For the sixth day in a row, the price of the US dollar against the Japanese yen (USD/JPY) currency pair is moving amid a downward correction. The currency pair settled around the 115.40 level at the time of writing the analysis after testing the support level at 115.04 recently. The US dollar fell despite expectations for the future tightening of the US Federal Reserve's policy. Yesterday, Federal Reserve Chairman Jerome Powell pledged to do what was necessary to contain rising inflation and prolong growth, while staying away from new details about the path of US monetary policy.

“If we have to raise rates more over time, we will,” Powell told the Senate Banking Committee on Tuesday under questioning at his second term confirmation hearing as central bank chief. "We will use our tools to restore inflation."

Both Republicans and Democrats have expressed concern that the Federal Reserve is overstimulating the economy at low rates and buying bonds as inflation far exceeds the officials' 2 percent target. The US central bankers were surprised by the persistence of inflation and want to rely on it this year without impeding growth. Prices rose 5.7 percent in the twelve months to November according to the personal consumption expenditures price index, the Fed's preferred benchmark.

Powell's comments were more cautious than those of some of his colleagues, who publicly called on the Federal Reserve to start raising interest rates at their March meeting. The president usually tries to avoid providing policy guidance before he has had a chance to discuss matters with the Federal Reserve's policy-setting committee, which will meet next January 25-26. While stressing that the Fed does not prioritize Congress's mandate for price stability over the full employment target, Powell said the focus could change and for now there was more focus on inflation.

“To have a very strong labor market that we want with high participation, it will take a long expansion,” Powell added. “And to get long-term growth, we will need price stability. In a way, high inflation is a serious threat to maximizing employment.”

The hearing confirmed the bipartisan support that Powell is likely to gain for another term beginning next month. US President Joe Biden nominated Powell for a second term as president and chose Federal Reserve Governor Lyle Brainard as vice president; Its confirmation hearing is scheduled for Thursday. It is also expected that Biden will soon nominate three new governors to fill the remaining vacancies.

The financial markets cut Powell's comments step by step. Stocks' losses petered out, with the S&P 500 and Nasdaq 100 indices galloping higher while bonds fluctuated.

Investors are betting that the Fed will start raising the federal funds rate in March, two years after cutting it to nearly zero at the start of the pandemic in March 2020. A Labor Department report on Friday showed that the unemployment rate in the United States fell to 3.9 percent in December - It is close to its pre-pandemic low of 3.5 per cent.

Fed officials said in December that they would expedite the end of the asset purchase program, and expected to raise interest rates three times this year.

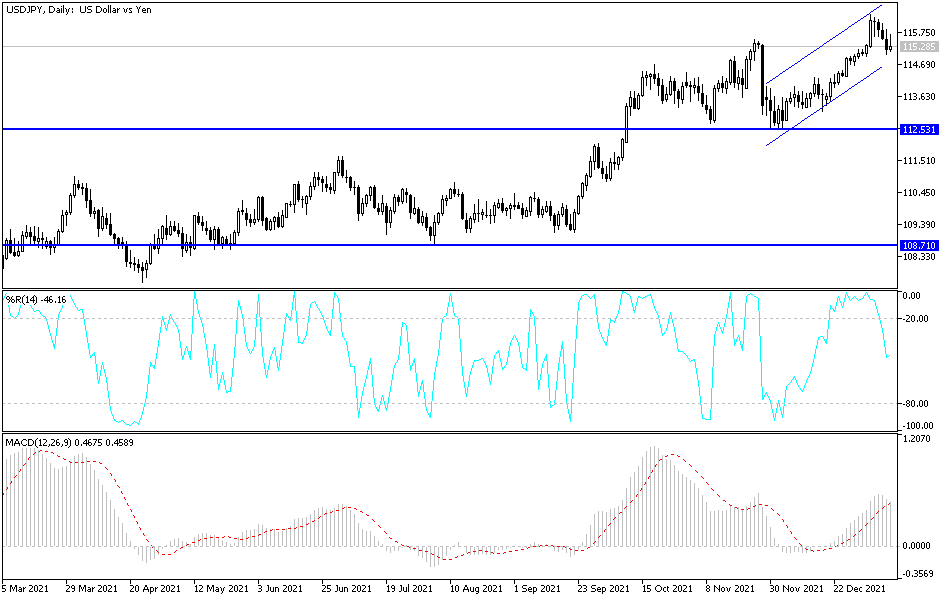

According to the technical analysis of the pair: Amid the current selling operations, the USD/JPY currency pair moves towards the 114.40 support level, the current ascending channel may be broken. The bears’ control may increase to move towards the 113.25 support level, which confirms the change the general trend is to the downside. On the upside, the return of the breach of the last resistance 116.35, which reached the ceiling of the upper line of the channel, will increase the bulls' dominance for a longer period. So far, I still prefer to sell the currency pair from every bullish level.

The USD/JPY pair will be affected today by the risk appetite of investors, as well as the reaction from the release of US inflation figures.