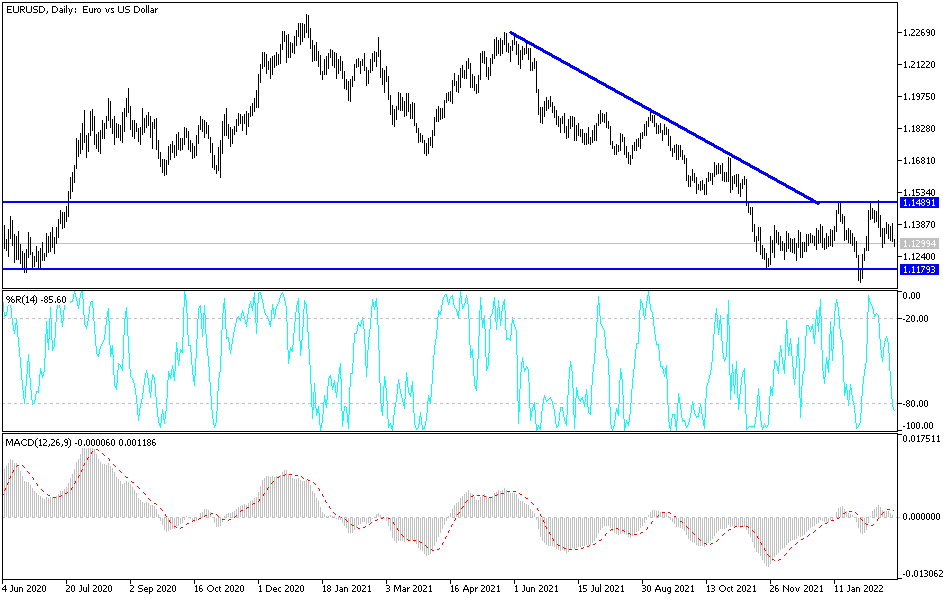

I expected before that the recovery attempts of the EUR/USD currency pair may quickly collide with renewed fears of war in Europe. At the beginning of this week's trading, the EUR/USD recovered to the resistance level 1.1390, and quickly returned to the support level 1.1288 at the time of writing the analysis. The euro's gains were halted by market concerns about the increased risk of conflict in Ukraine, which may continue to have a repressive effect on the single European currency in the coming days. The euro made a short-term attempt to revive its rally in early February last week but the gains made amid a short retest of 1.14 steadily declined by Friday's close.

This was after residents were evacuated on Friday from separatist provinces in eastern Ukraine, to Russia, and the increasing cases of ceasefire violations raised the risk of a conflict that could continue for some time now. Commenting on the performance, Carol Kong, FX analyst at the Commonwealth Bank of Australia said, “We expect the euro to extend gains as the year progresses, in part due to our expectations for a weaker dollar. An earlier-than-expected ECB tightening cycle could also boost the EUR. However, we maintain our view that the euro could test its February low at 1.1235 if Russia invades Ukraine.”

Overall, while the mood in global markets may improve as the new week opens after French diplomacy prompted the White House to announce on Sunday that Presidents Joe Biden and Vladimir Putin are likely to meet face to face in the near future, this meeting is not necessarily one in person. Game changer.

Global markets were preoccupied with the large Russian military force amassed on the Ukrainian border, but Russia's parallel and highly interconnected attempt to compel the United States and NATO into what Moscow calls "security guarantees" has been largely ignored.

Russian forces gathered near the border in October and November to conduct "exercises" before Moscow in December published a draft treaty containing a list of security-related proposals it often labels as "demands" which, if not met, could lead to measures being taken. Unspecified military. In response to a direct question about what these measures are, he said: They can come in all shapes and sizes. He will make his decisions based on the suggestions of our army. For his part, Foreign Minister Sergey Lavrov said in an interview on January 28 with radio stations Sputnik, Echo Moscow, Govret Moskva and Komsomolskaya Pravda, of course, other departments will also participate in the formulation of these proposals.

The responses of the United States and NATO have thus far left the Russian government without reason for optimism, and this is likely to remain the case.

The guarantees required are often erroneously described into trivialities across other media outlets, but Ukraine's national news agency and the BBC's counterpart, Ukrinform, covered most of the bases in the following brief summary from January 5 this year. The current camp of military forces along the Ukrainian border and the subsequent push for treaty agreements with NATO and the United States follow the same pattern of events from last year when the border itself was first drawn up in April and May by a large military formation.

At the end of May, the Moscow Defense Minister announced that about 20 new “units and formations” would be established in the Western Military District by the end of the year due to perceptions of an increased threat from NATO.

According to the technical analysis of the pair: I still see that the trend of the EUR/USD currency pair will remain bearish as long as it is stable around and below the 1.1300 support. The bears are now preparing to test stronger support levels as long as the global concern about the outbreak of a war is ongoing, and the closest to the trend is now the support levels 1.1265 and 1.1180, and then the psychological support at 1.1000. This may actually happen if the war breaks out in Ukraine.

On the upside, I still see that the resistance levels 1.1490 and 1.1560 are the most important for the bulls to control the trend as a first stage. Today, the euro will be affected by the announcement of the German IFO reading, and the US dollar will be affected by the announcement of the US consumer confidence reading.