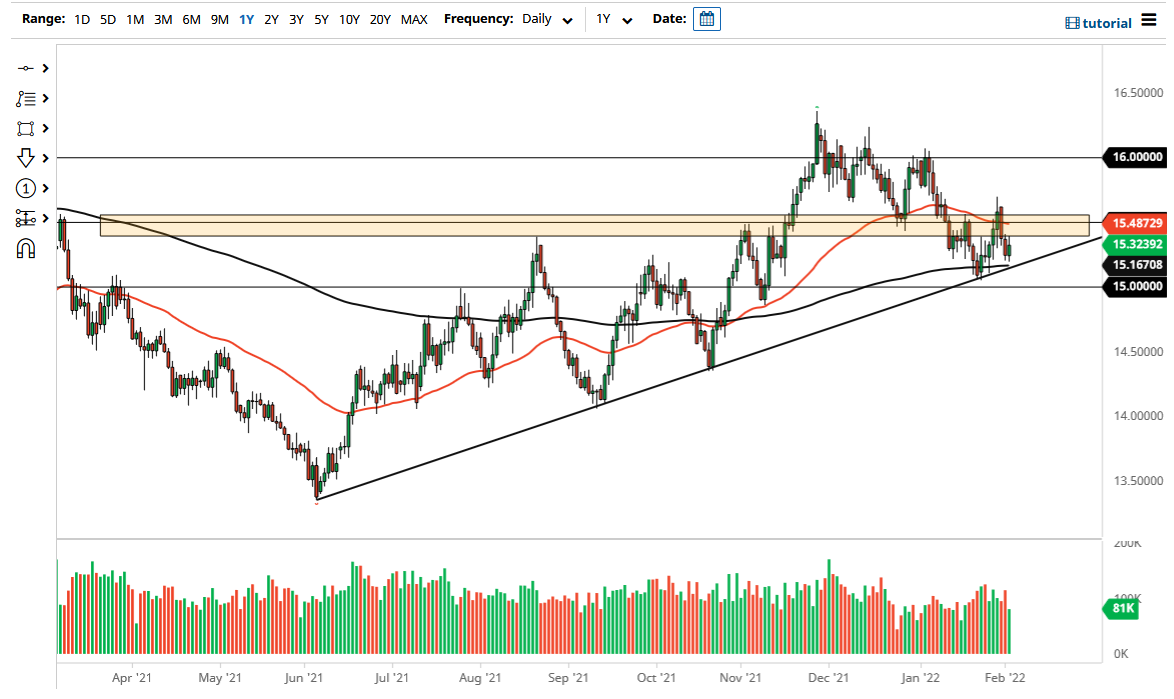

The US dollar bounced a bit on Wednesday against the South African rand as it tested a major uptrend line. Because of this, it does make a certain amount of sense that we have to pay close attention to whether or not this trend line holds, because so far it has shown a proclivity to do so. Furthermore, we have the 200 day EMA sitting just below, and that could offer significant support. Because of this, I think we have a situation in which we need to pay close attention to the next couple of days, because it could give us a bit of a “heads up” as to where we go longer term.

For what it is worth, it should be noted that the US dollar has struggled against multiple emerging market currencies, so it is not just here that we are seeing a bit of a problem for the greenback. Ultimately, I do think that we will have a bigger move sooner or later, but at this point we are in an area that is going to cause a lot of noisy behavior. After all, the 200 day EMA sits just below and right on the uptrend line, while at the same time the 50 day EMA sits above near the 15.50 level offering resistance. We are squeezing between these two moving averages, which is quite often the beginning of the next big move. Whether or not we rally is more than likely going to have to do with risk appetite. For what it is worth, we have already seen other emerging markets break out against the greenback, so be interesting to see how this plays out.

If there is a sudden “risk off move” around the world, that will shun currencies such as the South African rand, but the interest rate differential between the two still favors the ZAR, so that is something that you need to pay close attention to. While interest rates in America are rising, the reality is that they are nowhere near getting close to South Africa, and there is quite a bit of trading community out there that believes the Federal Reserve will not be able to raise rates anywhere near as aggressively as they have suggested. If that is in fact going to be the case, the US dollar will suffer.