An important trading week occurred for the price of the GBP/USD currency pair, which jumped towards the resistance level 1.3628, its highest in three weeks. It retreated at the end of trading towards the level of 1.3505 after the announcement of stronger than expected numbers of US jobs. Trading closed stable around the level of 1.3527. Sterling's strong gains against the other major currencies came after the Bank of England chose to raise interest rates again, but the currency's gains were quickly reversed after British Central Bank Governor Andrew Bailey took a more pessimistic tone regarding future rate hikes.

As announced, the Bank of England raised interest rates by 25 basis points, although some members were keen to raise rates by 50 basis points. The Monetary Policy Committee (MPC) voted 5-4 to increase the bank rate by 0.25 percentage point but said those minority members favored a 0.5 percentage point increase in the bank rate, to 0.75%.

Overall, the bank's almost 50bp vote for a 50bp raise points to more rallies ahead and may come soon. Indeed, the bank can so far meet market expectations to deliver 100 basis points of gains by the end of the year. The Bank of England raised its key interest rate to contain the fastest inflation in three decades, with some policymakers unexpectedly seeking a more aggressive response to higher prices. The move heralded the start of a new era as the Bank of England will begin to dispose of 895 billion pounds (1.2 trillion US dollars) of bond holdings it has accumulated over the past decade to stimulate the British economy.

The decision came shortly after British Chancellor of the Exchequer Rishi Sunak announced a 9-billion-pound program to help consumers with rising energy bills. The more expensive fuel helps explain why the BoE is concerned that inflation could soon peak at more than triple its target.

"We did not raise interest rates today because the economy is imploding," Bank of England Governor Andrew Bailey said at a news conference in London after the decision. “We run the risk that some high imported inflation will become ingrained in the domestic economy, leading to a longer period of high inflation.”

Overall, the Bank of England is leading the way in a global tightening of monetary policy, as institutions move to address the rapid acceleration of prices in the wake of the pandemic shutdowns. The US Federal Reserve is expected to launch its own rapid tightening cycle this year, and there has been speculation that it could include a 50-basis point rise. Commenting on this, Dan Hanson of Bloomberg experts said: “The Bank of England is doing everything it can to confirm its anti-inflation credentials - introducing its first-rate hike since 2004 along with plans to scrap its balance sheet. This urgency, combined with vote fragmentation and a sign of more moves in the coming months, suggests increases are likely in March and May, with the risk of another moving in August. But the cautious medium-term outlook indicates that market expectations of rates of up to 1.5 per cent by the end of the year still seem far from reality.”

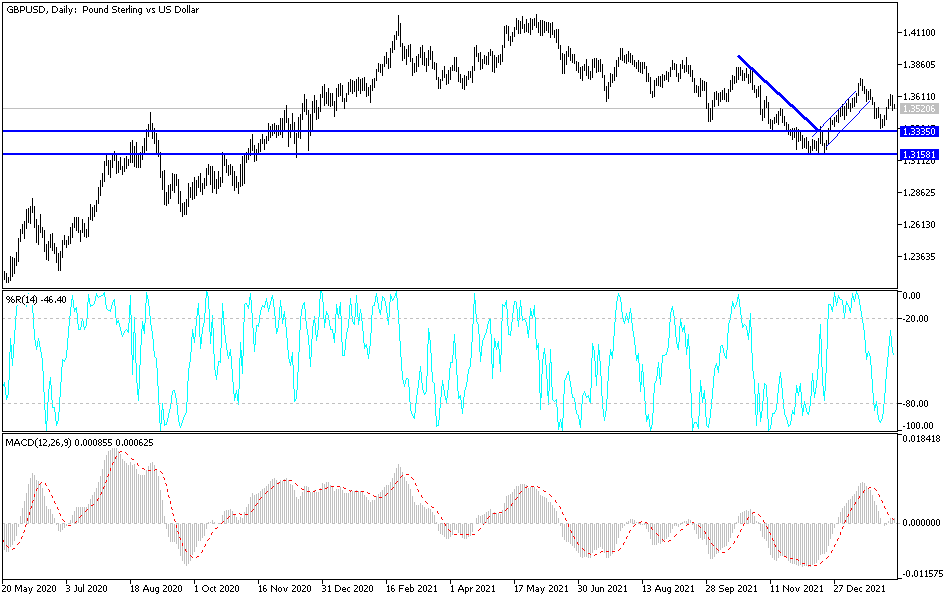

According to the technical analysis of the pair: Despite the performance at the end of trading last week, the price of the GBP/USD currency pair still can move upwards as long as it is stable around and above the 1.3500 resistance. The declines will remain an opportunity to buy the currency pair. The economic performance and the future of monetary policy tightening in the benefit of the pair's gains is lacking in investors' appetite for risk and the recovery of global stock markets that support the pound. The closest targets for the bulls are currently 1.3585 and 1.3670, respectively.

On the other hand, the pair will not abandon the bullish outlook and the bears will start to gain stronger control over the trend without moving towards the 1.3365 support level. The focus of the forex market this week will be on the US inflation figures and the growth rate of the British economy.