The S&P 500 has been crushed on Thursday as we continue to react to negative geopolitical situations. Obviously, the biggest one would be the Ukraine/Russia issue, but we also have to worry about China/Taiwan after the Olympics. That being said, this is a market that will continue to see reasons to sell off, not only due to the geopolitical issues, but the fact that we are almost certainly going to see a significant slowdown globally due to supply chain issues does no favors for the S&P 500 either.

Beyond all of that, the Federal Reserve looks like it is going to get very aggressive with its monetary policy, and that should continue to weigh upon stocks as well. With all this being said, it is difficult to imagine a scenario where you would want to get overly bullish on this market, due to the fact that there are far too many issues out there. If we break down below the bottom of the Monday candlestick, it is very likely that we will go looking towards the lows again, near the 4225 handle. If we break down below 4200, then it is very likely that we go much lower. If that happens, it will kick off the lot of massive selling, and I think we could go quite deep at that point.

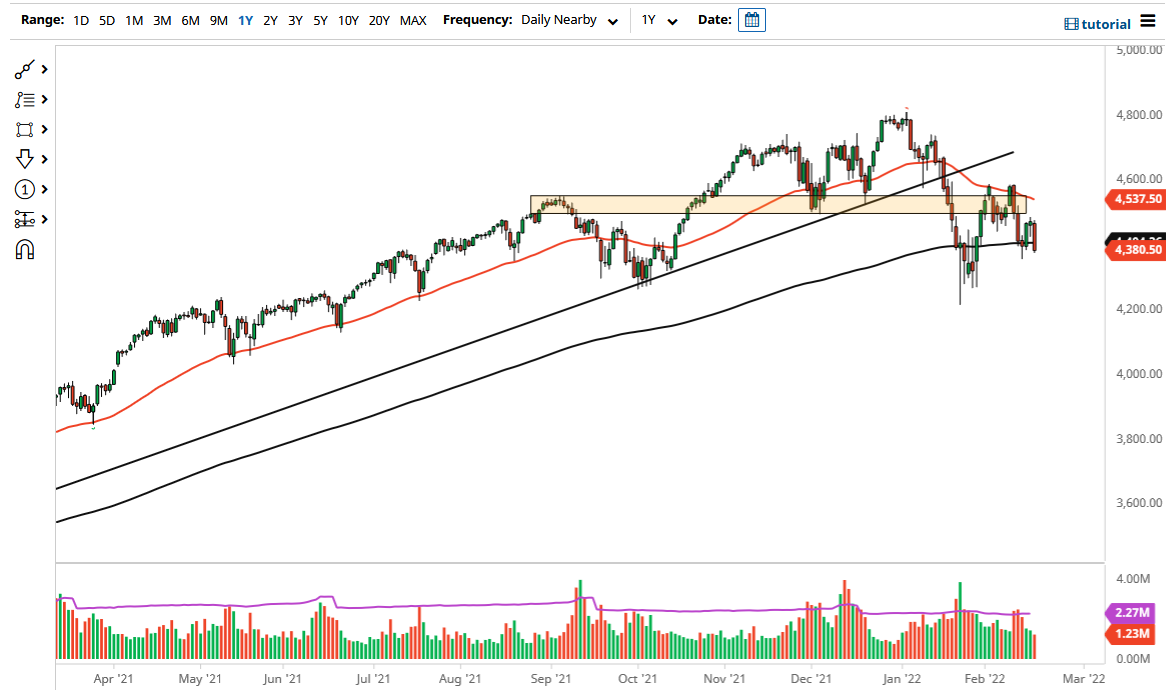

To the upside, the 50 day EMA is starting to slink lower, currently sitting at the 4537 handle. This is an area that I think will continue to be worth paying attention to, because if we can break above there then we will make an attempt at the 4600 level. Breaking above that allows the market to go higher, perhaps reaching towards the 4740 handle. I think it would take a lot of good news to make that happen, and quite frankly this looks horrible at the moment. I have been buying puts, as I do not like shorting this market flat out due to the fact that if we lose enough, the Federal Reserve will come in and save Wall Street either through jawboning, or perhaps a reversal of monetary policy. After all, the Federal Reserve has been protecting Wall Street for 13 years, and it is hard to imagine that would change anytime soon. That is not to say that they are close to intervening yet, but that is almost certainly something that you need to keep in the back of your mind.