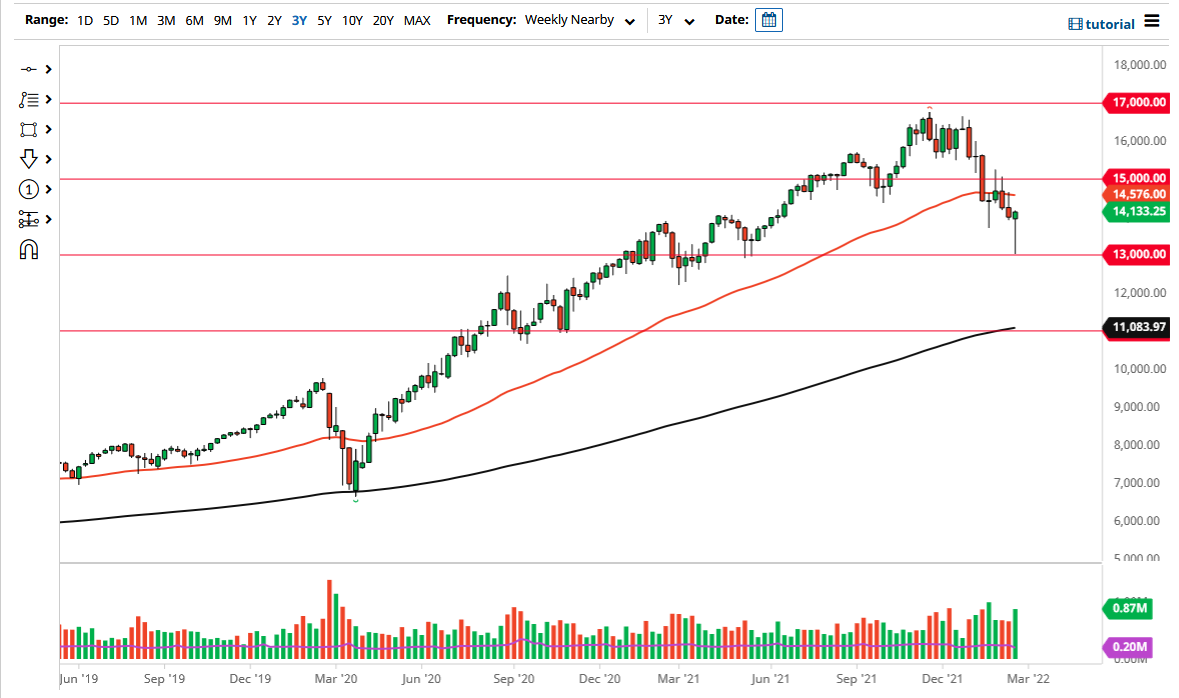

The NASDAQ 100 has drifted lower during a majority of the month of February but has found the 13,000 level to be supportive enough to keep the market afloat as things stand. This is a market that has pulled back quite nicely, and a lot of value hunters will be looking to get involved. However, the NASDAQ 100 is full of major tech growth stocks, and they typically need a loose monetary policy environment or at least a high growth type of situation economically.

While the economy seems to be doing okay for the moment, the reality is that if inflation continues to take off the way it has, there is only a matter of time before the market start to price in the idea of a major slowdown as consumers will step away from purchasing things. In fact, we are already starting to see that so the next couple of inflation numbers will be crucial when it comes to the US markets.

You can see from a structural standpoint, the 13,000 level has clearly offered a major amount of support, and it is an area that has been important in the past. The fact that we are forming a hammer for the last week of the month does bode well, but it would take very little to send the market back down. The NASDAQ 100 will be moving based upon the headlines coming out of Ukraine and Russia, and the several speeches that we will hear this month from Federal Reserve governors heading towards the interest rate decision.

A lot of traders out there are starting to focus on the fact that they do not believe the Federal Reserve will be able to raise interest rates as fast as once thought, but at this point if inflation gets out of hand, is very likely that the Federal Reserve will have no choice but to do so. If they start tightening monetary policy, that is very toxic for the NASDAQ 100 as a lot of the stocks demand lots of liquidity, something that the Federal Reserve is getting ready to do.

Keep in mind that liquidity has fueled the markets for the last several years, and the NASDAQ 100 is a major beneficiary when it comes to liquidity as it forces money into riskier assets. Unfortunately for the NASDAQ 100, there is only about seven companies that do a majority of the weighting, so you have to pay attention to all the usual example such as Apple, Microsoft, and Alphabet.