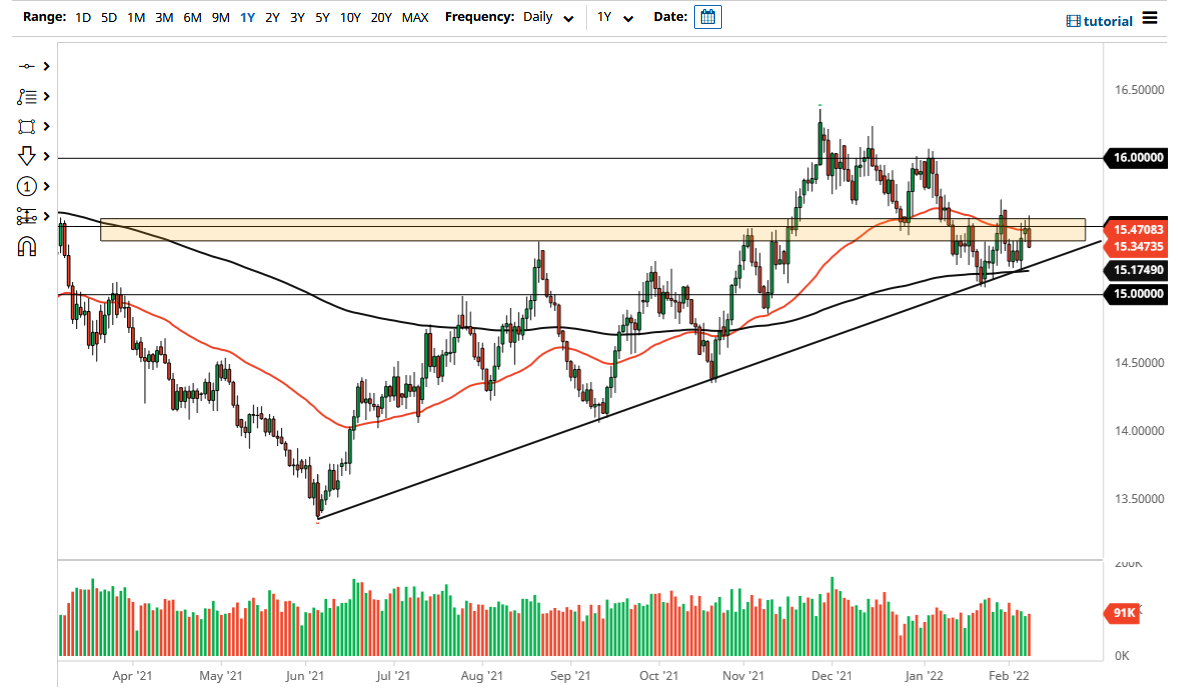

The US dollar rallied just a bit on Tuesday to break above the 15.50 rand level, only to see sellers come back into the market and push it back down. This is a market that is supportive, and if we can break down through this region, I think the US dollar could be sold off quite aggressively. I think we will continue to see a lot of noisy behavior, but it is very likely that we will hear a lot of noise right here. After all, the uptrend line sits just below, and so does the 200 day EMA. Ultimately, I believe there are plenty of reasons to think that the area will cause a bit of noise, especially considering that we have the CPI numbers coming out on Thursday.

It will be interesting to see how the breakdown continues, and whether or not we can break down below the 200 day EMA. If we break down below there, then the 15 rand level would be targeted next. A shot below there then has the US dollar falling rather rapidly down towards the 14.50 rand level. On the other hand, we could turn around and break to the upside, clearing the 15.20 rand level, allowing a move towards the 16 rand level based upon the longer-term uptrend. That being said, the market has been very noisy over the last couple of weeks, and I think the Wednesday could be very choppy as well, simply due to the fact that CPI comes out the next day.

The shape of the candlestick is very negative, but it is not a serious breakdown. The overall attitude of the market is still one of confusion, so I think you need to pay attention to those levels I mentioned previously for a bigger move. After all, it is difficult to trade this market from the short term due to the spread, but it does tend to move in a long-term attitude for quite some time, so it is likely that we could see a bigger move by the time we get done with Thursday. In the short term, mark your charts up and pay attention to the couple of levels that I mentioned in order to place a longer-term trade. Keep in mind that these exotic currencies do tend to move for bigger moves if you are patient enough.