russian tensions.

It probably would have been a lot to expect a lot of traders out there willing to hang on to risk going into the weekend so this move should not be a huge surprise. That being said, if we were to break down below the bottom of the lows of the week, then I think the US dollar would probably get rather hurt at that point, as the interest rate differential will continue to favor the ZAR. On the other hand, if we were to turn around and take out the 15.25 rand level, we could see an attempt to rally again. That being said, the 50 day EMA sits just above, and it is likely that we would see a lot of resistance above regardless of the cause of the move.

In general, this is a market that I think is going to continue to be noisy, but it should be noted that we have been struggling to pick up momentum to the upside for a while. Because of this, it is more than likely going to continue to be a scenario where we are very choppy, just as you have seen over the last month or so. The market looks as if it is going to try and make a move soon, but we need a little bit of certainty in one direction or the other when it comes to risk appetite before we realize that move. Until then, you probably need to keep your position size relatively small and focus more on a potential breakout point than anything else. This pair is highly volatile under the best circumstances, so it is not a huge surprise to see where we are now.