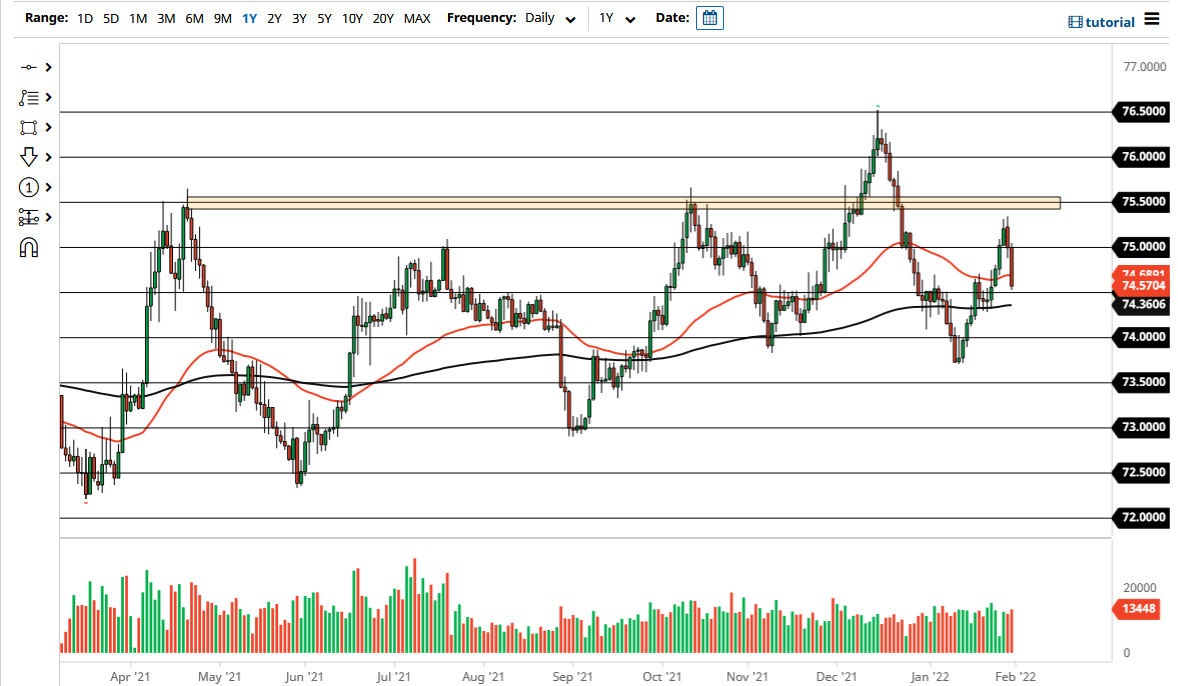

The US dollar fell rather hard on Monday to slice through the 50-day EMA and lose almost ½ a rupee. Ultimately, this is a market that is trying to find some type of momentum one way or the other, and the Monday session went quite a ways towards making that happen. That being said, the ₹74.50 level is an area that has been important multiple times due to both support and resistance, so I think you need to pay close attention to this area to see whether or not it can hold.

In general, you should keep in mind that the Indian rupee is considered to be an emerging market currency, so it does have a lot of external influence on it. However, the Reserve Bank of India keeps a tight lid on how far the market will send this pair, so this is why you see it so range-bound. If we were to break down below the 200 day EMA, then it is possible that we could go looking towards the 0.74 level. The Indian rupee is highly sensitive to overall Asian growth, and of course the coronavirus situation in that part of the world. It does seem to be stabilizing a bit, despite the fact that China is hell-bent on having zero cases.

The size of the candlestick is something worth paying attention to, and it would be a continuation of the previous move lower. At this point, a breakdown just below the 0.74 level could even have people talking about a massive “head and shoulders”, which would be a horribly negative sign. It is far too early to really bank on that, but it is something to keep in the back of your head for the future. Market participants will continue to look at US dollar strength as a guide for this market, which makes sense considering that the Indian rupee is so illiquid in comparison to other currencies. In other words, if the US dollar spikes against the euro, then it could be potentially bigger over in this market, so you need to keep that in the back of your head. It is worth noting that although we closed at the bottom of the range for the session, we are sitting right on support.