With strong indications of the BOE's tightening future, the major focus of economists and markets will remain on the Bank of England's decisions about a new rate hike. The question remains how many times the Bank will have to raise rates throughout the year. Before this important event, the GBP/USD currency pair is settling around the 1.3460 level, amid a cautious rebound upwards, after the pair collapsed to the 1.3357 support level last week. Commenting on the performance of sterling. Jane Foley, senior FX analyst at Rabobank, says that although sterling has started 2022 on a positive note, the sharp rise in the cost of living in Britain poses a risk to the outlook.

Despite the heavy criticism, the government appears set to lift National Insurance in April in a move some economists say threatens consumer spending and consumer confidence, the two main drivers of Britain's dominant service sector. Under the plans, employees, employers, and self-employees will pay an extra 1.25 pence in GBP from National Insurance from April 2022 for a year.

Both British Prime Minister Boris Johnson and Chancellor Rishi Sunak stressed at the weekend that the rise would precede, despite concerns that UK consumers are facing a once-in-a-generation rise in the cost of living. The implications are significant given that the April tax increase comes in the same month that the energy price ceiling is set to rise by 51%, representing a double dose of negativity for consumers.

FX analysts often cite concerns about the UK's future growth as one of the reasons for the pound's fall in 2022. Analyst Foley notes that the pound has made a resilient start to 2022: “Without a doubt, the pound has been resilient...this flexibility owes Much to market expectations that the Bank of England is likely to raise interest rates at a robust pace this year.”

The Bank of England is skewed to raise the bank interest rate by 25 basis points on Thursday, February 3rd, in what amounts to a second straight hike. Another 100 basis points are priced by the markets for the coming year. The first rise of 15 basis points in December helped the pound rise against the euro and dollar during the December-January period. But, looking ahead, Rabobank sees a risk that after the expected 25 basis point rate hike in February, the bank will struggle to tighten policy further this year, which could prove headwinds to support sterling from Interest rate forecast channel.

Given Rabobank's view that the US dollar will recover with the start of the Fed's tightening, the bank sees a risk that the GBPUSD exchange rate will fall below the 1.30 level in the middle of the year. They seek to return to the level of 0.85 in the exchange rate of the euro against the pound in a period of three to six months.

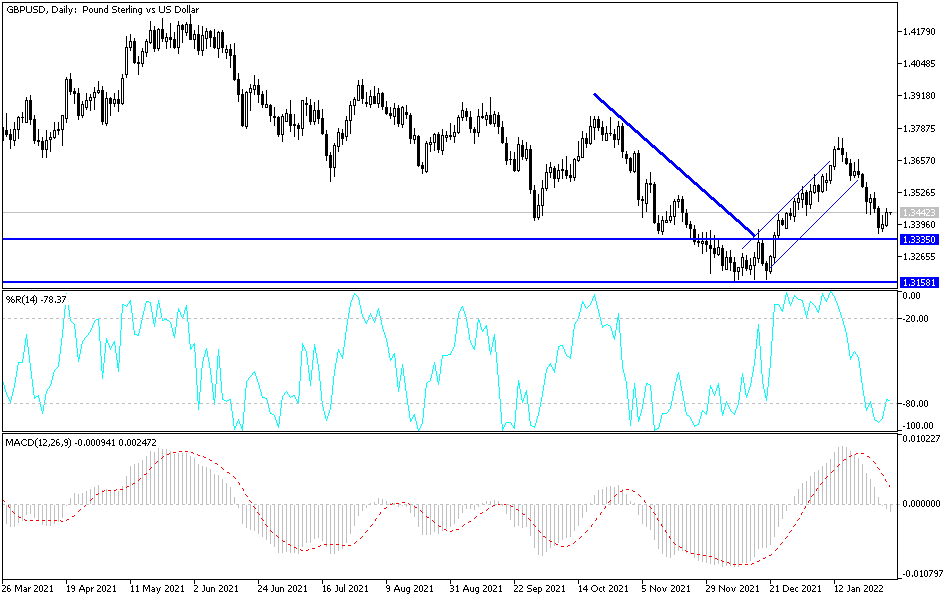

According to the technical analysis of the pair: On the daily chart below, the price of the GBP/USD currency pair is still under downward pressure. The bulls have to break through the resistance levels 1.3520 and 1.3660, to return to its ascending channel that it abandoned since the middle of last month's trading. On the downside, the 1.3330 support level will remain the most important for the bears to launch further down.