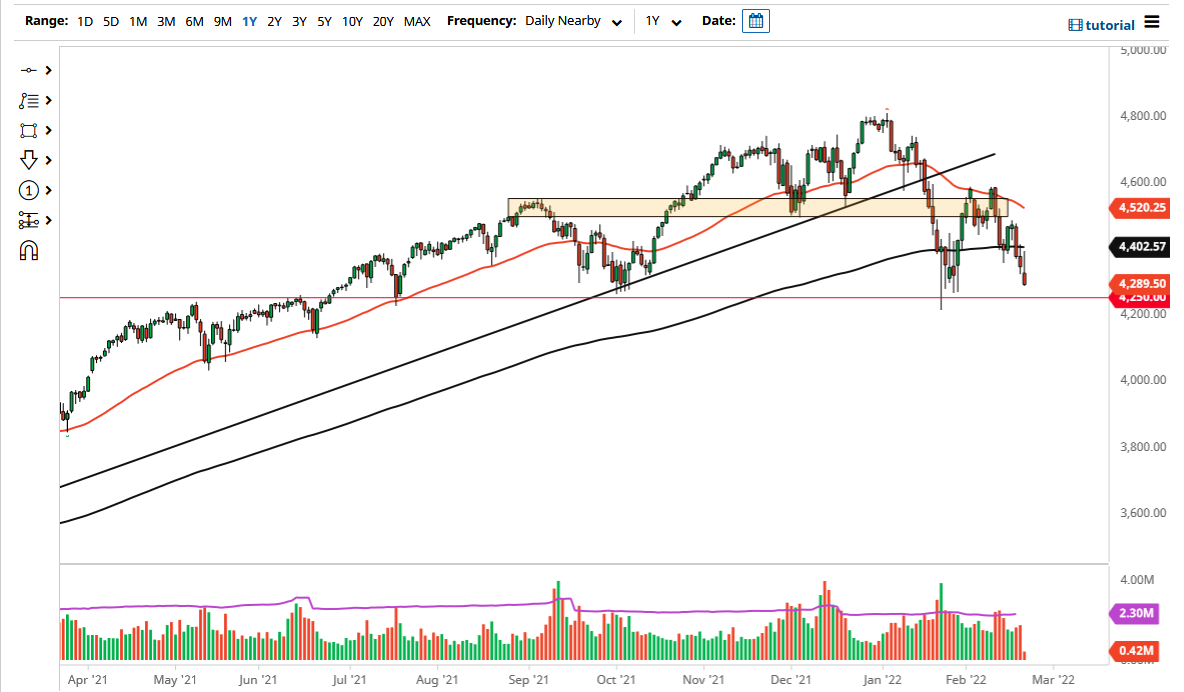

The S&P 500 fell rather significantly on Monday as we gapped lower, turned around to fill the gap and even gain significantly above there, and then sold off again. As a result, we ended up forming a bit of an inverted hammer, and now we are looking at the 40 to 50 level as a potential support area. That area being broken to the downside could bring in a fresh round of selling, and we have a lot of things lining up at the same time that could cause major problems.

Keep in mind that Monday was Presidents’ Day in the United States so trading was limited in general and would not have been as liquid as usual. That being said, with Vladimir Putin acknowledging the sovereignty of the breakaway republics in Ukraine, it looks as if the situation is getting much worse, not better. Furthermore, we have the Federal Reserve looking to tighten monetary policy, and it is a bit of a perfect mix for the S&P 500 to struggle. With that being the case, it is very likely that we see this market go lower.

Watch the NASDAQ 100, because it is right on the precipice of breaking down already. The S&P 500 has a little bit of distance to cover before we break down, and the NASDAQ 100 is a little quicker to fall apart as it is farther out on the risk spectrum. Nonetheless, it could be a bit of a “heads up” as to where we go next. The only thing I think that helped this market during the day was the fact that the underlying index was not open. I fully anticipate that today is going to be a very negative day overall.

If we can get back above the 200 day EMA, I would be interested in perhaps taking a look at the overall attitude of the market and perhaps whether or not the fundamental situation has changed, but we would need the tensions in the Ukraine to calm down, and then we would also need to see the Federal Reserve change its monetary policy. I would not hold my breath for either in the short term. That being said, one would think that eventually the markets would sell off enough to have Jerome Powell and the Federal Reserve do something.