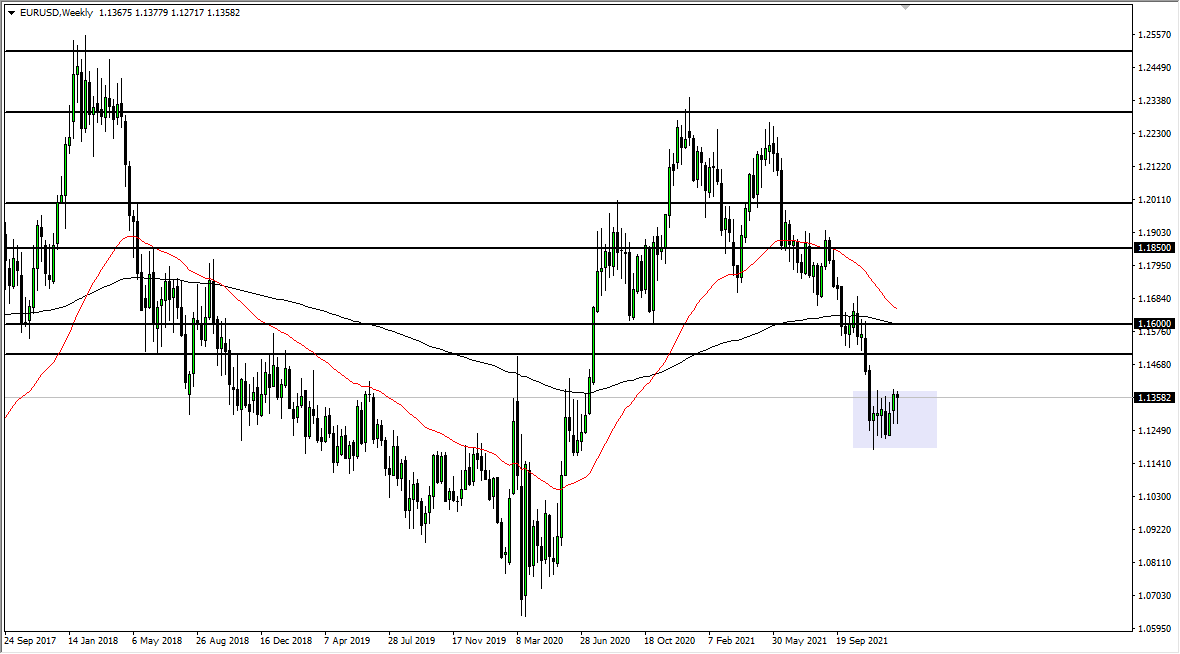

EUR/USD

The euro spent most of the week falling, but on Thursday and Friday turned around to show signs of strength. The question now in my mind is whether or not we can break out to the upside. The 1.1375 level has been significant resistance previously, so I think if we can break above there it is very likely that the euro will continue to go higher, perhaps reaching towards the 1.15 handle. Otherwise, this is a market that could turn around and fall for the week, as the 1.1225 level underneath continues to be significant support. We will either break out to the upside, or we simply grind away like we have been doing over the last several months.

