The price of the USD/JPY currency pair moved at the beginning of the new week's trading with upward gains to the resistance area 115.43 and settled around the 115.06 level at the time of writing the analysis. The bulls got a strong impetus from the stronger-than-expected US jobs numbers which supported expectations of a US interest rate hike. The currency pair gains in anticipation of US inflation figures, which may reinforce expectations that the US Federal Reserve will start raising US interest rates in March. It is likely to push the market into more dollar longs if the data surprises the rise in expectations.

US inflation is widely expected to reach a new high of 7.3% in January while the consensus is that core inflation has likely risen to 5.9%. The Fed itself is generally seen as likely to outperform the European Central Bank when it comes to raising interest rates this year and next.

“The data is unlikely to generate much volatility since this weakness has already been ruled out,” says Lee Hardman, FX analyst at MUFG. “The main event will be US CPI data for January. We have not yet reached the peak and further increases in annual CPI rates are expected. We may have reached the point where strong inflation indicators have a limited impact on market prices.”

Investors are still measuring the impact of rising inflation on businesses and consumers, while remaining cautious about the Fed's plan to fight inflation. Investors will get another major update on inflation on Thursday with the Labor Department's report on consumer prices for January. The Fed's plan to raise interest rates to fight inflation. As such, investors anticipate the first hikes in March and are concerned about the pace and quantity of price increases in 2022.

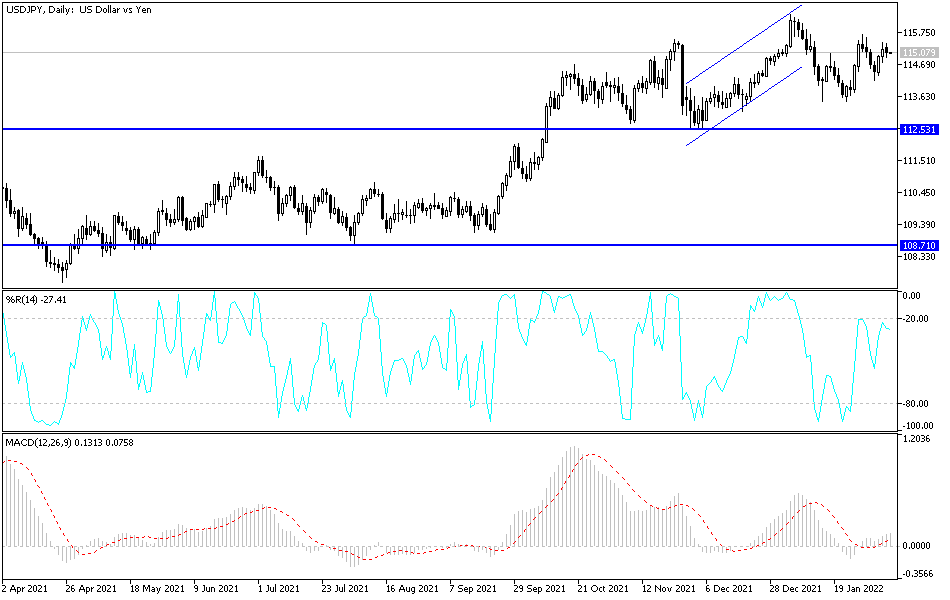

According to the technical analysis of the pair: The 115.00 resistance still supports the upward trend of the USD/JPY currency pair, but the bulls' dominance needs more momentum. This may happen if the currency pair moves towards the resistance levels 115.85, 116.20 and 117.00. On the other hand, and according to the performance on the daily chart, the currency pair will give up its bullish momentum in case it moves towards the 113.60 support level, which is moving the bears strongly downwards. The performance of the currency pair may remain in narrow ranges until the announcement of the most prominent US inflation figures for the US dollar pairs for this week.