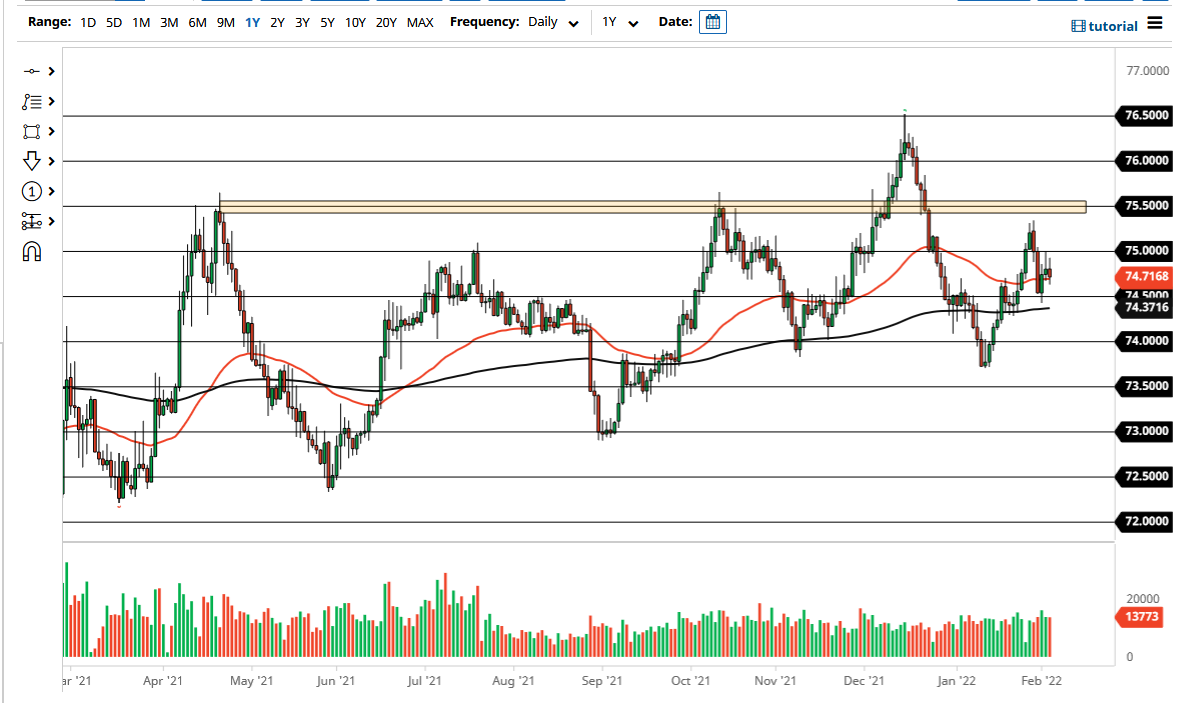

The US dollar has gone back and forth during the course of the trading session on Thursday as we are hanging about the ₹74.70 level. You can see that we rallied and then fell during the trading session. The 50 day EMA is sitting just below, and it does suggest that perhaps we are continuing to see a little bit of noise in this overall region. That being said, it is worth noting that we are also squeezing between a few “midcentury mark” that this market does tend to pay attention to.

The ₹75 level has been an area of importance more than once, and that of course it would be a psychologically important figure also. You can see that we ended up forming a shooting star during the previous session on Wednesday, as that level offered resistance. It did so again during the day on Thursday, so it does make a certain amount of sense to look at the ₹75 level as a major resistance barrier. If we can break above there, then the market is likely to go looking towards the highs from the previous week.

On the other hand, if we were to break down below the ₹74.50 level, we could make an attempt to take out the 200 day EMA to the downside. If we do take down that support level, it is likely that the US dollar will fall rather significantly against the rupee, and for that matter more likely than not several other emerging market currencies as well. With this being the case, I think you will essentially look at this through the prism of “risk on” or possibly “risk off.” In a risk off version, obviously this helps the US dollar but when people are willing to take a bit of risk, they start looking at places like India to get bigger returns. That of course demands more Indian rupees, as people try to buy local assets. All things being equal, this is a market that certainly looks as if it is trying to build a massive head and shoulders pattern, but that might be projecting too far into the future. I think we are going to see a lot of volatility, especially on Friday as we have the jobs number coming out of the United States. Because of this, you will need to be willing to handle a bit of volatility.