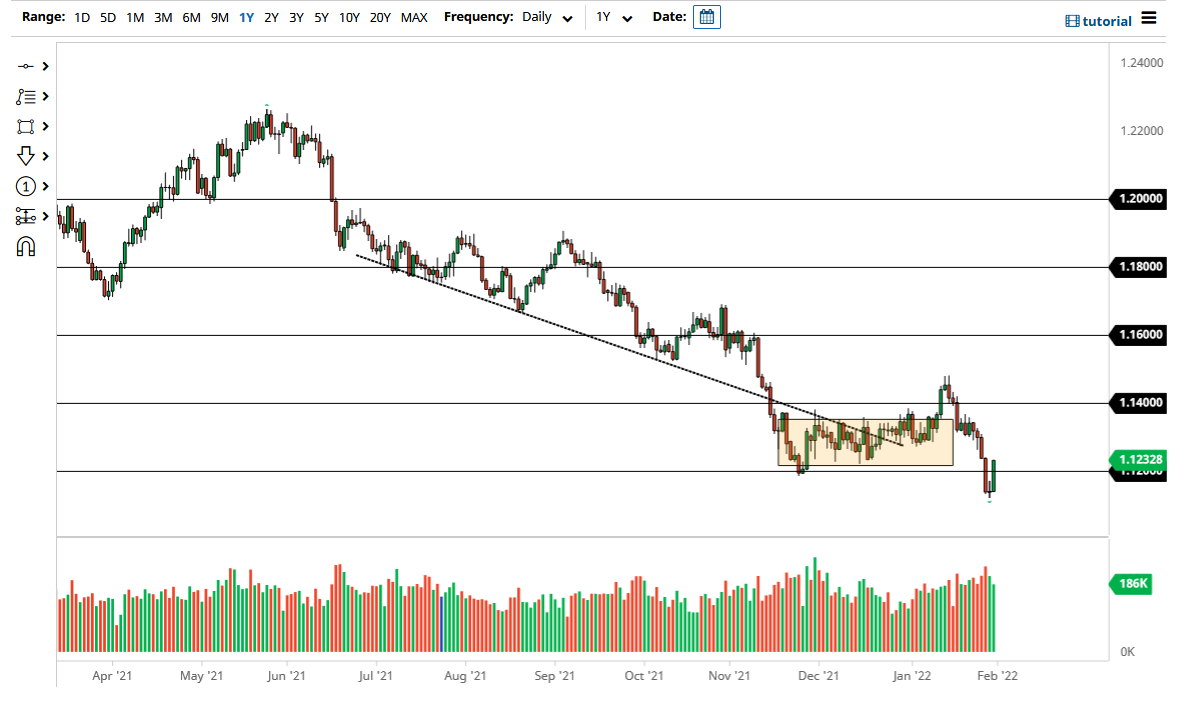

The euro shot higher against the US dollar on Monday, gaining a bit over 8/10 of a percent. Furthermore, the euro has broken above the psychologically and structurally important 1.12 handle, which previously had been a major low. At this point, it looks like we are trying to get back into the consolidation area that we had been in previously, and the fact that the US Dollar Index showed a bit of exhaustion further confirms that this pair should continue to rally a bit.

The candlestick is very impressive but at the end of the day it is still a bullish candlestick in the midst of a bigger downtrend. As long as that is the case, it does make sense to simply sit on the sidelines and wait for an opportunity to start shorting again. This is a market that has been in a downtrend for quite some time, and as the European Central Bank is nowhere near trying to tighten monetary policy, it is a bit difficult to see the euro sustainably improving against the greenback which has the Federal Reserve tightening monetary policy throughout 2022.

This is not to say that they cannot change course, and we do have an ECB meeting this week. However, nothing is expected to happen in the short term, and it is a bit rich to think that the European Central Bank would step in and shock the market. The last thing they want to do is see the euro spiking rather rapidly. After all, although the European Union is starting to strengthen a bit, it still has to rely on export markets, and if the euro itself gets to be too strong, that can greatly reduce those selling opportunities.

We have been for several years in a currency war. It is basically a “race to the bottom” by central banks around the world in order to cheapen their own currencies. It is all about the ability to have other economies buy your goods, and lift up your own economy. Unfortunately, that puts currency traders in a situation where they are trying to figure out what is “less bad” when it comes to all of these markets. With that in mind, the ECB will more than likely get its way, allowing traders to sell the euro based upon the fact that they will almost certainly be a lot less hawkish than the Federal Reserve is.