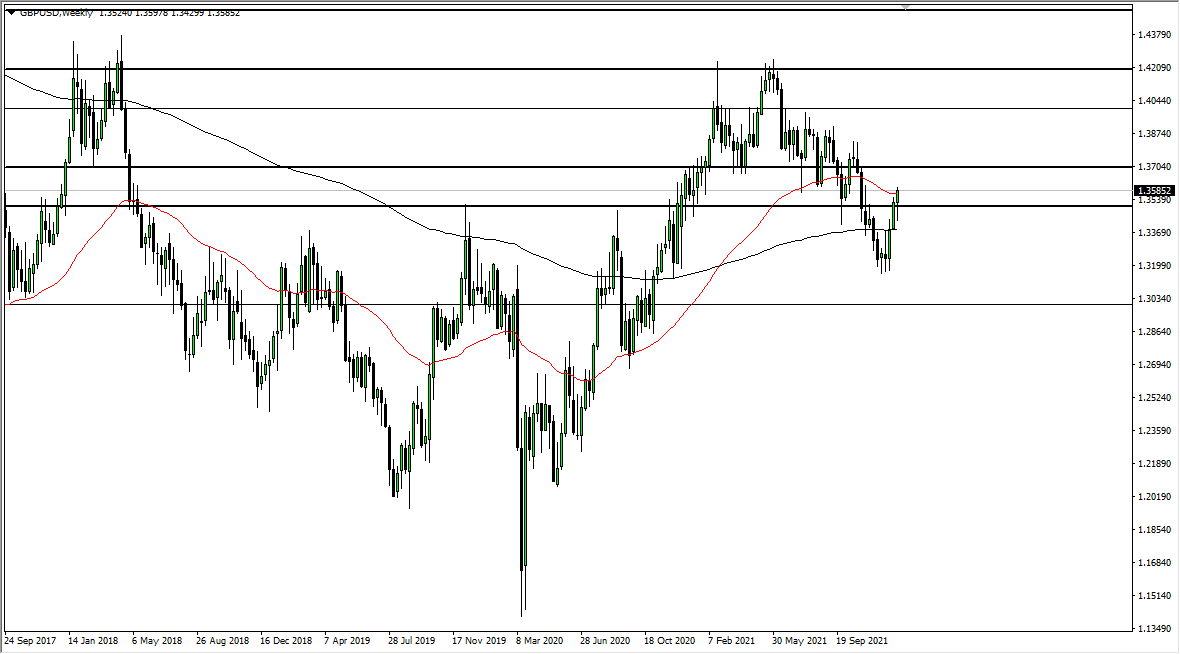

GBP/USD

The British pound initially fell during the course of the trading week, but then turned around to show signs of life again as we recaptured the 1.35 handle. The 50-week EMA is slicing through the top of the candlestick, but at this point it looks as if the British pound is ready to continue going higher. If that is going to be the case, then I think this pair will probably go looking towards the 1.37 level above, an area where we have seen quite a bit of selling recently. Otherwise, if we blow through the bottom of this candlestick for the past week, that would be a very negative turn of events.

