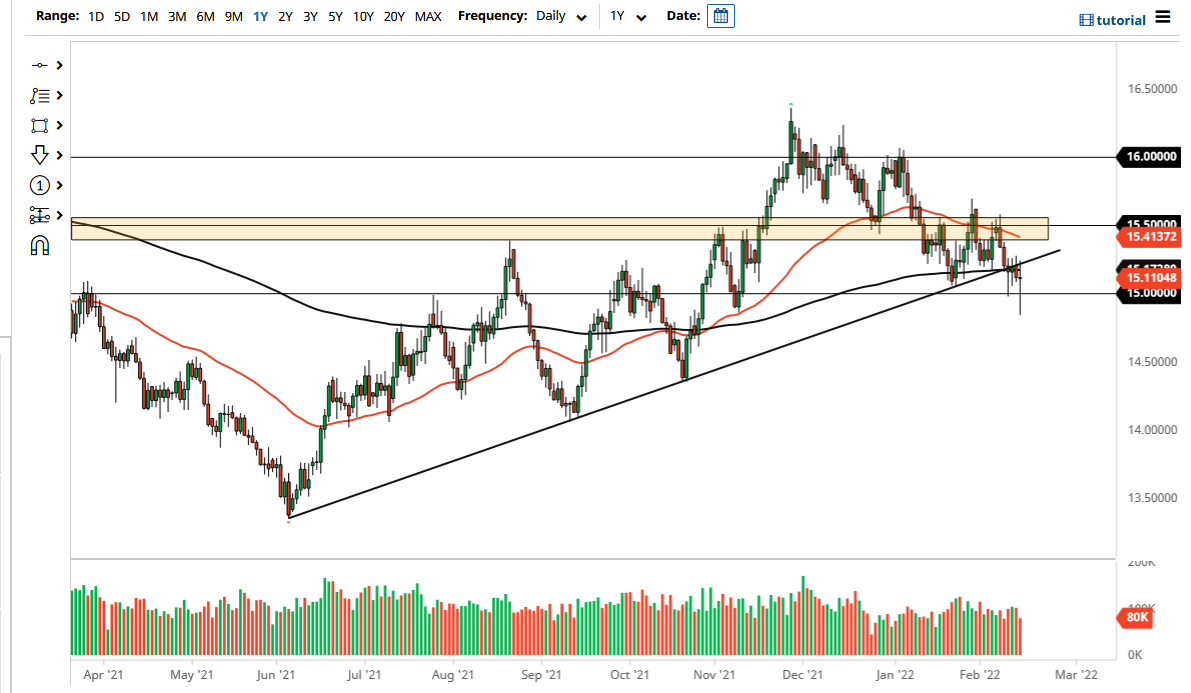

The South African rand initially picked up quite a bit of strength against the US dollar, breaking down below the 15 rand level initially. However, we have turned around to form a bit of a hammer, which sits right at the 200 day EMA. That being said, commodity prices have dropped during the day and that has worked against the value of the South African rand, which of course is very sensitive to a lot of commodities. That being said, it will be interesting to see if we can hold on to this area or if will see a turnaround in the short term.

A breakdown below the bottom of the hammer would send this market towards the 14.50 rand level underneath, as it is the next support level. Breaking down below the 14.50 rand level, then it is possible that we could go looking towards the 14 rand level. On the other hand, if we break above the highs of the last couple of days, we could get a run towards the 50 day EMA which is sitting at the 15.41 rand handle. Breaking above that then opens up the possibility of the 15.50 rand level, an area that has been significant resistance previously.

In general, this is a market that looks like it could be very noisy in the short term, so you need to be cautious about getting too aggressive. That being said, if we were to break down below the bottom of the hammer, then I would become aggressively short. To the upside, I do not think that I can get aggressive with the US dollar until we can break above the 15.50 rand level, because it would clear enough noise that it would make it interesting for me. Beyond that, you would need to see the US dollar rally in other markets as well, as it should be a general “US dollar positive” type of move in overall.

Keep in mind that this pair does tend to be very choppy from a day-to-day perspective, so you will need to be patient to get the next trade set up. It is obvious that we have a lot of noise in this general vicinity that will continue to make this market difficult to deal with in the short term.