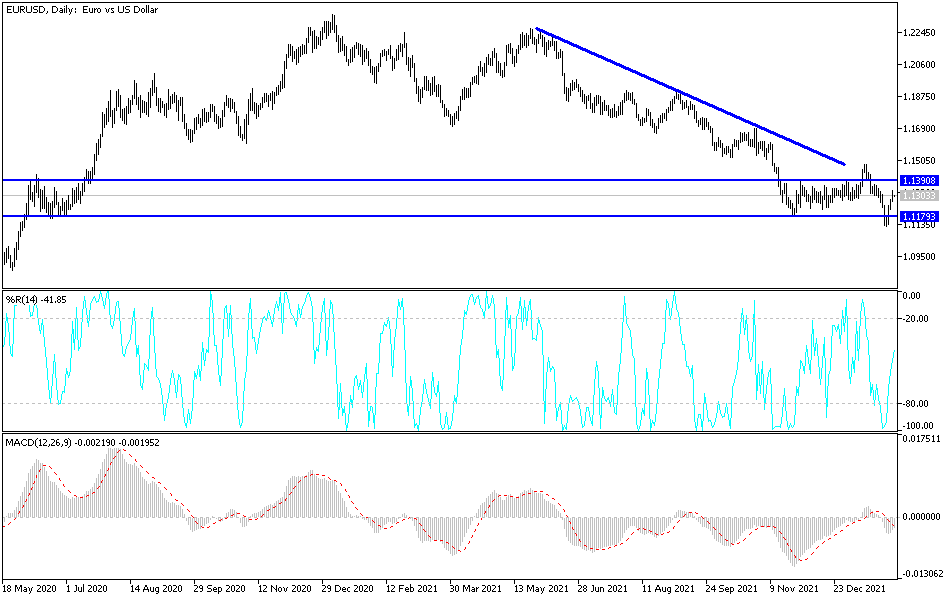

Amidst a state of risk appetite that dominated the markets, the EUR/USD exchange rate rose to key technical resistance levels during this week's trading. This happened after inflation figures released by Eurostat put the European Central Bank under the spotlight ahead of Thursday's monetary policy decision. The bullish momentum helped the euro-dollar pair rebound towards the resistance level of 1.1330, which is stable near it, ahead of the most important event for the euro pairs in the forex market. Helping the rebound was a broad-based drop in dollar exchange rates in what appeared to be another bout of profit-taking, although the euro also rose against other major currencies after the release of January inflation data.

According to official figures, the Eurozone inflation rate rose from 5% to 5.1% last month in the face of an economic consensus that was looking to drop sharply to 4.4%. This represents the biggest bullish surprise to expectations in the history of Eurostat harmonized consumer index prices. Looking at the main components of eurozone inflation, energy is expected to register the highest annual rate in January (28.6%, compared to 25.9% in December), followed by food, alcohol, and tobacco (3.6%, compared to 3.2% in December) and services (2.4%), stable compared to December) and non-energy industrial goods (2.3% compared to 2.9% in December).

While the official inflation rate was the most significant surprise, the smaller-than-expected drop in core inflation was just as important as it indicates that European “core” and domestic inflation pressures could be slower to subside this year compared to many including European Central Bank policy makers had been expecting this.

Commenting on the numbers, Tuuli Koivu, economist at Nordea Markets, said: "The consensus expected both numbers to decline for technical reasons." "However, overall inflation has risen slightly, and given that the decline was less than expected in core inflation, it appears that inflationary pressures are already accumulating faster than expected."

Core inflation fell from 2.6% to 2.3% in January, but consensus expectations favored a decline to 1.9%. This is likely a more significant development for the ECB because this inflation measure ignores changes in energy volatility and food costs while excluding differences in regulated price elements such as Alcohol and tobacco. Klaus Fiestesen and Melanie Debono of Pantheon Macroeconomics say, “We did get a reduction in non-energy inflation that we had been expecting – mainly due to the end of the core effects from the temporary reduction of VAT for 2020 in Germany – but it was more timid than what we were expecting.”

The January bullish surprise is the first indication that European inflation pressures may eventually prove to be steadier than many had imagined, which could have repercussions for the European Central Bank's monetary policy. The problem with the euro is that the ECB's forecast currently envisions inflation remaining at elevated levels during the opening quarters of the year before declining in the second half.

According to the technical analysis of the pair: The recent rebound of the EUR/USD currency pair has not yet exited the bearish channel. According to the performance on the daily chart, the bulls rushed towards the resistance levels 1.1390 and 1.1465, to find a strong ground for the rebound higher. So far, stability is still below the 1.1300 support that supports the downside view. The European Central Bank's signals to tighten its policy and the reaction from the announcement of the US jobs numbers will determine the closing of the pair's trading for this week. I still see the pair's rebound gains vulnerable to selling.