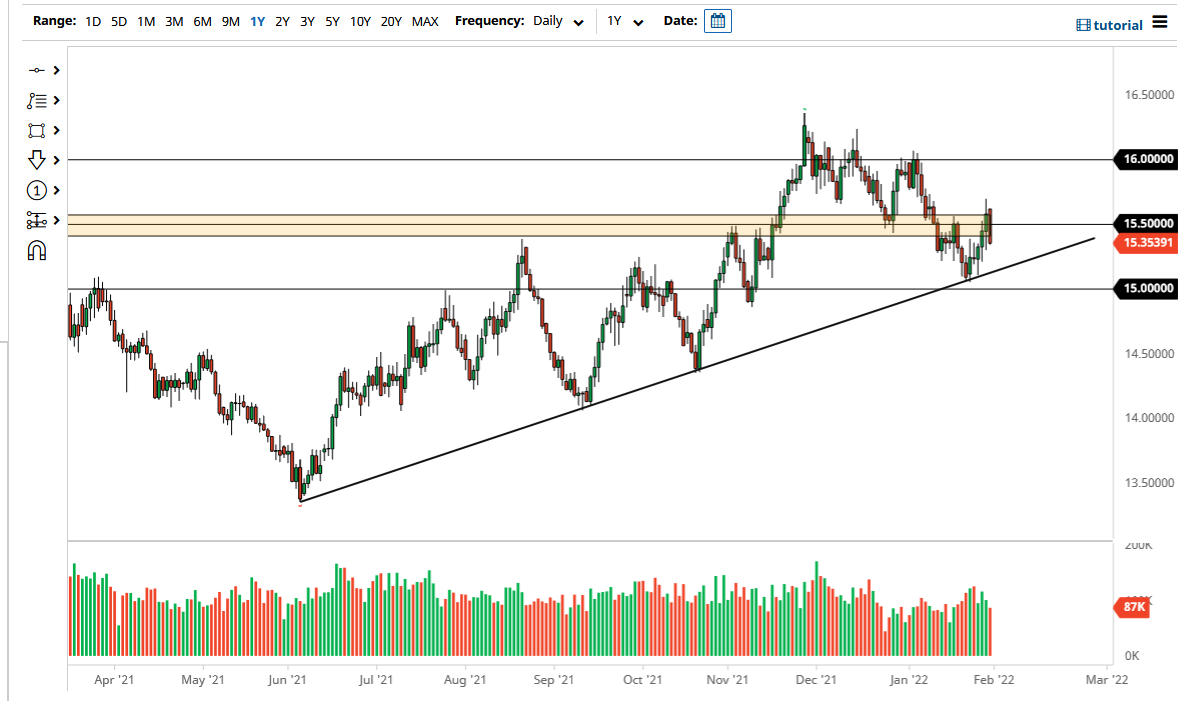

The US dollar broke down significantly on Monday against the South African rand, as it looks like the resistance region of 15.50 rand is trying to hold. If that is going to be the case, it will be interesting to see how this plays out longert erm due to the fact that there is a bigger uptrend line just underneath.

The 15.50 rand level has been important previously, and although it is not technically a bearish engulfing candlestick, this candlestick does look a lot like that. However, keep in mind that the market needs to keep an eye on risk appetite, because the US dollar is considered to be much safer than the South African rand, so if we continue to see fear in the market, it is almost certain that the US dollar will eventually pick up momentum. If that is the case, then we have a situation where we are simply going to see this more or less driven by risk appetite right now. That is probably true with most currency pairs at the moment, as well as other financial assets.

Unfortunately, volatility is here to stay, so it is going to be difficult to trade some of these pairs. The South African rand is considered to be an emerging market currency, and it is going to be very sensitive to things like interest rate situations in the United States, which has an influence on the US dollar, which then has an influence on commodities, of which South Africa is a major exporter. It is a bit of a “knock on effect” that you have to connect all of the dots to truly understand. Given enough time, US dollar strength or weakness will certainly show itself here.

If we break above the highs of the trading session on Monday, then we could see a return to the overall uptrend, but I think it is probably going to be a bit noisier than simply turning around. I think it is a matter of finding a supportive candle to get long or paying close attention to whether or not we can break down below that uptrend line. The 15 rand level of course is a major area to watch as well.