The NASDAQ 100 initially sold off on Wednesday as we saw a lot of “risk off trading” early in the day. That being said, Russian troops are supposedly building up and heading towards the border again, so it will be interesting to see how Ukraine affects the stock market, as it seems like there are a whole list of potential issues. Ultimately, this is a market that needs a “risk on environment”, and interest-rate dropping. Whether or not that is going to be the case is an open question, but I certainly think that we have gotten way ahead of ourselves in both directions.

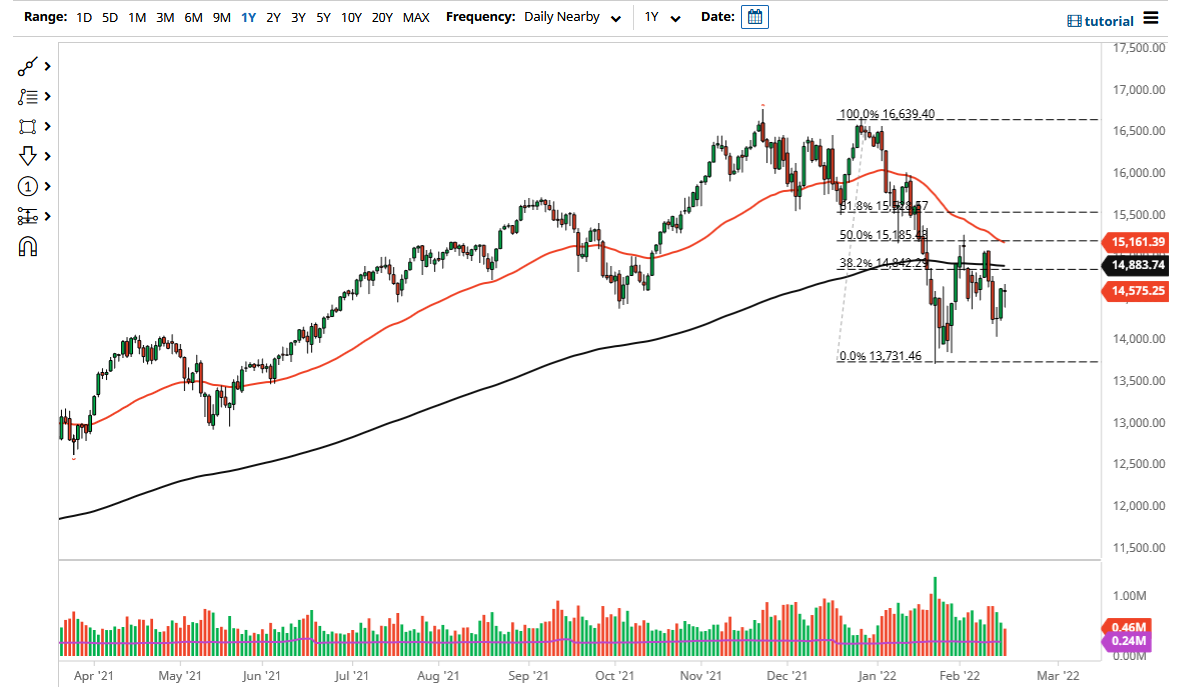

I think volatility is the one thing you can probably count on, and that typically is bad for the stock market in general, especially the NASDAQ 100. Because of this, I think that the 200 day EMA above has to be looked at through the prism of being extraordinarily resistive, because the market has been so beaten down. When you look at the larger pattern, you could suggest that we are trying to build a bearish flag, but at the same time you could also say that we just made a “higher low”, or perhaps even a bit of a “double bottom.” See the problem here? The markets are all over the place and do not seem to be very convicted in one direction or the other.

The 50 day EMA is sloping lower, perhaps suggesting that we might get a bit of a “death cross” coming. That is obviously a very bearish indication, but it is often a rather late indicator. I think the reason that this market is going to be so difficult is that it is moving on the whim of the latest headline, and we have a Federal Reserve that looks like it is going to start tightening monetary policy, something that is typically bad for growth stocks.

The one thing that I would say about trading this market right now is that you need to keep your position size very small, because the swings are violent enough that you can lose money in a very short amount of time. As a general rule, I have been trading roughly 33% of my normal position size, and it still feels like a workout by the end of the day.