The euro initially tried to rally during the early hours on Monday but found the 50-day EMA to offer a little bit of resistance. Ultimately, this is a market that continues to see a lot of noise, mainly due to the fact that everybody is running to the safety of the US dollar for a multitude of reasons.

The first reason is the fact that we are starting to see higher interest rates in America, as bond yields spike. Beyond that, people are worried about a global recession, something that seems very likely at this point. After that, we have the geopolitical tensions between the Russians and the Ukrainians, and that has people looking to pull money back into the safety of the US dollar. Furthermore, if a land war breaks out in Europe, a lot of people would be a bit nervous about having money and that part of the world.

Whether or not the Russians actually invade the rest of Ukraine is a completely different question, and one that you just never know the answer to. One thing is for sure: it has certainly grabbed all the headlines, and it is obvious that it is the one thing that everybody seems to be paying attention to. In that scenario, it is very difficult to trade, because regardless of which you may or may not believe, the reality is that you have no control over it. In a sense, this is a bit of a lesson for the market overall: you never have control once you enter the trade other than when you decide to get out of it.

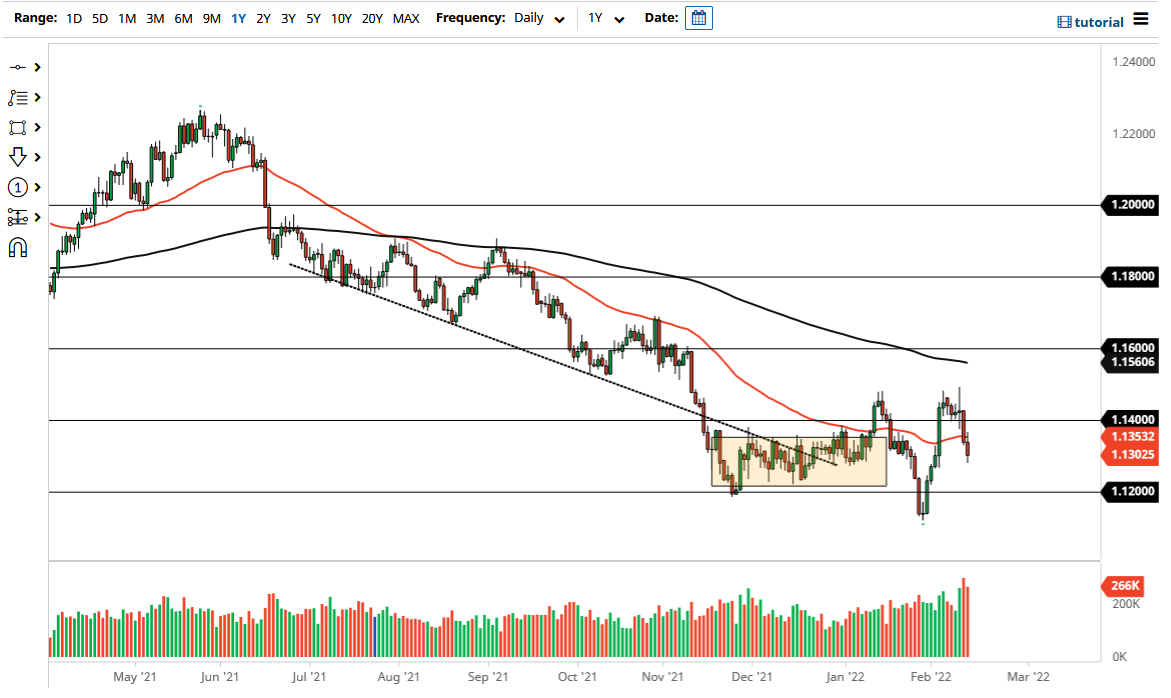

You can see that we recently formed a bit of a double top above, which is a bearish pattern. Whether or not we drop all the way down to the previous lows is open for debate, but I think at this point you need to see the occasional rally as a potential selling opportunity at the first signs of exhaustion. We are still very much in a downtrend, and that has not changed despite the fact that Christine Largarde has at least admitted that there is inflation and people got quite excited for a moment there. Longer term, I believe this is a market that continues to be noisy at best.