The German DAX Index had a horrible session on Monday, gapping lower to kick off the future session and then simply continued falling. This is in reaction to all of the tension at the Russia/Ukraine border, as European traders did not have the ability to react to the news late Friday that the Russian troops were starting to move closer to the border. Because of this, it does make sense that Europeans would be nervous, even in a place like Germany.

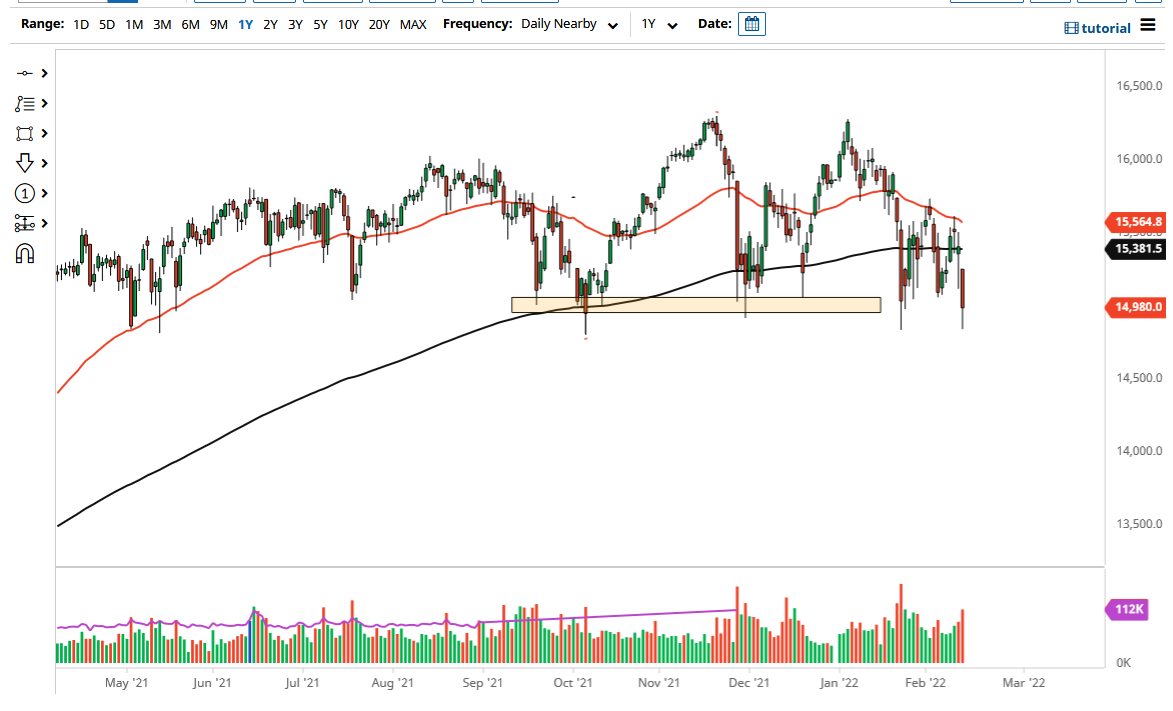

The 14,800 level has been massive support, and it is worth noting that we did in fact stay above there. We tested it, and certainly tried to break down through it, but at the end of the day we found ourselves above that region. Because of this, it is very likely we will continue to see noisy behavior, but if we were to break down below the bottom of the Monday candlestick, that could be a very ugly turn of events for the DAX. At that point, I would anticipate this contract will go looking towards the 14,500 level, and then 14,000 after that.

At this point, the only thing you can count on is a lot of volatility. In that scenario, you need to be very cautious about the idea of trading with any real size at all, and you need to be nimble. Stop losses are crucial and will save your account. Do not be surprised at all to see wild gyrations intraday, because that seems to be the norm in everything I look at. The DAX should not be any different. For what it is worth, the euro looks like it is trying to at least stop the bleeding, but at the end of the day I do not even think people are paying attention to the currency markets at the moment.

If you want to know what is going to happen with the DAX, I suggest becoming friends with Vladimir Putin. If you can get some type of information from him, you might have an idea as to how the directionality of this market will be. Granted, it is very likely that we will eventually go lower anyways because we have been running out of momentum. If we break down below the lows of the session on Monday, I am going to short this market.