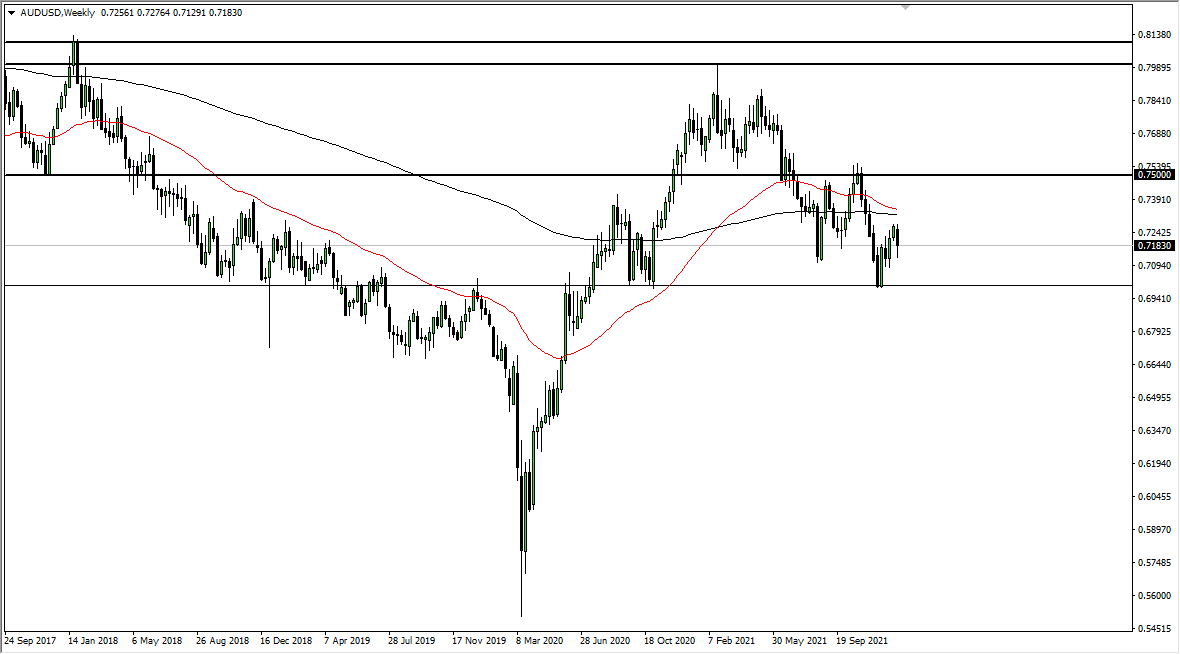

AUD/USD

The Australian dollar spent most of the week falling but has turned around quite nicely on Friday in order to form a bit of a hammer. That being said, this is a market that has continued to break down, rally, and then break down again. I think the real target for sellers at this point it is going to be the 0.70 level. That being said, you should pay close attention to the upside at the 0.7275 handle, an area that has been extraordinarily resistive on the daily charts. Breaking above that could open up the Aussie to bigger gains, but out of all of the major currencies against the US dollar, with perhaps the exception of the Japanese yen, the Aussie is the least impressive.

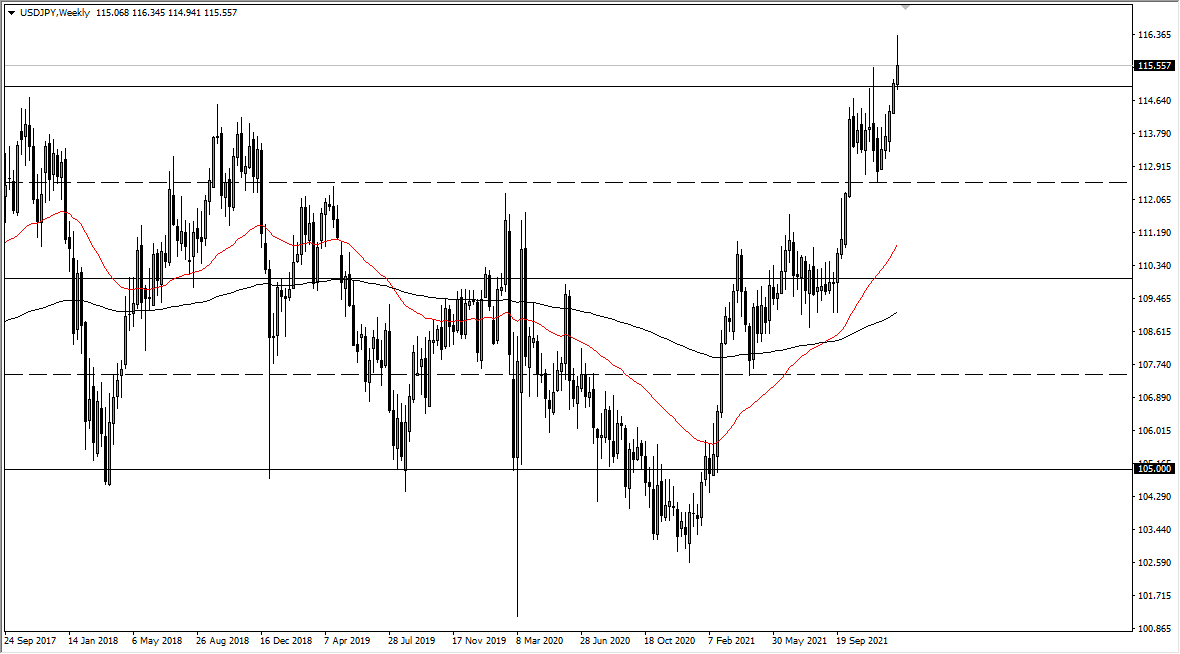

USD/JPY

The US dollar has rallied against the Japanese yen during the bulk of the week but has given back some of the gains as the jobs number came out at about half of what was expected on Friday. That being said, I think this is a market that is ready to pull back a bit, which should find plenty of buyers underneath near the ¥155 level, and then again at the ¥114 level.