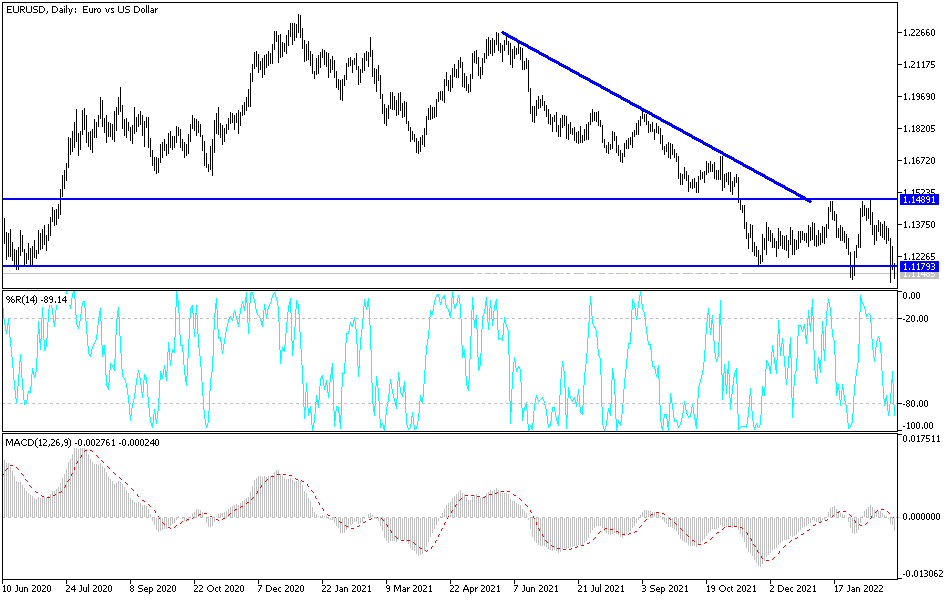

At the end of last week’s trading, the price of the euro currency pair against the US dollar EUR/USD attempted to recover after its collapse to its lowest level during 2022, reaching the support level of 1.1106. This recovery brought the price of the currency pair to the resistance level of 1.1273. The expansion of the Russian war operations in Ukraine, as mentioned before will remain an important factor to sell the EUR/USD pair when trying to rebound. It actually fell back to the 1.1124 support level at the beginning of this week's trading.

The recent temporary recovery of the EUR/USD was buoyed by comments from European Central Bank President Christine Lagarde, who indicated that the ECB may continue on the path towards monetary policy normalization. President Christine Lagarde said at a press conference after the meeting of the European Council of Finance Ministers and Central Bank Governors.

We will include in that the geopolitical development that will have a clear impact. But Lagarde also said: “But we are driven by our mandate of price stability and financial stability, and we will make those decisions at the next monetary policy meeting, and thereafter.”

Prior to the events of recent days, the euro had strengthened during the first weeks of February after Bank Governor Lagarde said after the last ECB policy meeting that inflation risks in the eurozone were shifting to the upside, before also refusing to reaffirm the previous view that European interest rates will be as well. It is unlikely to rise this year.

This has increased financial markets' confidence to bet that the era of negative interest rates is approaching, even though the Russian incursion into Ukraine has multiple ramifications for the European and global economic outlook. This has led some in the financial markets to question this week whether such assumptions about interest rates can overcome conflict in Europe.

“The euro has managed to squeeze away from its low convincingly from a technical point of view, and a rebound back above 1.1121 (January low) mitigates immediate downside risks, as well,” says Sean Osborne, senior FX analyst at Scotiabank. Believe". He added, “The trend oscillators are bearish across the short, medium and long term studies; The euro's rally may remain shallow and short-lived for the time being.”

Recently, EUR/USD has already rebounded to a high of 1.12 amid a broad recovery in financial markets elsewhere, which some analysts have attributed to the limited nature of economic sanctions adopted in Europe, the United States ,and the United Kingdom as a result of Russia's incursion into Ukraine. Thomas Matthews, Markets Economist at Capital Economics says, “This could plausibly reflect several factors: a view that the sanctions packages that were unveiled may have been less stringent—particularly in relation to Russia's energy sector—than had been anticipated; Believing that the war might end quickly. Or simply that some asset prices — particularly US stocks — have already fallen a lot this year, and a recovery was due.”

The measures announced so far are not expected to have any impact on the energy sector, which is the main driver of a large current account surplus that supports the Russian economy; Instead, many of the sanctions target Russian businessmen and some leaders. Friday's rebound in international markets came as Russian forces rolled into the Ukrainian capital, prompting President Volodymyr Zelensky to seek help from neighboring European countries.

According to the technical analysis of the pair: The general trend of the EUR/USD is still bearish and will remain as long as the Russian war continues. Bears’ control is getting stronger by reaching the support area of 1.1150 now, which may support the next important move towards the psychological support level 1.1000. As mentioned before, any attempts to recover the currency pair will remain an opportunity to sell again. Currently, the closest resistance levels for the currency pair are 1.1230 and 1.1300, respectively. The EUR/USD will continue to react to the developments of the Russian war with more interest than the reaction from US data results.