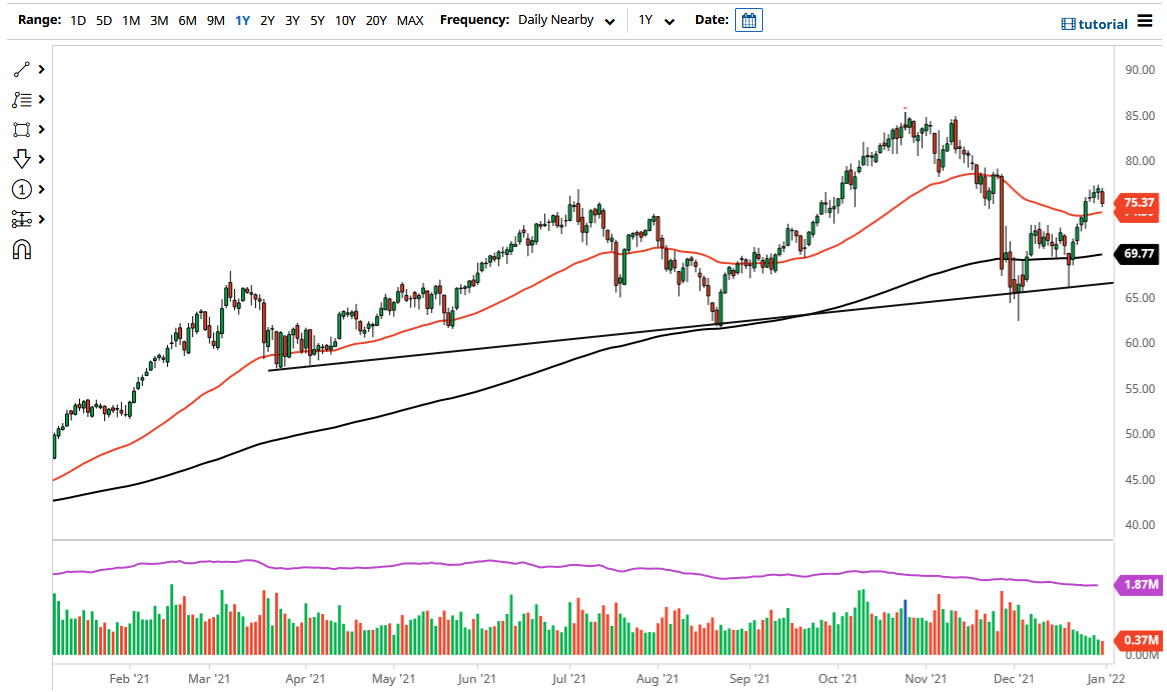

The West Texas Intermediate Crude Oil market fell a bit on Friday as traders started focus on New Year’s Eve and all of the weekend’s festivities. That being said, the market has had a very strong move over the last couple of weeks, so a little bit of profit-taking heading into that would not be a huge surprise. We are still above the 50 day EMA, which of course will attract a certain amount of attention in and of itself, so I think that at this point in time I would not read much into the fact that Friday was a red candlestick.

As we get back to work, traders will have to put money back on their books in order to take risk on, and crude oil certainly looks like it is a great candidate for something like that. With the 50 day EMA sitting just below the $75 level, that means that the $75 level has little bit more psychology attached to it than usual. Nonetheless, you can see that we have skyrocketed over the last couple of weeks and I think it has become obvious as to which direction traders are starting to trade this market now that massive lockdowns due to the omicron seem to be off the table. That was one of the biggest concerns that most traders had, that economies would have to shut down and thereby kill the idea of demand for energy.

Now that traders have to get back to work, they will find alpha to generate, and crude oil is one of the best places to do so. While we did not completely wipe out the massive selloff from about a month ago, we got awfully close to it and that does suggest that perhaps we will eventually make that attempt once traders start to put full positions back on. Another thing to pay attention to is the jobs numbers coming on Friday, and that will also give us a big “heads up” as to potential energy demand, so it could be yet another reason to think that the market may go higher over the intermediate term. I have no interest in shorting this market right now, as I believe it is well supported all the way down to at least $70.