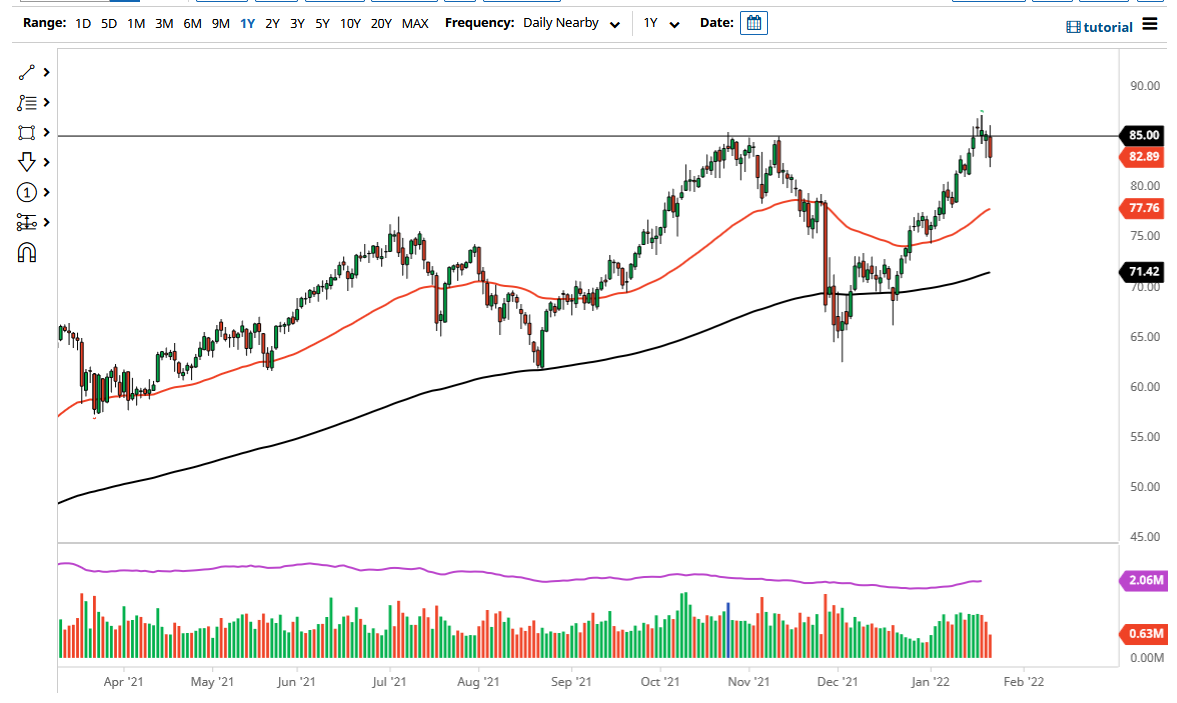

The West Texas Intermediate Crude Oil market initially tried to rally on Monday but found the area above the $85 level to be a bit too much. At this point, we continue to see that area be significant resistance, as it is a large, round, psychologically significant mid-century number and an area where we had recently seen a significant high. At this point, it should offer a bit of resistance. This is a market that I think is trying to do everything it can to find buyers, and I do think that eventually they will come back.

When I look at this chart, I think of it as a proxy for the overall potential economic reopening trade. Granted, most stock markets are on the back foot at the moment, which does make sense due to the fact that we have seen so much in the way of negativity as far as reacting to central banks is concerned. When you look at this chart, you can see that we barely broke above the $85 level, but we were also overextended. With that in mind, it does make sense that we need to pull back. The pullback will more likely than not offer a bit of value that a lot of people will take advantage of, but we need to see markets calm down a bit before oil can take off. After all, if you have the US dollar spiking in a bit of a panic bid, oil will struggle a bit.

That being said, OPEC+ is struggling to produce enough crude oil to hit production targets, so oil will continue to strengthen as economies around the world reopen. That does not necessarily mean that there are going to be shortages or anything like that, but it should put a little bit of a bid underneath the crude oil market. However, this does not necessarily mean that it will be easy for this market to simply take off towards the $100 level. That is the consensus, but at the end of the day there is nothing more important than price, and narratives are just that: narratives.