Gold prices rose today as the dollar weakened although higher US interest rates are still looming. The price of an ounce of gold is now stabilizing around the resistance level of 1877 dollars, despite the confirmation of the US Federal Reserve minutes yesterday on the future of US interest rate hikes this year. In general, the demand for the yellow metal, which is considered a safe haven, increased amid continuing concerns about tensions between Russia and Ukraine. Recently, US President Joe Biden stated that his country has not verified Moscow's allegations that troops are withdrawing from the border.

For his part, NATO Secretary General Jens Stoltenberg told reporters in a day or two, "It remains to be seen if there is a Russian withdrawal ... What we see is that they have increased the number of troops and there are more forces on the way." This was mentioned during the meeting of NATO defense ministers in Brussels. Cyber attacks on the websites of the Ukrainian Defense Ministry as well as two major Ukrainian banks have also led to fears that Russia is still ready for an invasion.

In US economic news, data from the Commerce Department showed US retail sales rose 3.8% in January after declining 2.5% in December. Economists had expected US retail sales to jump 2% compared to a 1.9% decline originally reported for the previous month.

The Labor Department also released a separate report showing US import prices rose 2% in January after declining by a revised 0.4% in December. The sudden rise in import prices reflects the largest monthly increase since April 2011. Economists expected import prices to jump 1% compared to a 0.2% decrease originally announced from the previous month.

In other economic news, the Federal Reserve released a report showing US industrial production increased 1.4% in January after declining 0.1% in December. Economists had expected industrial production to rise 0.4%.

The Federal Reserve released the minutes of its January monetary policy meeting, reiterating the view that it would be appropriate to start raising US interest rates. The belief that interest rate hikes should start soon comes as participants noted that inflation remains above 2% and that the labor market has made significant and broad progress over the past year.

The minutes showed that participants compared the current situation to the last time the Fed began de-aligning monetary policy in 2015. It determined that there is currently a much stronger outlook for growth in economic activity, significantly higher inflation, and a significantly tighter labor market. As a result, most of the meeting participants suggested that a faster pace of interest rate increases than in the post-2015 period would likely be justified, the Fed said.

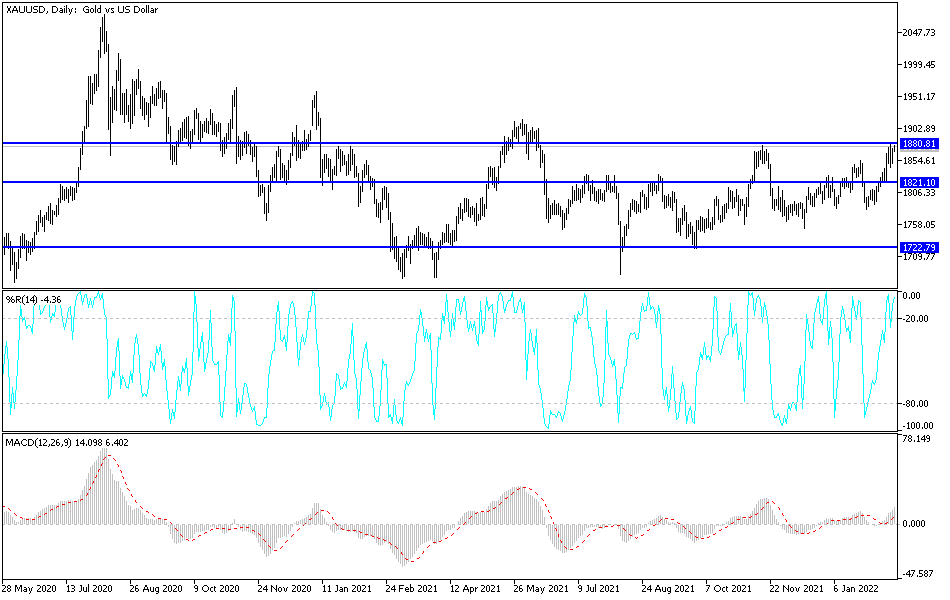

According to the technical analysis of gold: The assurances on the future of raising US interest rates and the leadership of the US Federal Reserve for the future of tightening the policy of the rest of the global central banks, gold prices have other factors that support its gains. Gold price stability above the psychological resistance 1800 dollars an ounce is still supporting the bulls to launch higher. Currently, they are the closest to testing the resistance of 1885 dollars, which may inevitably support the breach of the psychological resistance of 1900 dollars, especially if the Russian threat continues.

On the other hand, the gold price will not abandon the upward path without moving below the $1800 level, otherwise the trend will remain bullish. The price of gold today will be affected by the level of the US dollar and the extent to which investors take risks or not.