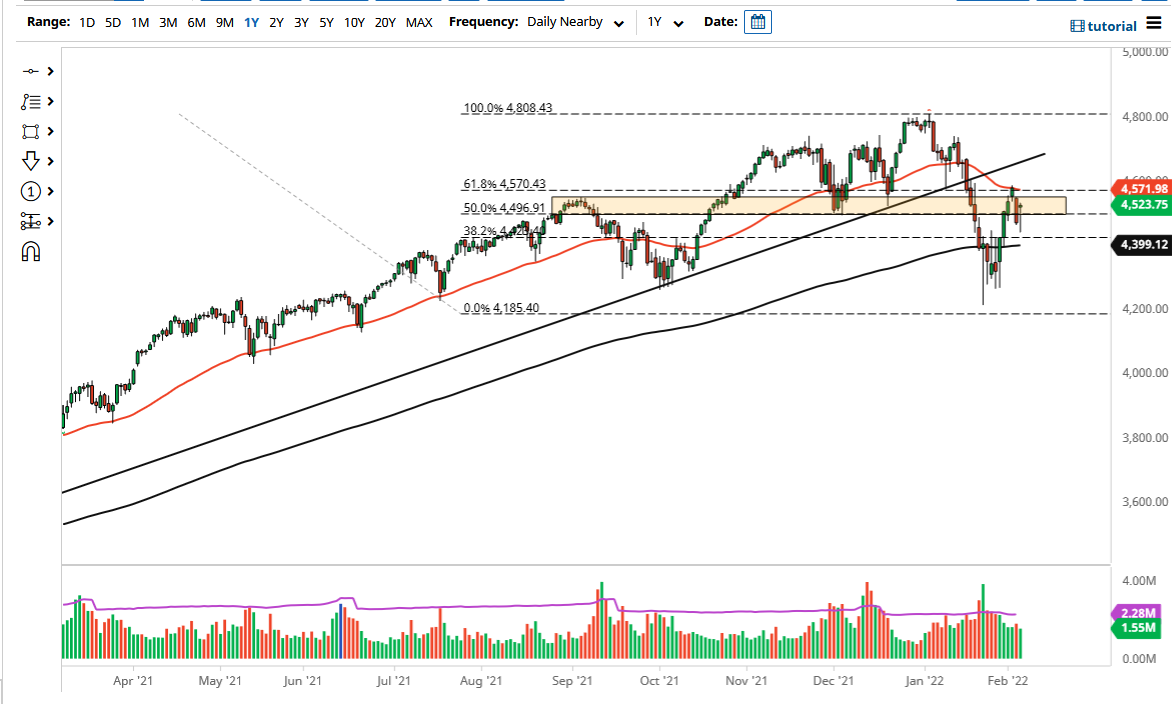

The S&P 500 fell significantly on Friday as we awaited the jobs report after initially gapping higher. We spiked down to the 4440 handle, before bouncing and forming a bit of a hammer. That being said, the jobs number being stronger than anticipated will send interest rates much higher, which of course worked against the value of stocks.

Later in the day, we saw a lot of buying pressure, so at this point I think we are still arguing over the same territory, which should not be a huge surprise considering just how noisy the markets have been as of late. Have we turned the corner and started a new bullish run? I would not go that far, but if we can take out the 50 day EMA above, it is possible that we could make a serious move higher. However, a lot of this is going to come down to the bond markets and what they are trying to price in as far as rate hike expectation.

While we know the Federal Reserve is going to raise interest rates in March and perhaps even cut the balance sheet down, the reality is that money is still going to be very loose for quite some time. With that in mind, people on Wall Street may be trying to talk themselves into the idea of a bullish run going forward. Because of this, you would anticipate seeing a lot of volatility, and it is worth noting that we are in the midst of earnings season. We are currently squeezing between the 50 day EMA and the 200 day EMA, which is a recipe for more volatility to calm.

If we were to turn around and break down below the bottom of the candlestick for the trading session on Friday, we do not have authority go looking for support. That would be in the neighborhood of 4000, where we had consolidated against just a couple of weeks ago. Regardless, I think the one thing you can count on is a lot of noise, as the markets are trying to figure out exactly what to do with themselves. I believe that eventually we will get some type of clarity, but it has also become obvious that the Federal Reserve is okay with the markets being volatile and volatility should lead to some type of feedback loop.