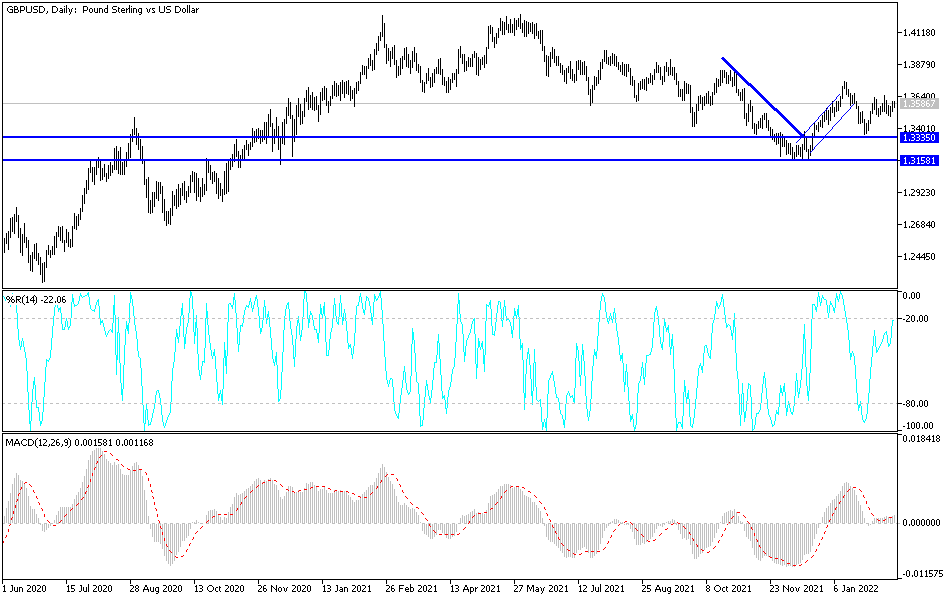

The price of the GBP/USD currency pair is settling around the resistance 1.3597 at the time of writing the analysis. This is despite the confirmation of the US Federal Reserve minutes yesterday on what the markets are quoting that the bank is fully prepared to raise US interest rates as long as inflation in the country records record highs.

The Institute for Fiscal Studies has warned that rising inflation will add 23 billion pounds ($31 billion) to the cost of servicing Britain's national debt over this year and next. The retail price inflation index, which is used to increase payments on about a quarter of what the government owes, jumped to 7.8% in January, its highest level in 31 years, and is now well above the Office of Budget Responsibility's forecast made in October of income.

Isabelle Stockton, an economist at IFS think tank, said the unexpected rise in the retail price index would push debt interest costs for the 2021-22 financial year to £11 billion above expectations and "could easily add £12 billion" to borrowing in 2022- 23, which begins in April.

Britain's finance minister, Rishi Sunak, is already under pressure on public finances as a result of rising inflation. He pledged to provide nearly 10 billion pounds to help families during the cost of living crisis. Meanwhile, pressure on real wages, as well as higher taxes to pay backlog NHS clearance costs, will erode tax receipts by affecting growth.

The rising cost of servicing Britain's £2 trillion debt comes to the fore. Covering the EGP 10 billion in additional cost would require a tax increase equivalent to adding 2% to the basic income tax rate. The UK's tax burden has already reached its highest level in 70 years. Accordingly, Stockton added, “Government finances are now more vulnerable to increases in the cost of servicing its debt.” And “energy-price-driven increases in RPI are one source of this increase. Another may come from continued increases in bank interest rates set by the Bank of England.”

Most economic forecasters say more price increases await the UK, with most seeing a peak in the current inflationary cycle in April, when the energy bill was raised, and the government raised taxes on employees and employers. January inflation came in at 5.5% year-on-year in January, the Office for National Statistics said, up from December's 5.4% and market expectations of 5.4%.

This was the UK's highest inflation reading in 30 years and underscores the potential for higher interest rates at the Bank of England over the coming months. The Bank of England's forecast for annual inflation in the first quarter of 2022 shows a peak of 5.73%, not much higher than the January figure.

According to the technical analysis of the pair: I still see that the opportunity to rise in the GBP/USD currency pair exists. It breaks through the 1.3660 and 1.3720 resistance levels on the daily chart that supports a stronger control of the bulls, after which the future of psychological resistance may be considered 1.4000. Expectations of tightening policy both the Bank of England and the US Federal Reserve will continue to create a balance in the performance of the currency pair. On the downside, the support levels 1.3440 and 1.3330 will be important to return the bears' control over performance and change the pair's direction to the downside.