As with the rest of the risk currencies, the attempts to rebound higher for the GBP/USD currency pair did not last long by the end of the exciting week’s trading. It returned to rise to the level of 1.3438 after the currency pair collapsed to the support level 1.3273 in light of the Russian invasion of Ukraine. The currency pair returned to decline at the beginning of this week's trading, to reach the support level 1.3321, as Russia continues its war on Ukraine amid successive developments.

The pound sterling against the euro was threatening to drop below 1.19 before last weekend, as investor sentiment took a turn for the better and helped the euro but recently cost the dollar gains. The rapid sell-off that greeted the news of Russia's invasion of Ukraine on February 24 sent the euro and European currencies lower, but a recovery in sentiment followed. Commenting on the performance, Joe Manimbo, senior market analyst at Western Union, said: "Markets are assessing the ongoing Russian invasion of Ukraine that has prompted the West to impose a second tranche of sanctions aimed at undermining Russia's long-term finances."

The conflict is by no means over, but it appears that forward-looking markets are looking to the future and positive sentiment indicates that the conflict may be ruled out entirely. Commenting on this, Matthias van der Geogt, analyst at KBC Markets said: "Markets were preparing for some sort of return to normality beyond Ukraine." The analyst also notes reports that Russian President Vladimir Putin may be ready to hold talks with Kyiv on the country's neutral status and may further boost sentiment. "The slightly improved tone helped the UK and Canada currencies recover from two-month lows," Manimbo added.

A major component of market risk is the size and scope of the sanctions imposed by the West and its allies in response to the Russian invasion: so far they have been largely on the lukewarm side, particularly from the EU. It is reported that the Eastern European Union countries are looking for tougher sanctions than their counterparts in Central and Western Europe, while Italy was reported to have managed to obtain an exemption for the luxury goods sector in any sanctions package.

"Italian Prime Minister Mario Draghi has succeeded in securing a cut in Italian luxury goods from the package of economic sanctions imposed by the European Union against NATO," said Joe Barnes, Brussels correspondent for the Telegraph. An EU diplomatic source told Barnes: "Selling Gucci's loafers to the oligarch is clearly more of a priority than responding to Putin."

Belgium has reportedly negotiated concessions for its diamond exports according to Barnes.

Meanwhile, Germany, Italy and Cyprus oppose Russia's exit from Swift, with Germany's heavy dependence on Russian gas cited as a reason for opposition by Europe's largest economy. Fault lines within Europe are likely to ensure that Russian sanctions do not reach their full potential. From a financial markets perspective, this is actually supportive of risk, even if ethics are called into question.

But forex analysts are warning that any reprieve in market volatility may not last long amid reports of a decline in Russian forces in the Ukrainian capital. Indeed, the fighting is fierce and the European Union, the United States and Britain are signaling further sanctions. A number of EU figures - including Irish Foreign Minister Simon Coveney - assert that Russia's exit from the SWIFT payments system is still possible.

Such an outcome could trigger another market sell-off that would hit the Euro and Sterling and support the Dollar.

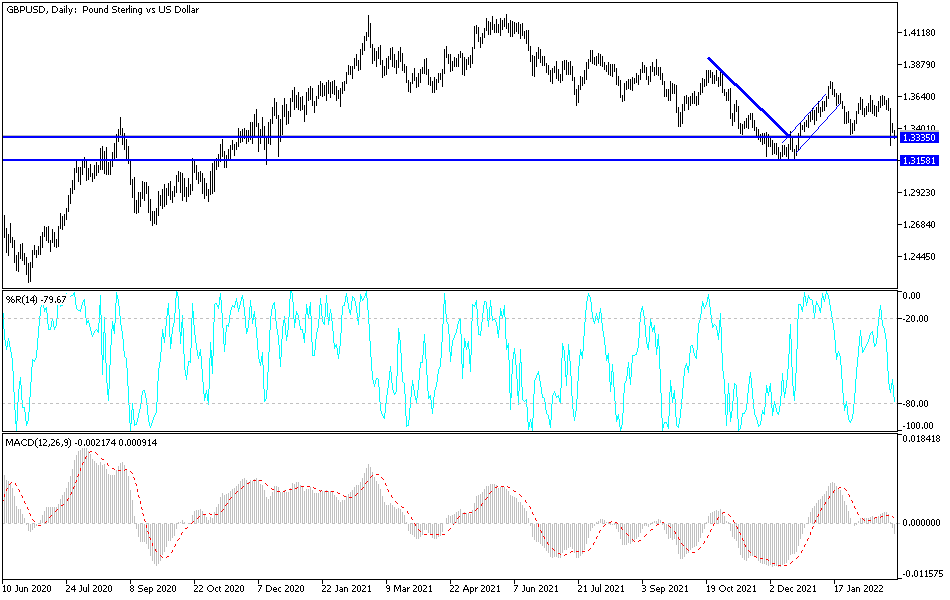

According to the technical analysis of the pair: The recent movement of the GBP/USD currency pair supports the bears' stronger control of the trend. Breaking the support 1.3300 according to the performance on the daily chart will support a further strong decline for the currency pair, and accordingly, the next support levels may be 1.3225 and 1.3100, respectively. I still prefer buying the currency pair from every descending level, considering that the continuation of the Russian war and the expansion of its consequences will support renewed selling with every opportunity to rise.

On the upside, according to the performance on the daily chart, the closest resistance levels for the currency pair are 1.3385, 1.3460 and 1.3550, respectively. The last level is important for the bulls to regain control of the trend.