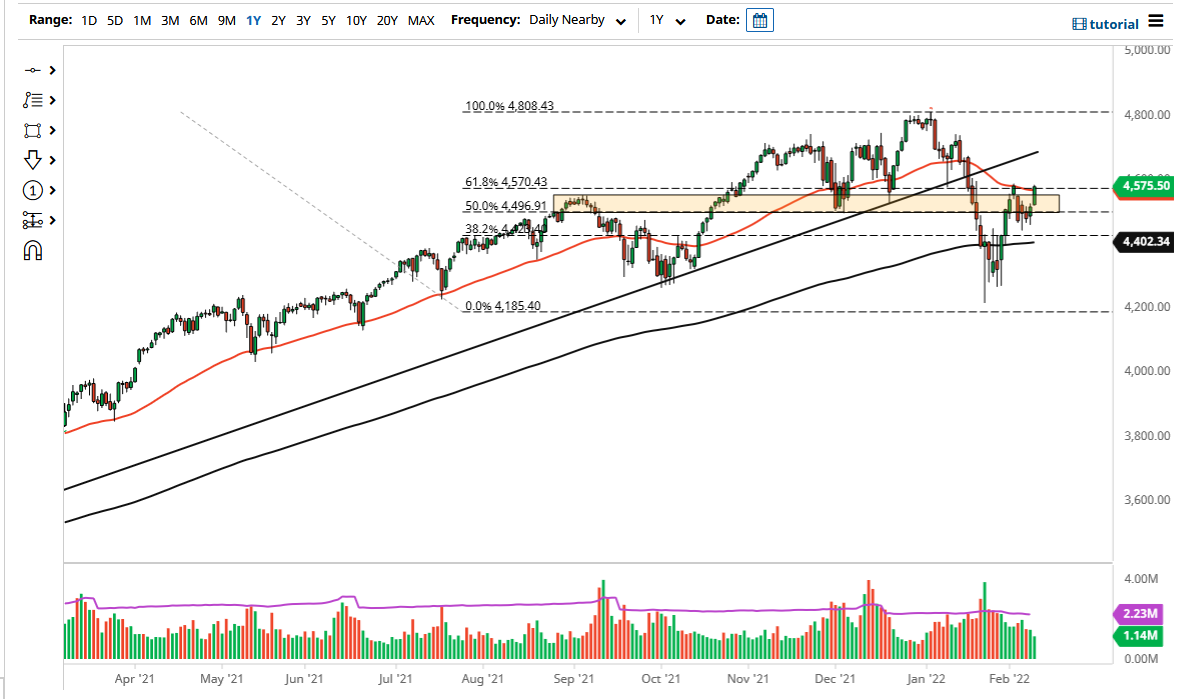

The S&P 500 rallied a bit on Thursday as we continue to see a lot of noisy behavior. When we look at this chart, it is easy to see that we are more bullish than bearish, but we need to get above the 4600 level to continue going higher. It certainly looks as if Wall Street is trying to push things higher in general, but this is a market that looks as if it is trying to front run the Federal Reserve. If the CPI number ends up being hotter than anticipated, that could be very negative for this market.

Keep in mind that J.P. Morgan decided to suggest that the “whisper number” was lower than anticipated, essentially having the market go higher. This is an unknown situation, and this could very well end up being a “buy the rumor, sell the fact” type of situation. The 50 day EMA is an area where you would expect to see a little bit of resistance, so ultimately, I think this is going to be a very interesting 24 hours. In fact, I would probably very cautious about putting any significant amount of money in this market until we see the reaction to the CPI figure.

The 4400 level underneath is sitting where the 200 day EMA is as well, and ultimately this is a market that I think continues to see a lot of questions asked of it. That being said, if we can break to the upside and close above there, then I think the selling is over for the short term. That being said, it would not take much for the market to get disappointed considering what the market has done during the day.

Keep your position size small, as it is hard to tell how this market will behave in the short term. That being said, the market is likely to hear so much noise around 10:00 AM in New York City that it is going to be almost impossible to trade at that point. The market is likely to continue to see a lot of speculation in the meantime, meaning that people will be placing bets in both directions. However, if you are going to do that, you are better off gambling because quite frankly that is the same thing.