Despite the strength of the US dollar following the announcement of stronger than expected results of US inflation levels, the GBP/USD currency pair showed remarkable resilience after the data was announced. USD strength supported the markets expectations for the future of aggressive tightening of the US central bank policy this year. The US pair fell to the level of 1.3514, but quickly recovered to the resistance 1.3609 before closing last week's trading, stable around the 1.3560 level. This steadfastness returns as mentioned before that the sterling is still supported by the expectations of a strong interest rate hike by the Bank of England.

Meanwhile, the dollar is expected to maintain support as the Federal Reserve races to raise interest rates in the face of rising inflation in the US. Commerzbank analysts therefore see “against the US dollar, we expect more or less sideways movement, as the Bank of England and the Fed will become more restrictive, the BoE started a little earlier, but the Fed is likely to follow suit at a faster pace than in March “. Accordingly, Commerzbank’s forecast file sees the price of the sterling dollar pair moving towards 1.35 by the end of March, and 1.34 during the second and third quarters, before 1.33 by the end of the year. The level of 1.35 is seen by the end of 2023.

Britain's economy has weathered another coronavirus boom better than expected during the last quarter of last year, according to official data released on Friday, and some economists doubt it is recovering from that autumn setback. UK GDP fell 0.2% in December as businesses and households curtailed activity and spending following the emergence of the Omicron strain in late November from the coronavirus. This left the British economy to grow at a quarterly pace of 1% in the last three months of the year, according to official figures.

The consensus or median estimate of economists was that a larger decline of -0.5% for December was likely, and that quarterly GDP should have been a little faster at 1.1%. Growth in the fourth quarter may have been negatively affected for statistical reasons when it revised National Statistics lowered its estimate for third-quarter growth from 1.3% to 1.1%.

The negative impact of Omicron on the economy appears to be easing rapidly especially since most of the restrictions have been removed again. It is not yet clear whether GDP will fall again in January, but indications that activity rebounded sharply in the second half of the month point to a significant increase in GDP in February, comments Nikesh Sogani, UK economist at Lloyds Commercial Banking.

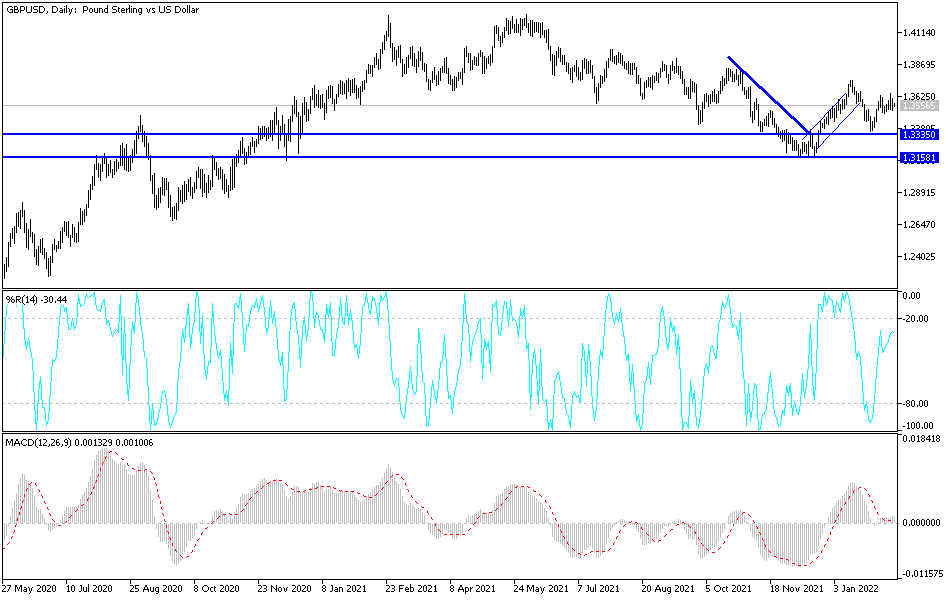

According to the technical analysis of the pair: On the daily chart below, it seems clear that the price of the GBP/USD pair is in a neutral position, supported by the expectations of tightening monetary policy for both the Bank of England and the US Central Bank. The performance may remain like this for a longer period, or at least until the nearest meeting of one of the two banks . The tendency will be to the upside more if the currency pair moves towards the resistance levels 1.3660 and 1.3740, respectively. On the other hand, bullish expectations may be affected if the currency pair moves towards the support levels 1.3485 and 1.3390, respectively. So far, I still prefer buying the currency pair from every bearish level.