The British pound has been aggressively bought off the forex market by investors in anticipation of the Bank of England's rate hike on Thursday, February 3. It will take it to multi-year highs, but the British currency could be challenged by economic disappointment later in the year as Economists say. The strong rebound gains for the GBP/USD currency pair brought it to the 1.3586 resistance level, its highest in two weeks, and is stable around it, ahead of the important and influencing data and events today and tomorrow. In general, gains were recorded by the pound against both the euro and the dollar at the beginning of the new month's trading as investors set a second interest rate for the Bank of England, which is likely to raise the bank rate to 0.50%.

Commenting on this, Derek Halpenny, Head of Research at MUFG, said: "The pound is trading at multi-year highs." And “the pound showed resilience at the start of 2022 and was the third best performing currency in the G10.”

The safe-haven Japanese yen recorded gains from the pound while the pound-dollar exchange rate was stable during the year at 1.35. Expectations of higher interest rates in the Bank of England are usually supportive of the Pound and reflect an acknowledgment that inflation in Britain is likely to remain elevated above 2.0% for some time. The bank will be daring to go ahead with another rate hike as the economy appears to have come out of the Omicron wave relatively unscathed.

Britain's economic growth slowed during December and January according to surveys, but economists expect a strong rebound in February as restrictions were lifted and self-isolation rates eased, allowing employment levels to return to normal and consumer confidence boosted. The International Monetary Fund said in its January 2022 World Economic Outlook that average GDP growth in the UK for the period 2021-22 was 5.95%, stronger than all other major advanced economies covered by the IMF.

Expectations of an economic recovery may allow the BoE to raise interest rates in February and point to more such hikes in the coming months. “The spotlight is now firmly on the Bank of England on Thursday: any indications that a faster and more stable normalization/tightening path will support the pound against both the dollar and the euro,” says Asmara Jamaliah, Intesa Sanpaolo Economist.

MUFG's Halpenny says the BoE will favor a "front-loading" rate hike, which means the final level of interest rate the bank achieves in this cycle could be lower than it would have been if the bank pursued a sustained cycle of hikes. "We see more BoE action with an additional 25 basis points increase in May which helps support the pound against the euro, but later in the year, slower growth risks may push the BoE to the sidelines and lead to a reversal of the pound against the euro," he added.

In a recent speech delivered by a member of the Monetary Policy Committee in the Bank of England, Catherine Mann, she said that she prefers to work on interest rates early to reduce inflation expectations among companies, and thus reduce the possibility of a “final” bank rate hike. Several economists we follow are warning that the UK economy could disappoint later in the year as consumer spending comes under pressure from high inflation and tax hikes, prompting the Bank to back off on rate hikes.

British inflation could exceed 7.0% in the first half of the year after a sharp rise in utility bills expected in April, which means that UK workers are expected to face a significant loss of earning capacity. Moreover, analysts say fiscal policy will become a headwind for consumers as National Insurance was introduced for employees and employers in April and income tax ranges were frozen, causing many families to pay higher taxes.

More economic challenges are expected against the EUR than do the dollar's outlook in the coming months, which recognizes that the strength of the dollar is likely to end this. general. Accordingly, MUFG expects the EUR/GBP exchange rate to be at 0.8250 by the middle of the year and 0.8350 by the end of the year. This gives an approximate forecast for the pound against the euro at 1.2121 and 1.1976, respectively; They forecast the GBP/USD exchange rate at 1.3580 and 1.3890.

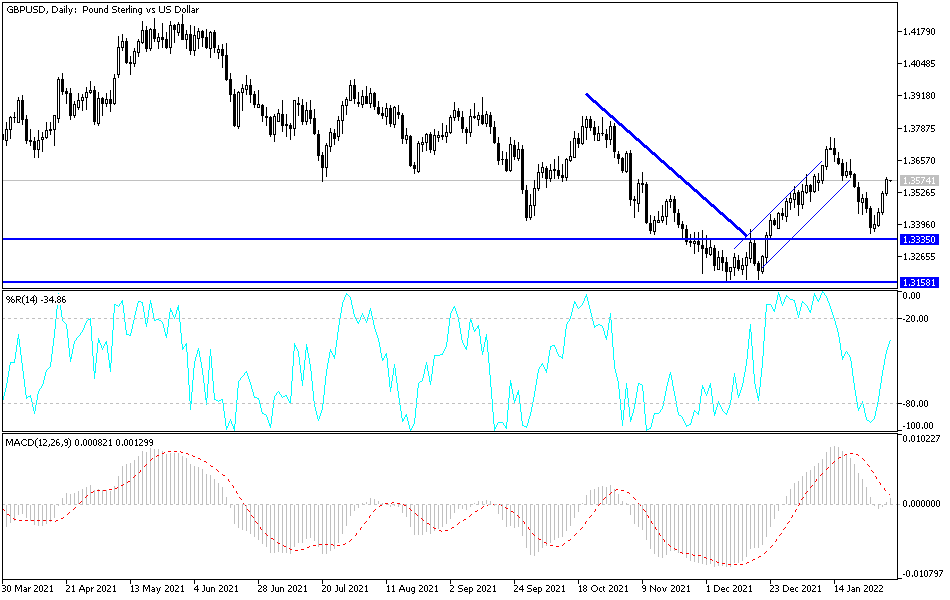

According to the technical analysis of the pair: Undoubtedly, the recent rebound of the GBP/USD currency pair is very important for the bulls. The rebound towards the current 1.3585 resistance has brought forex traders back to the vicinity of the last ascending channel of the pair. The bulls’ control may be strengthened in case the resistance levels are breached 1.3660 and 1.3770. That could happen quickly if the Bank of England today confirms expectations, raises interest rates and signals more tightening during the year.

On the downside, the bullish hopes will evaporate, as is the performance on the daily chart if the pair returns to the 1.3360 support area. The Bank of England's decisions may dampen the reaction from the US data of jobless claims, non-farm productivity and ISM services PMI.