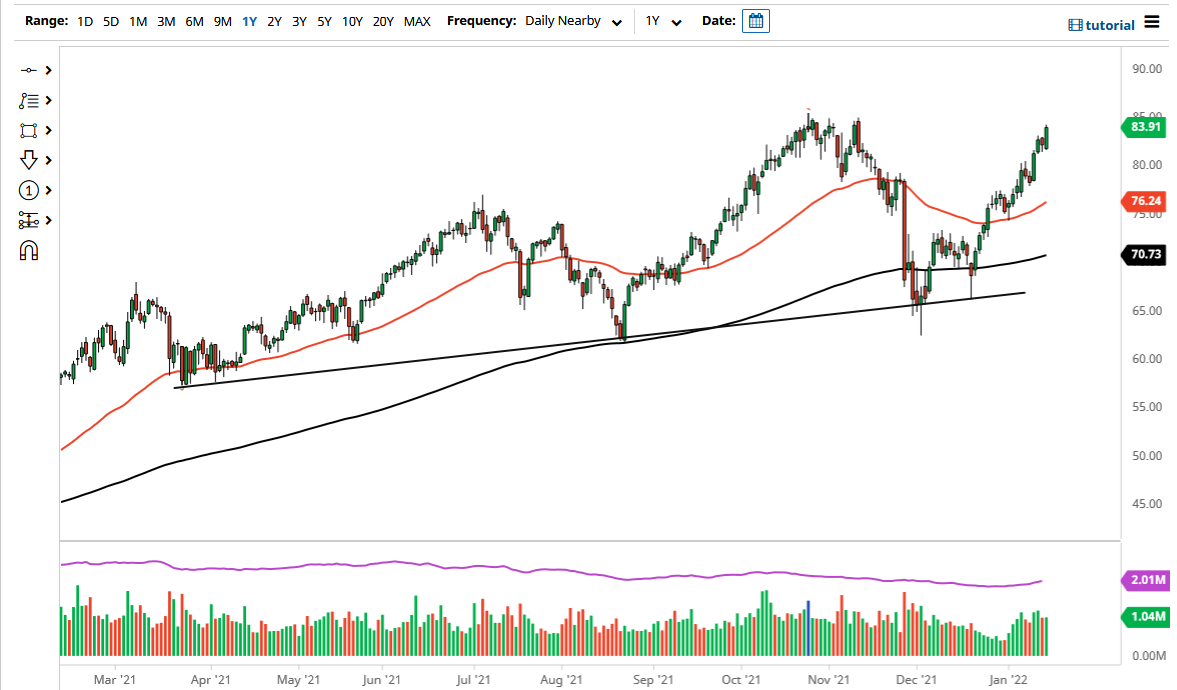

The West Texas Intermediate Crude Oil market rallied yet again on Friday to gain 2.2%. We are above the $83.50 level, so it does make a significant amount of sense that we may go looking towards the $85 level next. That being said, the market is likely to be a little overextended in the short term, so I would not be surprised at all to see a pullback. I would not sell this market, as I would be looking for some type of support in order to get involved in what is obviously a very bullish market.

Underneath, I think the $82.50 level as well as the $80 level should offer plenty of support, so having said that I think it is likely that we will continue to see this market continue to go higher, as we have been very bullish. That being said, momentum is a fickle thing and I think it is probably only a matter of time before we would see plenty of people trying to get involved in a market that they may have missed. Beyond that, we are having trouble with OPEC+ struggling to pump out as much crude oil as once thought, and that could continue to be a major issue.

Even more tailwinds are coming from the fact that the US dollar has been struggling a bit, although we certainly did not see a lot of weakness in the greenback during the Friday session. Ultimately, this is a market that I think will eventually find a reason to go higher, and perhaps go looking towards the $100 level. I think that is a longer-term call, but a lot of people out there are starting to call for it, and clearly momentum is on the side of the buyers. In fact, it is not until we break down below the 50 day EMA that I would even consider selling, which is nowhere near where we are right now, as we are roughly 6 dollars higher than that. This is a market that I think could go looking towards a little bit of value in order to get long again, and at this point it looks like one of the runaway markets for 2022.