Expectations of US interest rate hikes are still providing more strength to the US dollar against the other major currencies. The USD/JPY is still stable around the 115.65 resistance level after strong signals from the Federal Reserve to raise rates. The factors of raising US interest rates are strong and continuous and may compel the US central bank to commit to a number of rate hikes this year. By the end of last week, inflation-adjusted consumer spending in the US fell last month by the most since February, indicating that Americans are cutting back on spending amid the latest wave of COVID-19 and the fastest inflation in nearly 40 years.

The Commerce Department said Friday that purchases of goods and services, adjusted for price changes, were down 1 percent from November. The personal consumption expenditures price measure, which the Federal Reserve uses to target US inflation, rose 0.4 percent from the previous month and 5.8 percent from December 2020, the highest level since 1982. For unadjusted inflation, spending fell 0.6 percent, while income decreased, it rose 0.3 percent.

A separate report released by the Labor Department on Friday showed that US employment costs rose at a strong pace for the second consecutive quarter, highlighting the rapid compensation gains seen in the second half of the year as companies competed for Limited period of supply of workers.

The data comes after the US Federal Reserve, seeking to tame inflation and sustain the recovery, backed a hike in US interest rates in March and opened the door for more frequent and possibly larger-than-expected hikes after its two-day policy meeting on Wednesday. For his part, Chairman Jerome Powell said during a press conference last Wednesday, “There is a risk that the high inflation that we are seeing will drag on, and there is a risk that it will rise further.” And “We have to be in a position with our monetary policy to address all of those reasonable outcomes. ” The median forecast in a Bloomberg survey of economists called for a 1.1 percent drop in inflation-adjusted spending and a 5.8 percent increase in the price index from a year ago.

An increase in coronavirus infections due to the omicron variable is likely to slow spending in December as more Americans stay at home, and higher prices may also have been a deterrent. This effect may extend into the beginning of the first quarter as economic activity remains subdued, although most analysts expect the slowdown to be short-lived.

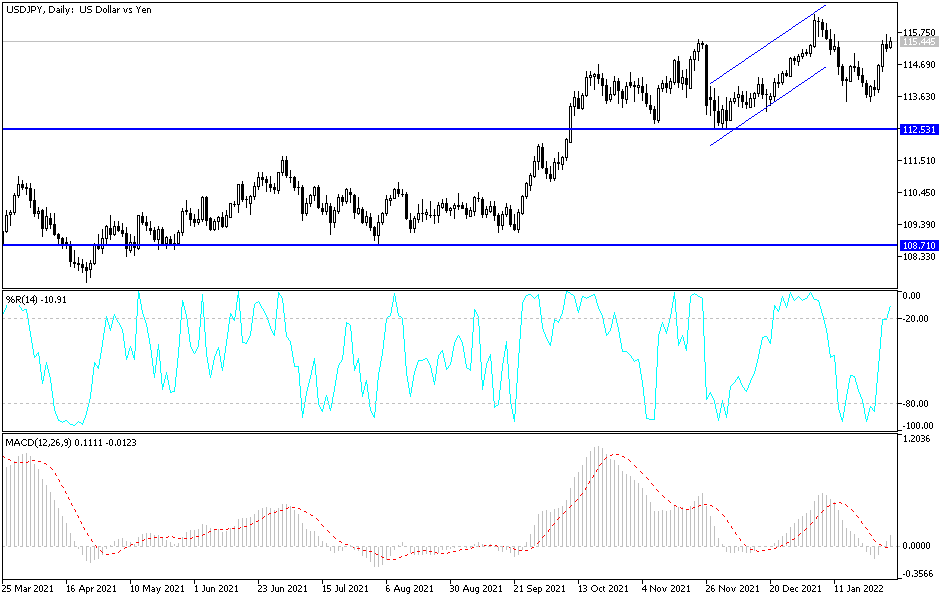

According to the technical analysis of the pair: On the daily chart below, the price of the USD/JPY currency pair is moving within an ascending channel that was formed recently. The bulls' control over the trend may be strengthened if the currency pair moves towards the resistance levels 115.85 and 116.35, respectively. At the same time, the current upward path of the pair will be negatively affected if the currency pair moves towards the support levels 114.75 and 113.65, respectively. I still prefer selling the currency pair from every bullish level.