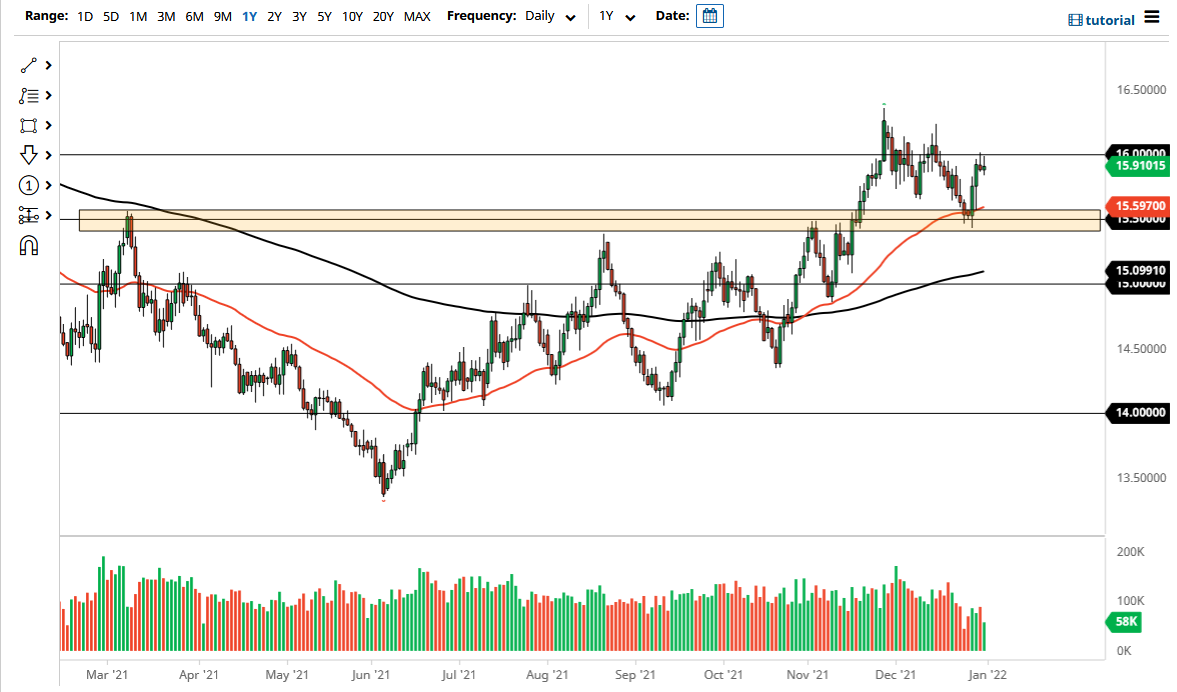

The US dollar initially tried to rally on Friday but pulled back from the crucial 16 rand level. By seeing the price action that we have over the last couple of days, it looks as if we may have to pull back just a bit towards the 50 day EMA, which currently sits just underneath the 15.6 rand level. It is worth noting that the last time we reached towards the 50 day EMA we did bounce, so it will be interesting to see if we do in fact try to get down there.

To the upside, if we were to somehow break above the 16 rand level, then it could open up the possibility of a move towards 16.33 rand, but as the omicron variant seems to have come and gone from South Africa, and the country is opening up its restrictions again, it is very likely that we will see the South African rand reflect that a bit. It is worth noting that the 15.50 rand level underneath was significant resistance, so I do think it could be a rather supportive area if we do get a big breakdown. That being said, the market tends to be very choppy and erratic, and I think that will continue to be the case going forward.

Once traders get back to work this week, it will be interesting to see whether they want to put “risk on” or if they are going to be a little bit more hesitant. Obviously, the South African rand is a currency that people put money into when they are hoping to put risk on, as opposed to the US dollar which they will jump into when they are a little bit hesitant. Pay close attention to the omicron numbers in South Africa, but they are down something like 40% week over week, which is a good sign and should continue to favor that country.

The last couple of days have been a bit hesitant, but we are still very much in an uptrend, so that is how I'm looking at this. Ultimately, this is a market that I think will have a couple of tough days before we finally make a bigger move once liquidity returns to normal and we have a bit more in the way of clarity.