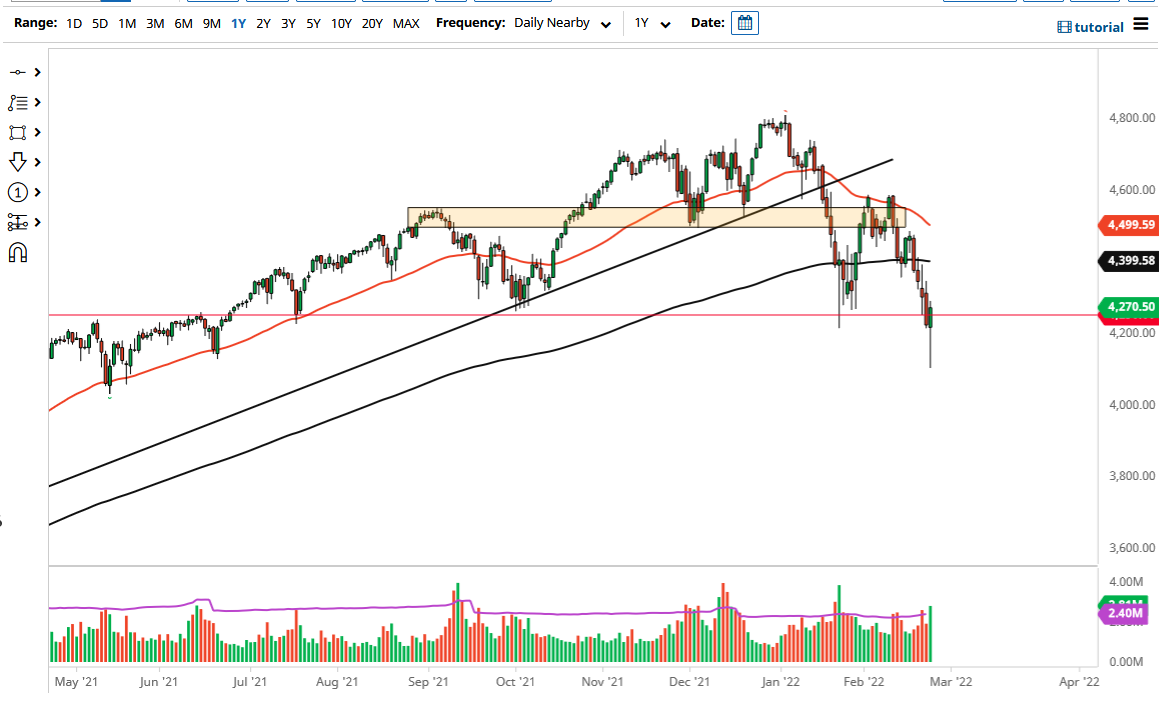

The S&P 500 has initially sold off during the trading session, reaching down towards the 4100 level before rallying quite drastically. That being said, the market has recovered completely to form a massive hammer right at the $4250 level, and therefore it looks as if we are going to try and recover and bounce. That being said, the market is likely to see plenty of selling above, and if you think that is the case, I think simply waiting for a day or two of this pair market bounce is an opportunity to short yet again.

If we break down below the bottom of the candlestick during the trading session on Thursday that would be an extraordinarily negative turn of events and send this market reeling. If this does in fact happen, it is likely that the market would go looking towards the 4000 handle. All things being equal, breaking down below there then opens up a massive bear market.

On the other hand, if we were to take out the 200 day EMA, then it is likely that we would see quite a bit of bullish pressure that point in time, and we could even see a bit of a trend change. Having said that, I do not necessarily expect to see that, and therefore am looking for opportunities to short this market but it may be a couple of days. That is fine, I can wait and will be paying close attention to the Federal Reserve because I think at the end of the day, that is the biggest game in town. Yes, noise about war obviously gets people excited, but I do not necessarily see that being a real threat beyond Ukraine now.

I think volatility continues to be a major issue, but eventually things will settle down. Once they settle down, then we will start looking at the overall real economy and see whether or not it is going to sustain itself. We barely pulled back from a major meltdown during the day, and I think the relief rally will be very strong during the day on Friday, but whether or not it sticks is a completely different question. I do not see anything good other than the fact that we did not see World War III started.