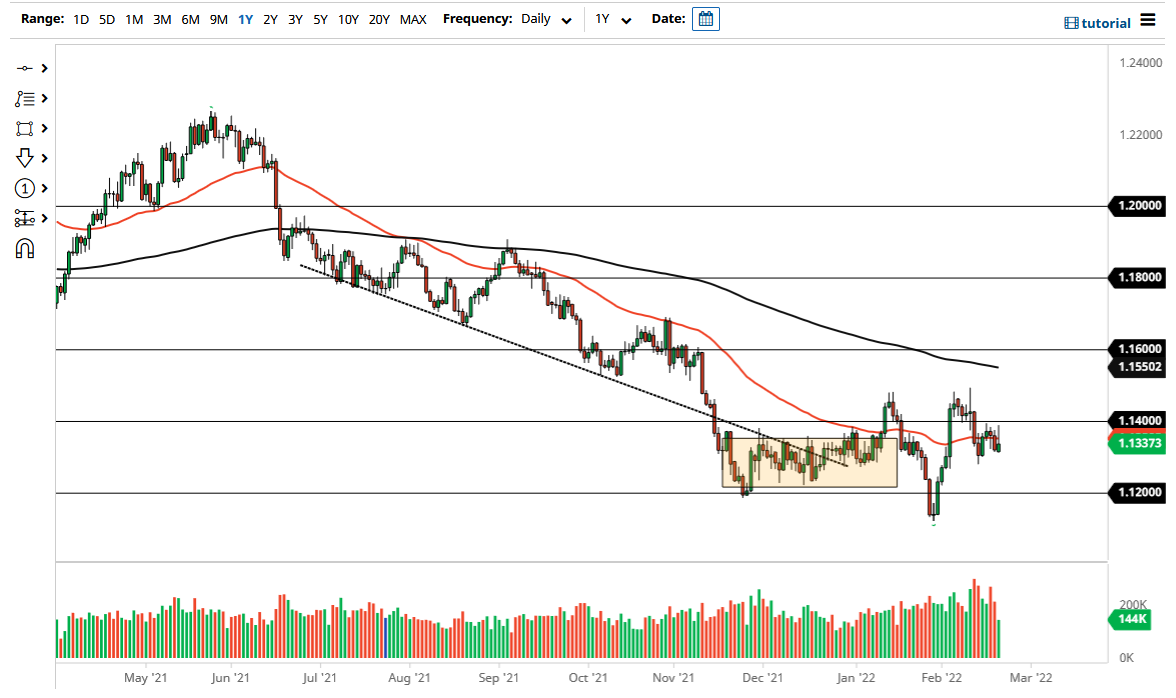

The Euro initially tried to rally towards the 1.14 level during the trading session on Monday but has given back gains rather quickly as the German PPI and PMI numbers came out at the highest level since the late 1940s. This suggests that we are going to continue to see a slowdown in the European Union, and therefore the Euro of course gets punished. Keep in mind that the United States was closed for Presidents’ Day, and as a result liquidity may have been a bit of an issue later on. That being said, this is a market that continues to see a lot of choppy and noisy behavior, especially as the 50 day EMA has chopped right through the middle of it.

Currently, the 1.13 level looks to be an area of short-term support, and if we break down below there that it is likely that we go looking towards 1.12 level, an area that has been even more noisy. That is an area that might be the bottom of the overall consolidation range that I think we are trying to carve out, just as the 1.15 level is massive resistance. All things been equal, I think we stay in this range, but we have been in a long term downtrend and that has not changed. Because of this, the very likely that we will continue to see a lot of choppy behavior, but I still favor the US dollar at the moment.

Despite the fact that we have seen such high inflation numbers out of Germany, the European Central Bank is nowhere near tightening, and it most certainly is far behind the curve when it comes to relation to the Federal Reserve. Because of this, should continue to favor the US dollar permit interest rate differential perspective, but beyond that you also have to pay attention to the fact that there are a lot of concerns about the Russia/Ukraine situation, which of course has a massive influence on how things are going to go in the Euro region. With that, I think you have to continue looking towards safety assets, or at the very least look away from the European Union. I look at short-term rallies as an opportunity to continue selling this market until something changes at either the ECB, or the Ukrainian border.