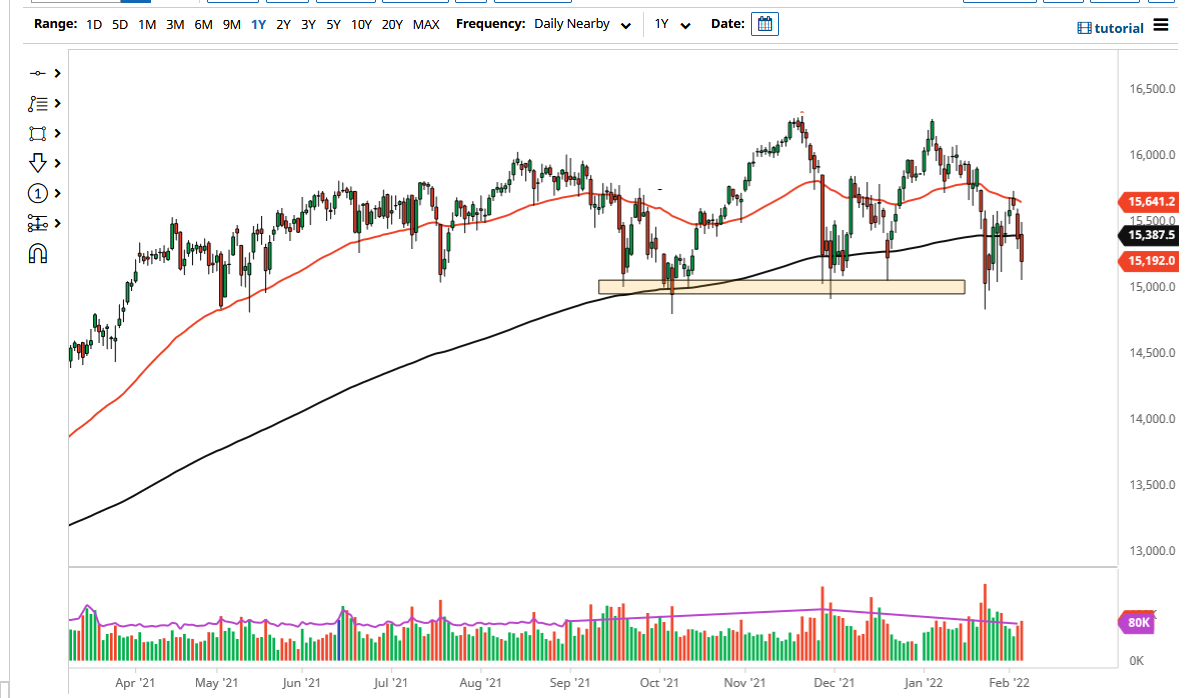

The DAX Index plummeted on Friday to slam into the crucial €15,000 region before bouncing towards the end of the day. You are seeing the same phenomenon in Germany now that you had seen in the United States when the Federal Reserve started to talk about tightening. The European Central Bank has finally admitted that there is something called inflation out there and has talked about the possibility of tightening sometime late this year. In other words, traders are starting to worry that there is going to be less “free money” in the European Union going forward.

It is at this point that we have to start to pay attention to the most recent lows, because if we can break down below there, then the DAX could drop down to the €14,000 level rather quickly. This would be a complete collapse of support, and that could send a lot of sellers into this market. If that happens, we could see a massive unwind and a quick selloff.

On the other hand, if we do get a little bit of calming in the markets, we could see a return towards the 200 day EMA. The question now is not so much as to whether or not we will break down or melt higher, it is probably more of a situation where we are either going to be grinding sideways again, or we are going to be falling significantly. I think that stock markets around the world have rough sliding ahead, and the next couple of months are going to be difficult to say the least. If you are trading the DAX, you need to be doing just that: trading. What I mean by this is that the ability to hang on to a longer-term position is probably going to be taken away from you until we get some of this noise sorted out.

The one thing that helps the DAX is that the ECB has plenty of time to change things as far as their future tightening is concerned, and they could step back and suggest that perhaps they are not quite ready to do so at the end of the year. If that happens, it will obviously help the DAX, as the stock traders around the world are hooked on cheap money.