Today's USD/TRY Signal

- Risk 0.50%.

- The sell trade of yesterday's recommendation was activated, and the deal is currently being traded.

Best buy entry points

- Entering a long position with a pending order from 13.29 levels.

- Place your stop-loss point below the 13.10 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 13.79.

Best selling entry points

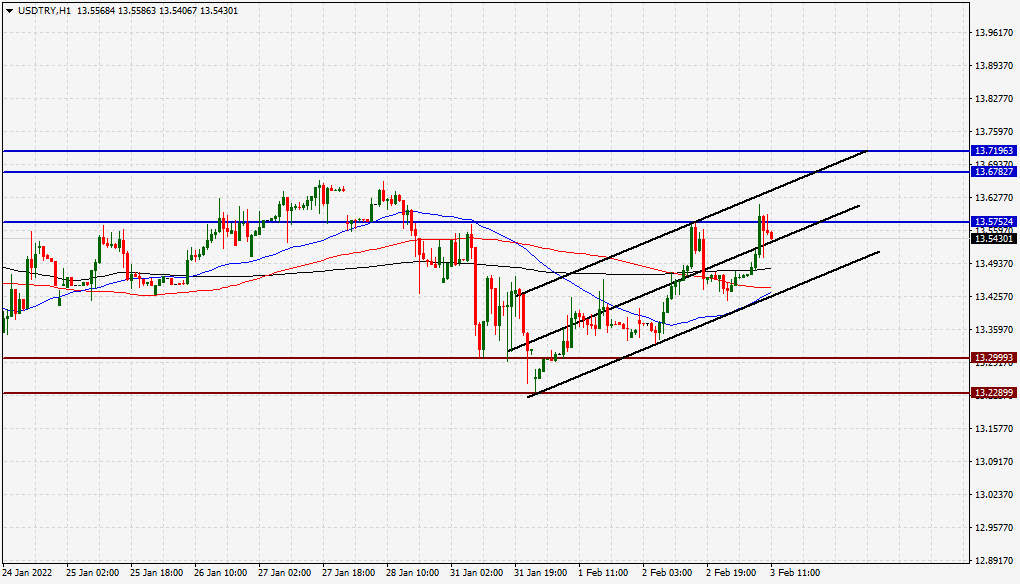

- Entering a short position with a pending order from 13.71 levels.

- The best points to place the stop loss are above 13.89 levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 13.30

The Turkish lira fell during early trading Thursday, as investors followed data from the Turkish Statistical Office, which showed a rise in the Consumer Price Index. It measures changes in the general level of prices by tracking all consumer goods and services. By 11.10% monthly, and by 48.69% compared to December of last year. The annual inflation rate in the domestic producer price index was 93.53 percent. Inflation in the country reached its highest level in twenty years and continued to rise for the eighth consecutive month. The Chamber of Neighbors in Istanbul announced in a statement issued yesterday that the inflation rate has risen to almost 51 percent.

On the technical front, the price of the Turkish lira declined against the dollar during yesterday's trading, and in today's early trading, after the lira rebounded from the resistance levels that we mentioned in yesterday's report, which are centered at 13.57 levels, where the lira is still trading less than the resistance levels that are concentrated at 13.67 and 1371, respectively. On the other hand, the highest support levels are trading at 13.30, 13.22 and 13.08. Meanwhile, the lira is trading within a bullish channel on the 60-minute time frame. The pair also rose to trade above the 50, 100 and 200 moving averages, on the four-hour time frame, as well as the 60-minute time frame. As the lira is still trading in a limited range now, we expect the lira price to decline until reaching the mentioned resistance levels and the upper border of the channel shown on the chart before starting to rise. Please adhere to the numbers in the recommendation with the need to maintain capital management.