For three trading sessions in a row, the price of the USD/JPY currency pair is exposed to selling operations that seem to take profits in preparation for the announcement of the important US job numbers at the end of the week. Expectations of raising US interest rates several times by the Federal Reserve, due to the strength of the economic recovery with a strong labor market and the highest inflation in 40 years.

Federal Reserve officials said they want to avoid unnecessary disruption to the US economy as they prepare to start raising interest rates, while showing little boldness for a strong 50 basis point move in March. US Federal Reserve Governor Jerome Powell announced last week that officials are ready to raise interest rates at their next meeting to curb the strongest inflation in four decades. But he declined to give specific guidance on the course of policy, aside from saying that subsidies should be removed steadily, and policy should be smart in response to incoming economic data.

Investors have raised their bets on pace increases since Powell spoke, turning nearly five this year versus the three officials expected in December. Wall Street economists were divided over when the Fed would act, setting as many as seven hikes as well as the risk of officials raising interest rates by 50 basis points - the first increase of that size since 2000 - to maintain price pressures.

Mary Daly, President of the Federal Reserve Bank of San Francisco, who has been one of the most pessimistic officials in the US central bank, said that interest rates may rise as early as March. But she denied that the Fed was behind the curve and cited several risks to the economy in addition to the ongoing pandemic, including headwinds as financial support evaporates.

Overall, officials turned to tighten policy after acknowledging that price pressures had failed to subside as expected. Atlanta Fed President Rafael Bostick told Yahoo Finance that his outlook requires three increases in 2022 and that he is not in favor of a 50 basis point rate hike in March. "I will adjust my policy not to be aggressive in terms of raising interest rates" if inflation slows more than expected, he added. Bostick sees inflation falling to an annual rate of 3 percent by the end of 2022, compared to nearly double that pace in the 12 months through December.

Economists argue that the Fed should move faster on rates and see demand pressures that they say the central bank needs to ease. But policymakers want to maintain resilience in the face of significant uncertainty about the economic outlook while COVID-19 continues to infect thousands of Americans every day.

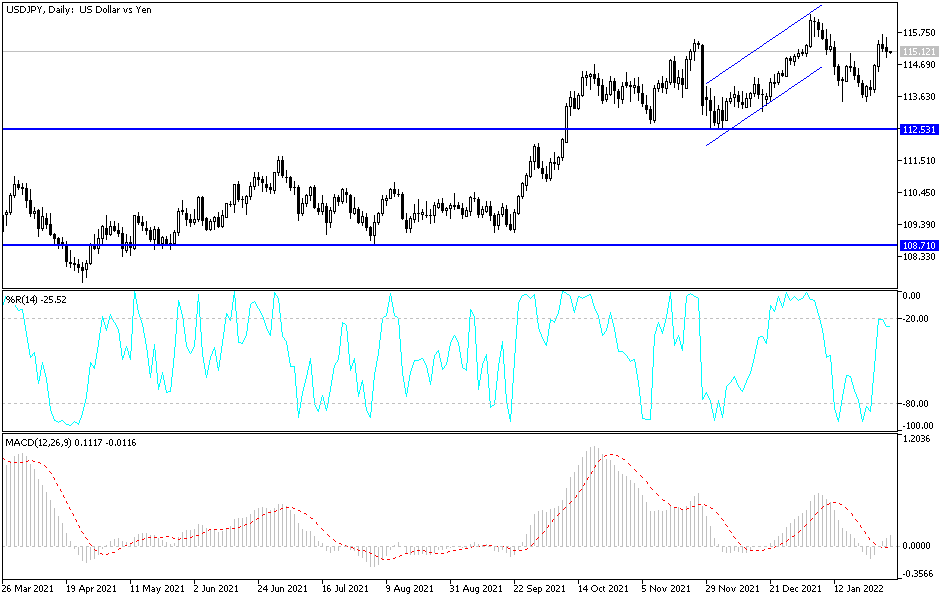

According to the technical analysis of the pair: The recent sell-offs so far have not exited the USD/JPY currency pair from its ascending path as long as it is stable around and above the most important 115.00 psychological resistance on the bulls daily chart for further launch to the upside. After last week's gains, I expected profit-taking as the Federal Reserve's announcement storm passed, and the US dollar pairs will cautiously focus this week on US job numbers. The goals of the bulls closest to the current performance are 115.65 and 116.35, respectively.

On the downside, the general trend will not turn down without moving towards the 113.35 support, otherwise the trend will remain to the upside. Today, the currency pair will be affected by the risk appetite of investors as well as the reaction from the announcement of the ISM Manufacturing PMI and the number of US jobs.