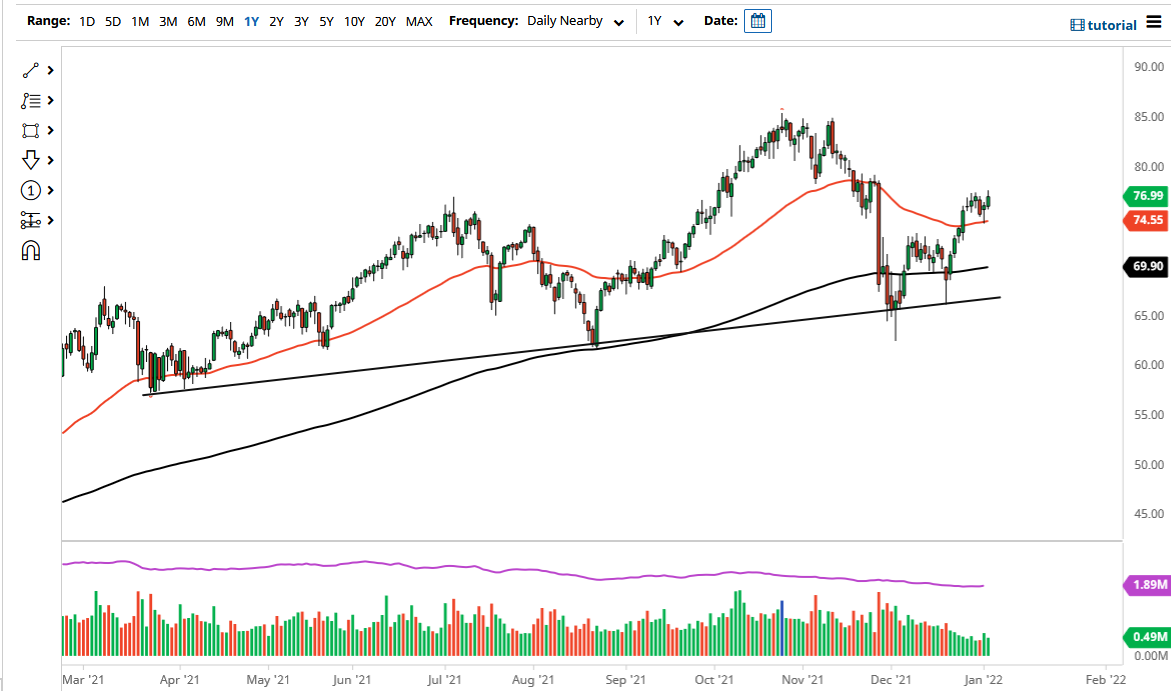

The West Texas Intermediate Crude Oil market rallied a bit on Tuesday to show signs of life and break through a very short-term resistance barrier. We have not been able to sustain the move significantly, but it still looks as if we are going to get more bullish pressure. When you look at the chart, it does not take a lot of imagination to suggest that we have just broken above the top of a bullish flag, which is a very bullish sign and could send this market towards the most recent highs near the $85 level.

To the downside, we have the 50 day EMA turning towards the upside and showing signs of positivity. That should be support, and I think that any short-term pullback will more than likely offer a nice opportunity to get long. However, if we were to break down below there, then it is likely that we will go challenging the $73 level underneath. The $73 level was an area of significant resistance previously, but I do not think that it will be as important this time if we get down to that area.

On the other hand, if we break above the top of the candlestick for the trading session on Tuesday, then it is likely that we could go looking towards the $79 level, an area where we had sold off from previously. If we can break above there and the $80 level, then it is likely that we could go much higher. Ultimately, this is a market that I do think continues to see plenty of buyers, and this will be especially true if we continue to see plenty of pressure. The market has been rallying for the last couple weeks, and the noisy behavior that we have seen over the last week or so is simply the market trying to build up enough momentum to continue what we had seen previously. I have no interest in shorting this market, but if we broke down below the $73 level, then we might see a little bit more of a correction, but that is about as negative as I plan on getting in this market anytime soon. This is a market that looks as if it is building up plenty of upward pressure.