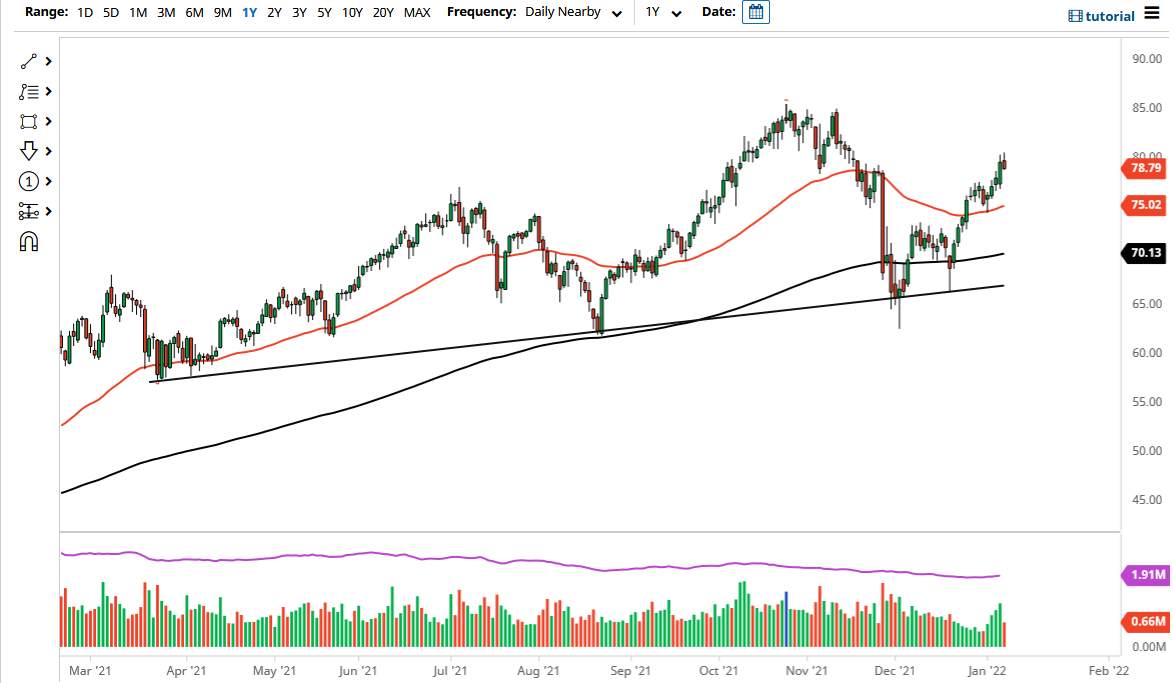

The West Texas Intermediate Crude Oil market rallied initially on Friday as one would expect, due to the significant momentum that we have seen to the upside. We rallied a bit on Friday but found the $80 level to be a bit too much to deal with. By pulling back the way we have, it does not necessarily signify that the crude oil market is about to fall apart, just simply that gravity is starting to come back into the picture.

If we pull back from here, there are multiple areas where the buyer should return. The most obvious one would be the 50 day EMA, which is where we sit at the $75 level. The $75 level does suggest a certain amount of psychology involved, and the 50 day EMA curling higher at the $75 level is something worth paying attention to. However, it is very likely that the $77.50 level could offer support as well, and I think this simple pullback is more or less a function of gravity and the large round number at the $80 level.

OPEC+ is going to continue to increase production by 400,000 barrels a day next month, but the reality is that there are several spots around the world that are having trouble producing. Libya and Nigeria are two of the bigger ones, so therefore whether or not OPEC+ can produce another 400,000 barrels a day is a completely open question. Ultimately, this is a market that is rallying quite significantly and has recently broken out of a bullish flag, so there are a couple of different reasons to think that we will go higher anyway.

Ultimately, this is a market that I think given enough time will reach towards the highs at the $85 level, but it does not necessarily have to happen in a straight line. Every time we pull back just a bit during the course of the next several weeks, I think there would be plenty of value hunters willing to get involved. Having said that, if we were to break down below the $75 level, it would completely change my opinion, but it does not look very likely to happen anytime soon.