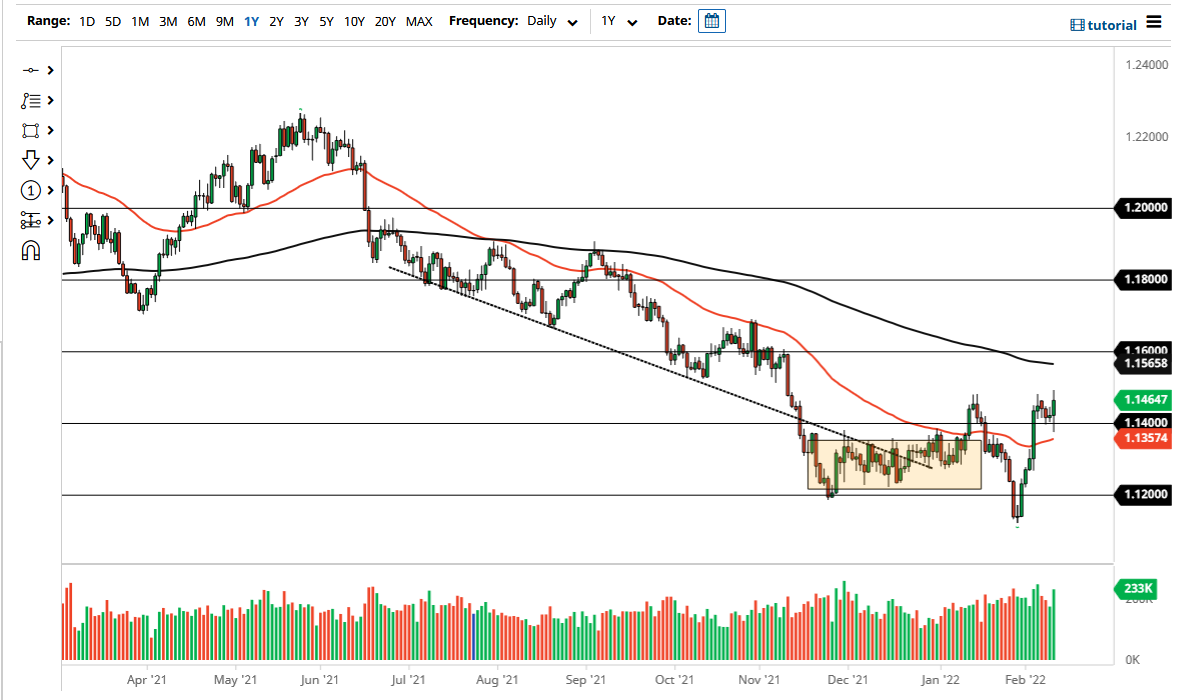

The Euro has gone back and forth during the course of the trading session on Thursday, initially plummeting below the 1.14 level after the CPI numbers in America came out much stronger than anticipated. The idea of course is that with a lot of inflation, you probably have a real fear of a sudden spike in interest rates in America, making people look towards the US dollar in order to get those yields. However, shortly after that happened, we saw the US dollar sell off, perhaps in anticipation of massive slowing down of the economy.

As the Euro rose, we then got word from St. Louis Federal Reserve Gov. James Bullard suggesting that he wants to see 50 basis points at the next meeting, and 100 basis points as far as hiking is concerned by July. In fact, even suggested that they should be doing it between meetings, and this of course sent the market back into another tizzy. We saw the Euro fall as the US dollar was favored against almost everything, so with that being the case is not a huge surprise to see that we gave up some of the gains. At the end of the day, we are essentially hanging about in the same area that we have been in for a while, and now that I write this, I think that a lot of the market is quite frankly exhausted.

If we break down below the lows again, then it probably opens up a move down to the 1.1350 level, possibly even lower than that. On the other hand, if we turn around a break above the top of the candlestick for the trading session on Thursday, then we could make a run towards the 200 day EMA, possibly even the 1.16 level after that. In general, you need to look at this as a situation where you have to pay attention to the difference between German and US bonds, and that should lead the way. Right now, it should favor the US dollar, but we have not seen the melt down that we might have had Mr. Bullard said that on any other day. By the time he stated this, we had already had the melt up, and at this point in time it is very likely that we are simply taking a breather.