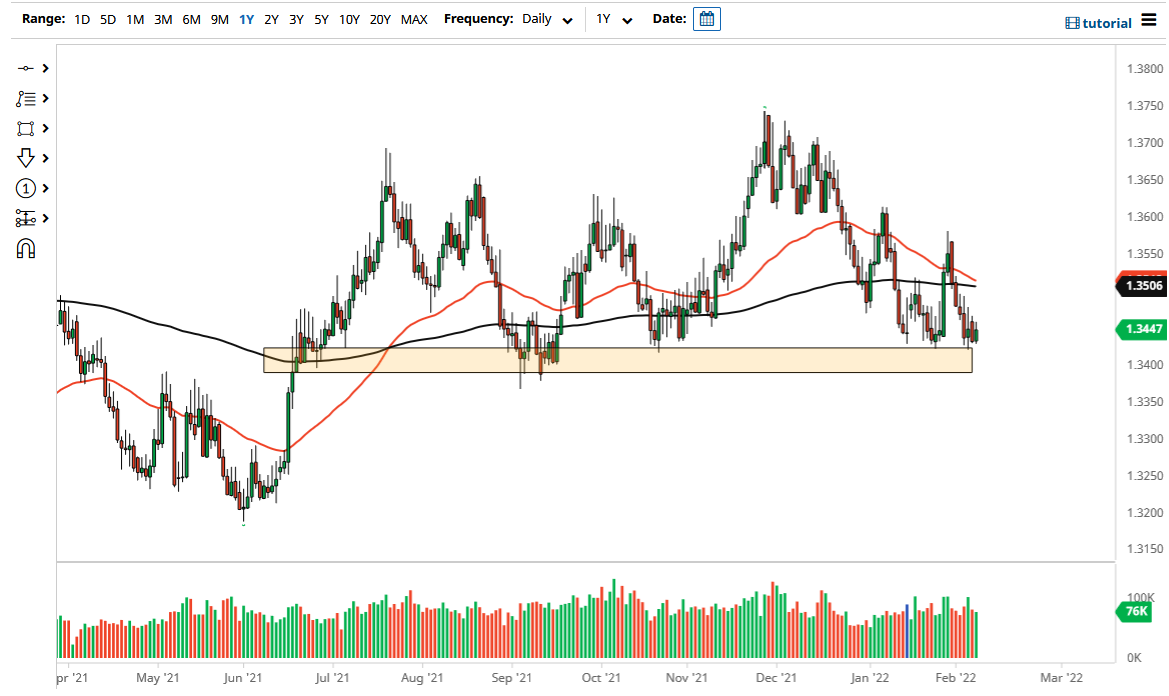

The US dollar did rally just a bit against the Singapore dollar, but as you can see, we are sitting on top of major support. At this point, it looks as if the 1.34 level is going to continue to be important, so clearing that allows the US dollar to shrink against the Singapore dollar, which is quite often thought of as the “Swiss franc” of the Asian region.

If you are not used to seeing how this pair trades, you need to understand that it is more or less a grind than a sudden move 90% of the time, and it does trade quite a bit like the USD/CHF, ironically enough. If we do break down, I think the market could go looking towards 1.3250 level, but it may take a while to get down there. That being said, we will have the occasional hiccup, but I think if we get that breakdown, it will all but ensure that we drop. Furthermore, the US dollar selling off here would probably continue to see US dollar selling elsewhere as well.

It is also worth noting that the 50 day EMA is getting ready to close below the 200 day EMA, forming the so-called “death cross.” Do not get me wrong; I do not read too much into that technical indicator, is just something that some people pay close attention to. Ultimately, it will be interesting to see how this plays out, because we are clearly at a very important level.

To the upside, if we can clear the 1.35 level, then it is likely that we could go higher, and it would also be in coordination with the US dollar rallying against other currencies around the world. The Thursday candlestick is going to be important, due to the fact that the CPI numbers coming out the United States will give us an idea as to what the inflation situation will be in the United States. The market has been grinding lower with “lower highs”, but we have not breached that major area. I think that by the time we get through the end of the week, we may have a little bit of clarity, so hold tight. It is very likely that we will see a nice longer-term trading opportunity.