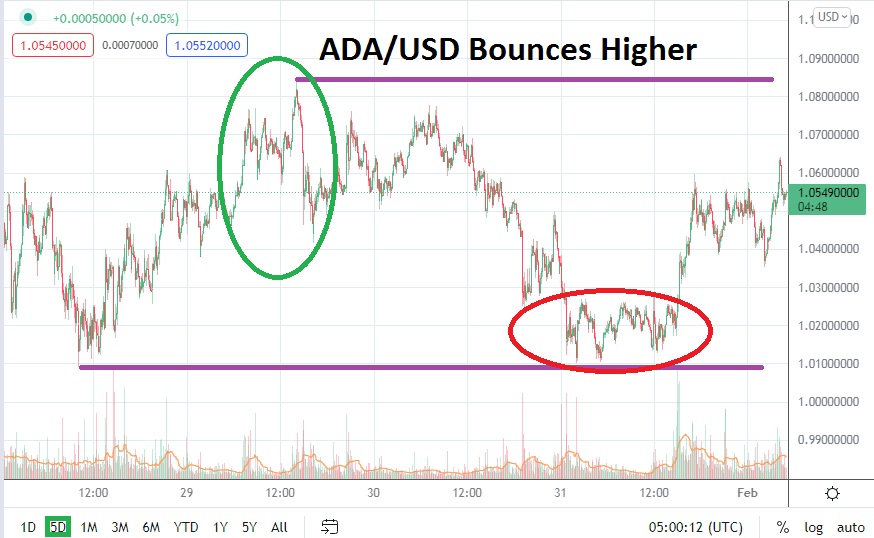

As of this writing, ADA/USD is near the 1.05500000 mark. This has been attained after Cardano once again flirted with lower prices on Sunday, traversing slightly over the one dollar ratio for much of the day. ADA/USD has correlated to the broad cryptocurrency market remarkably well. The reversal higher late last night mirrored results coming from many of the major cryptocurrencies.

However, before speculators declare this an opportunity to jump aboard a speculative train upwards, they should be aware that resistance remains a highlight technically even on short-term charts. While ADA/USD certainly moved higher last night, it did seemingly run into headwinds and was pushed backwards. ADA/USD remains within the lower realms of its price range and traders who are looking for quick hitting results need to remain cautious.

For optimistic bullish endeavors it is recommended that traders use solid entry point orders and as soon as a fill is reported, make sure a take profit target is promptly put to work. ADA/USD has the capability of turning volatile. Sharp spikes have not been pervasive in recent trading, but the potential for momentary fluctuations abounds.

If a conservative amount of leverage is used, this could allow a trader to widen their stop loss a bit further away from the current price of ADA/USD and allow for the cryptocurrency to apply its natural cyclical action. Traders pursuing upside momentum should note that resistance levels have been rather demonstrative. This morning’s early high slightly above the 1.06100000 ratio was blown backwards with a rapid pace, and it should be acknowledged that the value was not able to topple highs displayed on the 30th of January.

As the month of February gets underway, ADA/USD remains in a rather stark lower range and has failed to escape its grasp. The trading results from the past few days for Cardano have seen consolidation which traders will have an opportunity to decide is either a positive or negative sign.

Because ADA/USD, like the broad cryptocurrency marketplace, has been in a strong mid-term bearish trend, skeptics may believe selling opportunities still exist aplenty. Bearish traders may want to actually sell ADA/USD when resistance levels come into sight if they expect reversals lower are going to be exhibited. The tight short-term range of ADA/USD is a chance for fast trading results for traders who have solid risk taking tactics.

Cardano Short-Term Outlook

Current Resistance: 1.06500000

Current Support: 1.04100000

High Target: 1.084000000

Low Target: 1.007500000