The EUR/USD exchange rate has entered the new week's trading near three-month highs, but with the momentum behind its rally, the single European currency may now struggle to extend its recovery. The gains of the most popular currency pair in the Forex market reached the resistance level of 1.1484 and settled around the level of 1.1440 at the time of writing the analysis. It was its strongest rise since July 27 and the period immediately after EU members sealed their approval of the EU's coronavirus recovery fund.

While the euro's gains against the dollar fell on Friday, affected by the announcement of the stronger-than-expected US jobs report for the month of January, it remained comfortably above the 1.14 resistance. Widespread in financial markets that a possible end to the era of negative interest rates could be near in Europe.

In the near term, FX investors will focus on ECB President Christine Lagarde's speech as well as other ECB speeches this week, looking for indications of the pace of policy normalization from here. With some positives in the euro already in place, we have a more neutral view of the currency in the near term.

In general, the euro rose strongly against the other major currencies, after European Central Bank President Christine Lagarde said that uncertainty about the inflation outlook in the euro area has increased and that risks are skewed to the upside along the direct path forward. It also appears that it abandons the previous view that the European Central Bank's rate hike would be "highly unlikely" this year.

According to some analysts the US runs a large positive output gap (compared to the negative output gap in the Eurozone) and the US tightening cycle is likely to be much larger than that experienced in Europe. This was the reason why we would prefer the EUR/USD to consolidate near the 1.15 region, rather than call for a major bullish breakout.

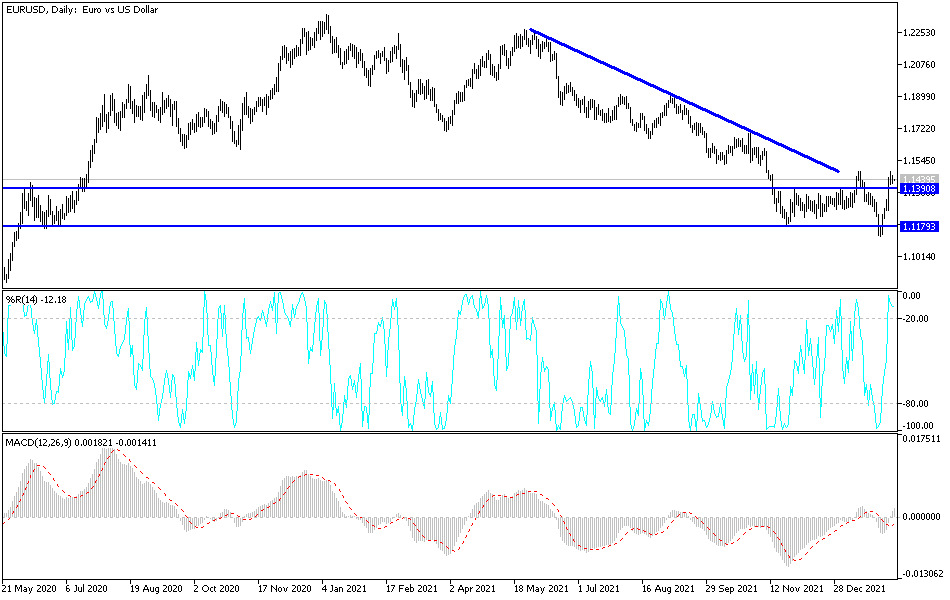

According to the technical analysis of the pair: With the current stability, there is no change in the technical point of view. The recent gains of the EUR/USD currency pair are enough to change the general trend of the pair to the upside. It breached important levels to form the bullish channel that was formed recently on the daily chart. The most prominent psychological resistance 1.1500 is currently important for a stronger control of the bulls. US inflation figures later this week, bearing in mind that the pair may be exposed to profit-taking, especially if investors return to balance the discrepancy between economic performance and the future of monetary policy tightening between the eurozone and the United States.

On the downside, the support levels 1.1360 and 1.1280 are important for bears to control and end the current bullish outlook.